3 3

Kumpulan Fima Berhad (11817-V) •

Annual Report 2018

Plantation Division

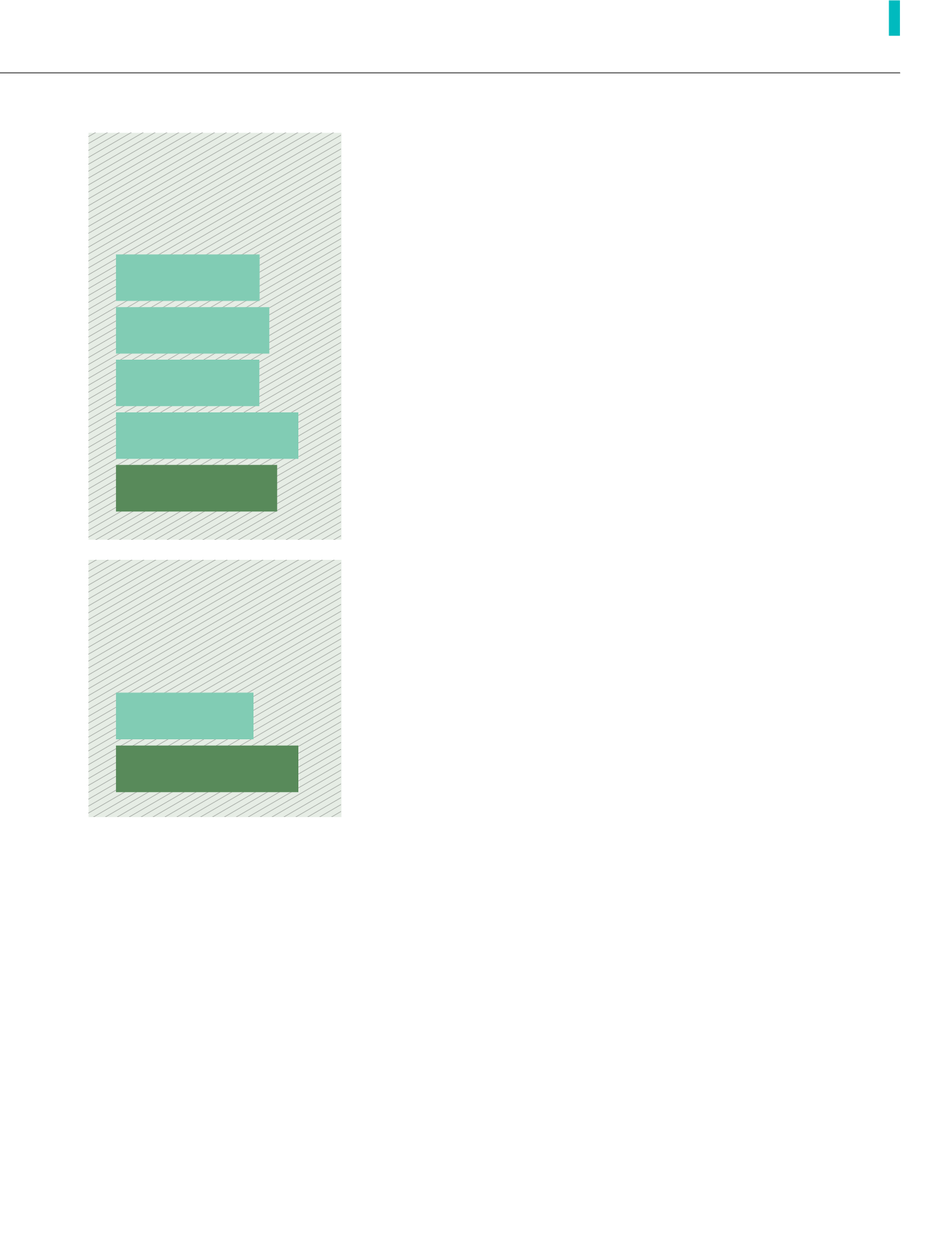

Average CPO

price realised

(RM/MT)

Group FFB

Production

(MT)

FYE2014

2,068

FYE2017

149,753

FYE2015

2,207

FYE2018

198,644

FYE2016

2,064

FYE2017

2,625

FYE2018

2,342

Estate Operations

Indonesia

As noted in the letter from the Group

Managing Director, PTNJL has instituted

legal proceedings to challenge the

revocation of PTNJL’s land title pursuant

to the Ministerial Order issued by the

Menteri Agraria dan Tata Ruang/Kepala

Badan Pertanahan Nasional Republik

Indonesia and the matter is currently

pending before the Mahkamah Agung.

