2 8

Performance Review

Management discussion and analysis

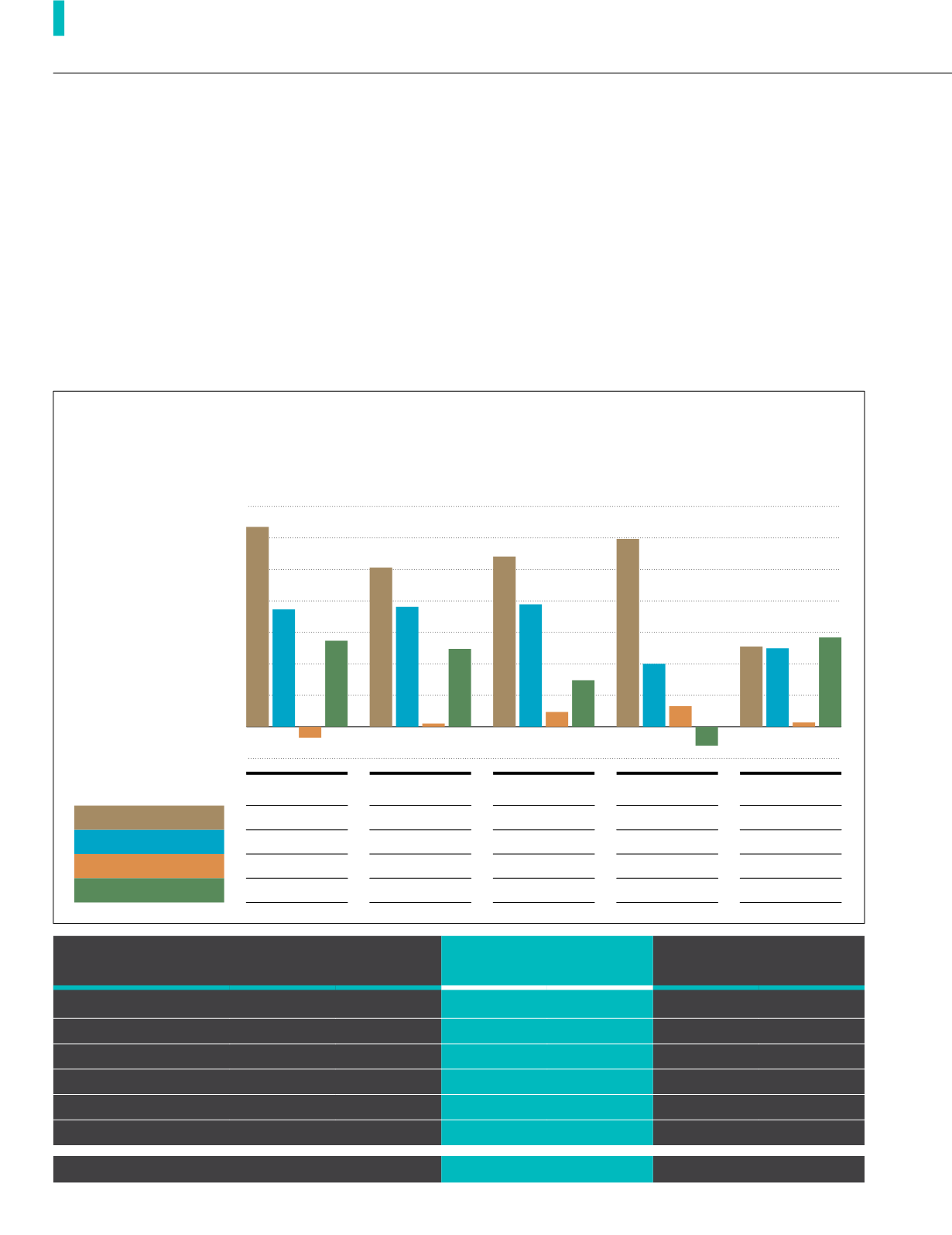

FYE2014

FYE2015

FYE2016

FYE2017

FYE2018

PBT Performance 2014-2018

(RM’million)

Manufacturing

63.39

50.54

54.01

59.61

25.48

Bulking

37.28

38.08

38.88

20.00

24.91

Food

(3.44)

0.28

4.72

6.52

1.36

Plantation

27.33

24.73

14.78

(5.96)

28.34

Profitability

FYE2017

RM million

Contribution

%

FYE2018

RM million

Contribution

%

Variance

RM million

Variance

%

Manufacturing

59.61

70.4

25.48

31.7

(34.13)

(57.3)

Plantation

(5.96)

(7.0)

28.34

35.2

34.30

575.5

Bulking

20.00

23.6

24.91

30.9

4.91

24.6

Food

6.52

7.7

1.36

1.7

(5.16)

(79.1)

Others

1.64

1.9

0.87

1.1

(0.77)

(47.0)

Associate Companies

2.86

3.4

(0.48)

(0.6)

(3.34)

(116.8)

Group PBT

84.67

100.0

80.48

100.0

(4.19)

(4.9)

During the year under review, the Group generated revenue of

RM482.46 million compared to RM547.21 million recorded last

year, a decrease of 11.8%. The decrease in revenue is mainly

attributable to the sharp decline in Manufacturing Division’s

revenue by 39.7% or RM92.57 million following the expiration

of a major supply contract, thereby offsetting the revenue

improvements from Plantation, Bulking and Food Divisions.

Despite the volatility in commodity prices during the year, our

Plantation Division recorded better revenue compared to the

previous year. Higher fresh fruit bunch production resulting

from better yield per mature hectare of 22.9 MT (FYE2017:

19.4 MT) coupled with higher volume Crude Palm Oil and

Crude Palm Oil Kernel sold were the key drivers behind

Plantation Division’s improved results.

Bulking Division also posted an improved revenue of RM53.54

million compared to RM47.46 million in the previous year due

to higher throughput of edible oil as compared to last year.

Food Division also recorded higher revenue on the back of

improved sales in all product segments especially tuna.