3 2

Performance Review

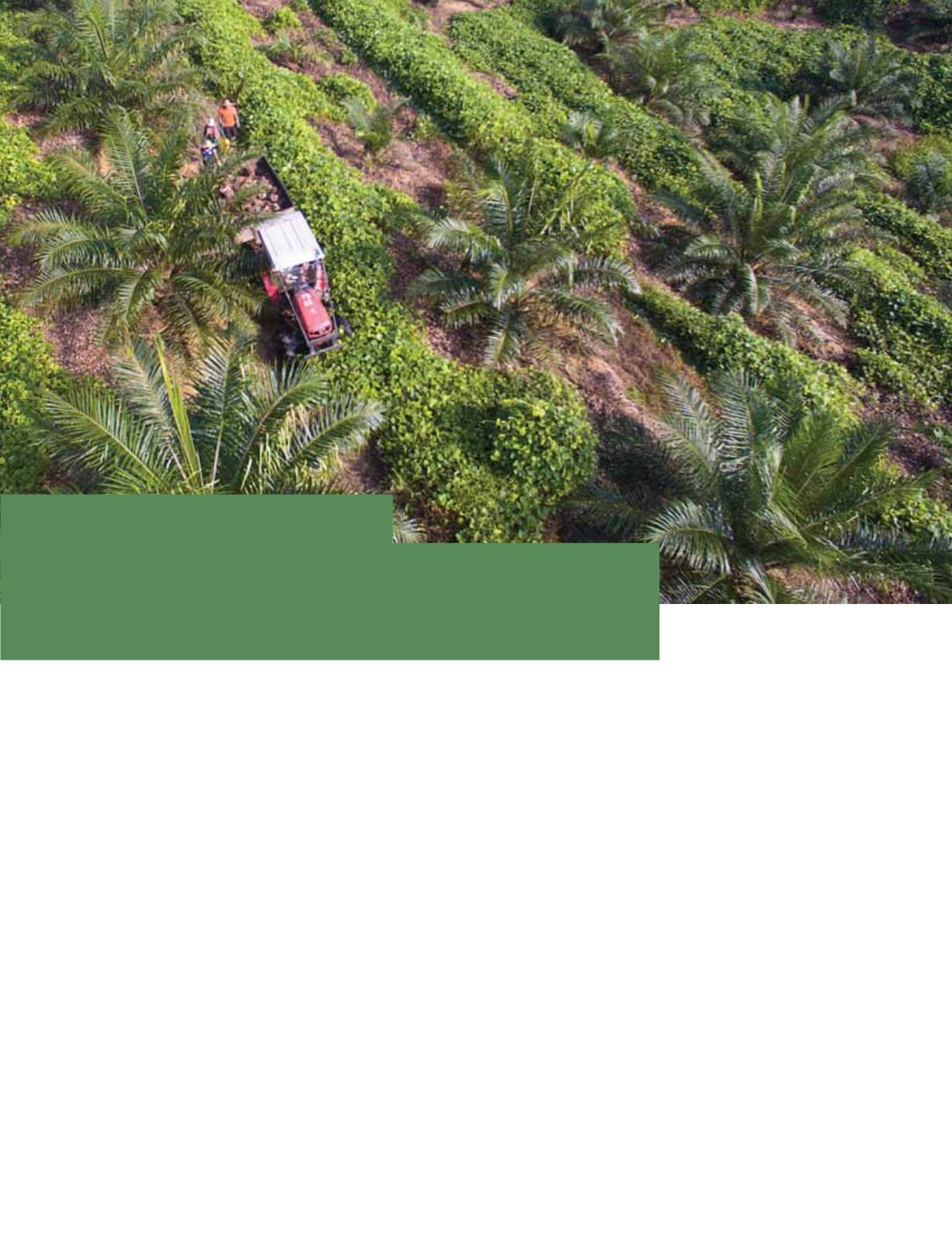

The Group owns and

operates 14 estates in

Malaysia and Indonesia

with land bank totaling

30,898 hectares, of

which 14,132 hectares

have been planted with

oil palm.

Plantation Division recorded a revenue

of RM153.65 million for the financial year

ended 31 March 2018, an improvement

of 4.6% from RM146.87 million achieved

last year. This follows the increase in fresh

fruit bunch (“FFB”) production to 198,644

metric tonne (“MT”) compared to 149,753

MT harvested last year with an average

yield of 22.9 MT per mature hectare

(FYE2017: 19.4 MT). The average price

realized for CPO (net of duty) registered

during the year was RM2,342.00 per

MT compared to RM2,625.00 per MT

last year. The decline in prices was due

largely to the significant increase in global

crop production as average palm yields

recovers from the effects of the El Nino

phenomenon.

Higher PBT of RM28.34 million was

recorded on the back of higher CPO

and CPKO sales volumes compared

to previous year in which the Division

had recorded loss of RM5.96 million

due to recognition of impairment losses

on property, plant and machinery

and biological assets in the Group’s

Indonesian subsidiary, PT Nunukan

Jaya Lestari (“PTNJL”) totaling RM29.37

million. Without the impairment losses,

the Division’s PBT for FYE2017 would

have been RM23.41 million.

FFB produced by PTNJL increased

33.4% to 175,425 MT (FYE2017: 131,484

MT). A higher yield per hectare of 27.5

MT was recorded compared to 20.6 MT

last year. Meanwhile FFB purchased

from third parties increased to 60,460

MT from 51,853 MT in the previous year.

FFB production of our Johor estates

have also improved by 4.0% to 17,912

MT, (FYE2017: 17,195 MT) due to better

yield per mature hectare of 21.1 MT

against the 20.3 MT achieved last year.

FFB production from the newly matured

areas at our estate in Miri, Sarawak had

increased almost five-fold y-o-y, from

1,075 MT achieved to 4,958 MT.

CPO and CPKO production during

the year under review was 51,887 MT

Building Momentum

Plantation Division