Notwithstanding, the local government

in Kabupaten Nunukan has up until

today allowed PTNJL to continue with

its plantation operations until the final

determination of the matter by the courts

and we are happy to report that there

have not been any material disruptions

to PTNJL’s operations. We attribute this

to the strong relationship that PTNJL

has cultivated and continue to have at

the grassroots level through PTNJL’s

economic and social contributions to the

local community over the years.

Should the outcome of the court’s

decision result in a final adverse

judgment, we do not anticipate that it

will have further material impact on the

Group’s balance sheet moving forward

as we have reflected our estimate of loss

by recognising a gross impairment loss

of RM44.74 million on property, plant

and equipment (“PPE”) and biological

assets in last year’s results of which,

as shareholders may recall, RM29.37

million and RM11.52 million (net of tax)

respectively, had been charged to other

expenses and reversal of revaluation

surplus of PPE previously recognized,

respectively, in the Group’s Statements

of Comprehensive Income. However,

future earnings may be affected.

Malaysia

The mature areas at the Group’s Ladang

Amgreen in Miri, Sarawak has reached

approximately 822 hectares (FYE2017:

474 hectares) and is further expected

to increase to 2,387 hectares by the

end of this current year. Management’s

immediate focus will therefore be

on maximizing yields and improving

agronomic standards of the fields.

Majority of the planting at this estate

were undertaken mainly between the

years 2012 – 2015 so the anticipated

increase in yields provide a basis for FFB

volume growth in the near term. We are

also currently considering the proposal

to revive the proposal to build a palm oil

mill in Miri (which was deferred last year)

as a stand-alone business and possibly

at a different location. This project is still

in its early stages including project and

site evaluations, as well as preliminary

engineering and design. Nevertheless,

we are excited by the prospects of this

project in terms of the economic benefits

that it can bring to the Group and the

surrounding communities and hope to see

it come to fruition. In the meantime, crops

harvested from Ladang Amgreen are sent

to a third-party mill for processing.

As at 31 March 2018, approximately 786

hectares have been planted at Ladang

Cendana in Kemaman, Terengganu.

Unfortunately, as a consequence of

elephant encroachment at the estate

during the year, over 17,000 young palms

planted between the years 2015-2016

on an area measuring approximately

127 hectares have to be replaced. This

will inevitably result in delays before the

new palms can be harvested. Estate

management is proactively looking at

ways to provide a safe wildlife corridor

for the elephants and other animals to

ensure that they do not wander off their

intended course and into neighbouring

communal/estate areas.

Planting and development at our

greenfield estates in Kelantan has been

progressing well with 110 hectares and

396 hectares planted at Ladang Dabong,

Kuala Krai and Ladang Aring, Gua

Musang, respectively. Planting on the

remaining areas at the estates has been

planned for this current financial year.

The permission and approvals for land

development at our greenfield estate

in Sg. Siput, Perak measuring 2,000

hectares have been obtained from

various authorities after much delay.

An environmental impact assessment

and 4,013 MT, respectively (FYE2017:

41,619 MT and 3,419 MT, respectively).

The Group’s average oil extraction rate

(“OER”) of 22.1% was slightly lower

compared to 22.7% OER recorded in

the previous year mainly due to lower

crop quality from smallholders and higher

rainfall of approximately 4,033.10 mm, the

highest in 5 years, which led to excessive

moisture in the fruit bunches.

Volume of FFB processed increased

28% to 234,029 MT from 183,328

MT in the previous year. Cost of FFB

production averaged RM359.56 per MT

while processing costs decreased from

RM34.47 per MT to RM28.53 per MT in

line with the higher FFB processed.