2 7

Kumpulan Fima Berhad (11817-V) •

Annual Report 2018

Management discussion and analysis

KEY FINANCIAL highlights

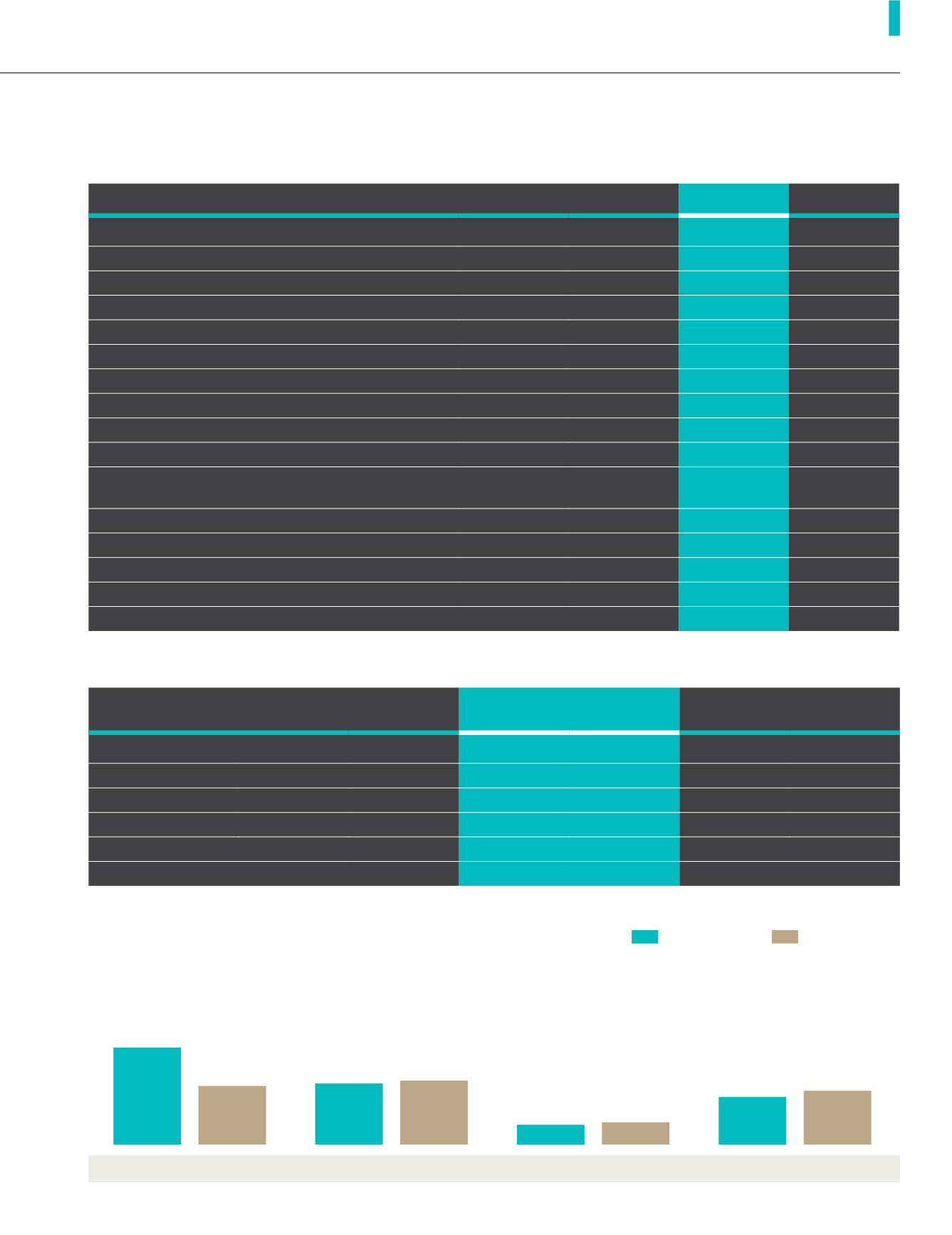

REVENUE

FYE2017

RM million

Contribution

%

FYE2018

RM million

Contribution

%

Variance

RM million

Variance

%

Manufacturing

233.35

42.6

140.78

29.2

(92.57)

(39.7)

Plantation

146.87

26.8

153.65

31.8

6.78

4.6

Bulking

47.46

8.7

53.54

11.1

6.08

12.8

Food

114.26

20.9

129.27

26.8

15.01

13.1

Others

5.27

1.0

5.22

1.1

(0.05)

(0.9)

Group Results

547.21

100.0

482.46

100.0

(64.75)

(11.8)

FYE2017

FYE2018

Variance %

Revenue

RM million

547.21

482.46

(11.8)

Cost of Sales (COS)

RM million

339.15

294.07

(13.3)

Gross Profit

RM million

208.07

188.40

(9.5)

Gross Profit Margin

%

38.0

39.1

2.9

Earnings Before Interest And Taxation (“EBIT”)

RM million

85.42

81.98

(4.0)

Profit Before Tax (“PBT”)

RM million

84.67*

80.48

(4.9)

Profit After Tax (“PAT”)

RM million

50.43

48.77

(3.3)

Profit Attributable to Equity Holders of The Company

RM million

29.84

32.06

7.4

Return on Average Shareholders’ Equity (“ROAE”)

%

5.0

4.8

(3.2)

Return on Average Capital Employed (“ROACE”)

%

8.0

7.7

(3.5)

Total Returns to Shareholders

- Gross Dividend Per Share

sen

9.00

9.00**

-

Net Cash Flow Generated From/(Used in) Operation

RM million

191.11

(7.52)

(103.9)

Total Assets

RM million

1,224.28

1,168.21

(4.6)

Total Liabilities

RM million

197.87

170.61

(13.8)

Capital Employed

RM million

1,077.34

1,052.14

(2.3)

Retained Earnings

RM million

315.38

322.33

2.2

* Without the impairment losses of RM29.37 million related to the property, plant and equipment and biological assets, the Group’s PBT would be RM114.04 million.

** Subject to shareholders’ approval.

Revenue

BY DIVISION (RM ’million)

233.35

Manufacturing

140.78

146.87

Plantation

153.65

47.46

Bulking

53.54

114.26

Food

129.27

▼

39.7%

-92.57

▲

4.6%

+6.78

▲

12.8%

+6.08

▲

13.1%

+15.01

FYE2017

FYE2018