2 2

Performance Review

Acquisition of Java Plantations Sdn Bhd

(Now known as FCB Eastern Plantations Sdn Bhd)

Details of the acquisition

FCB Plantation Holdings Sdn Bhd (“FCBPH”) entered into an agreement with

Java Berhad on 6 October 2017 to acquire Java Plantations Sdn Bhd (“JPSB”).

JPSB is an investment holding company having an 80% stake in Ladang Bunga

Tanjong Sdn Bhd, a joint venture company with Kumpulan Pertanian Kelantan

Berhad, which operates an oil palm plantation held under the Individual Title

Geran 36415, Lot 2429, Mukim Lubok Bongor, Jajahan Jeli, Kelantan measuring

approximately 3,290 acres or 1,331 hectares. The lease period for the land is for

66 years and expiring on 28 September 2069. Under the terms of the agreement

FCBPH has also assumed JPSB’s trade and other payables totalling RM29.18

million. The fair value of the net assets acquired was RM4.89 million (excluding

the shares of the non-controlling interest) resulting in a negative goodwill on

acquisition of RM275,000.

The acquisition was completed on 20 February 2018 and the effective price paid

for the acquisition is RM10,255 per acre.

Benefits of the acquisition

The acquisition would enable the Group to realise its strategy to expand its plantation

business in Malaysia and capitalise on the bright prospects of the palm oil industry,

which would provide a broader earnings base for the Group.

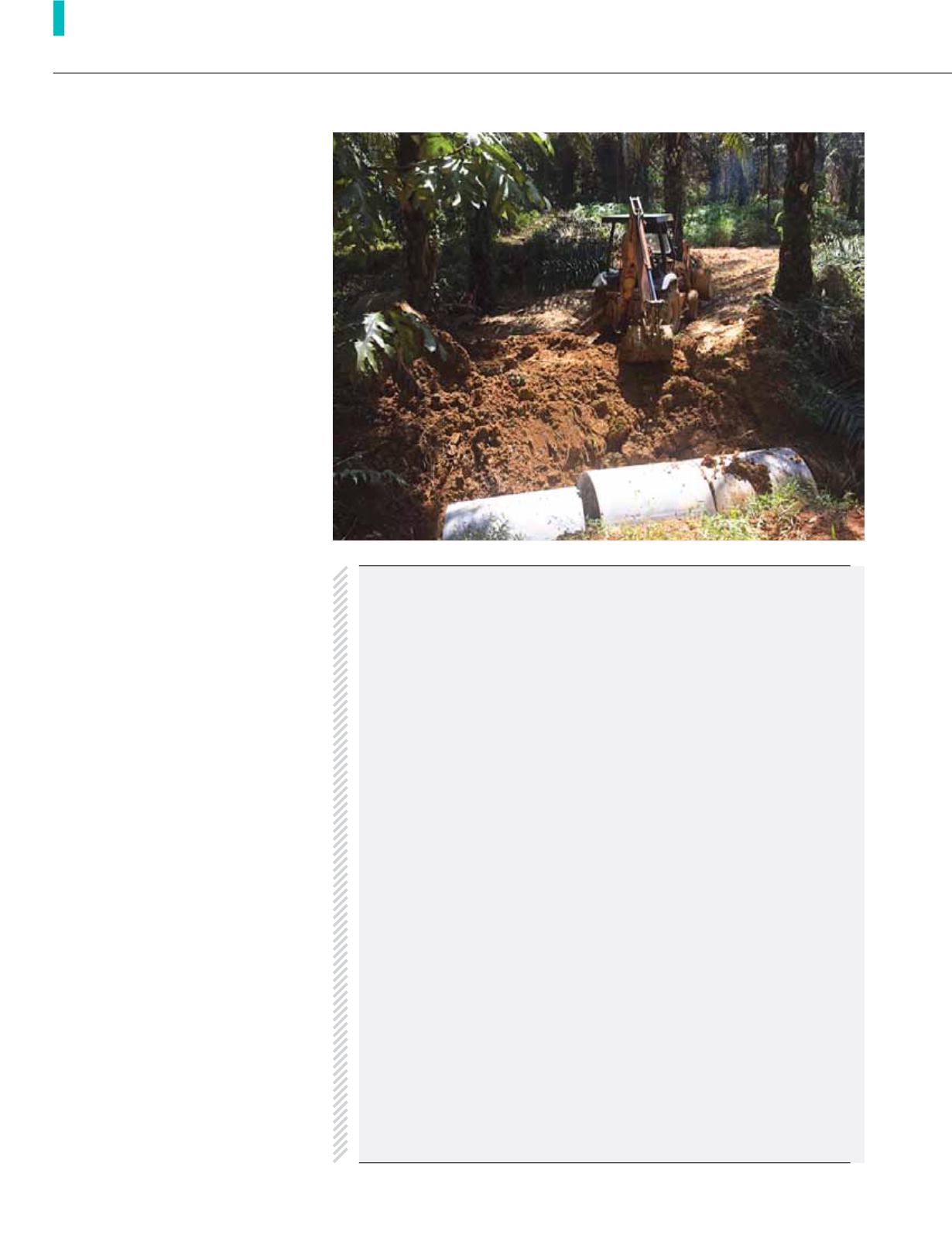

Progress made so far

Rehabilitation works on 566 hectares are ongoing to-date. Replanting works will

commence in this current financial year and scheduled to be completed by next

financial year.

Letter from the Group Managing Director

and intense competition between

terminals, as the overall decrease in

throughput had created excess capacity

for all players.

Group Earnings Before Interest and Tax

(“EBIT”) decreased 4.0% to RM81.98

million. Earnings per share and net

assets per share stood at 11.36 sen and

RM2.67, respectively.

As at 31 March 2018, we have cash and

cash equivalents of RM235.30 million.

Our capital expenditures (including

biological asset expenditures) totalled

RM32.50 million.

A more detailed review of the results and

the operating performance for the year

of each of the Group’s business divisions

is presented on pages 30 to 41 of this

Annual Report.

Dividend

The Board is pleased to recommend for

shareholders’ approval a final single-tier

dividend of 9.0 sen per share for the

financial year ended 31 March 2018 at

the forthcoming Annual General Meeting.

If approved at the forthcoming Annual

General Meeting, the dividend will be

paid on 5 October 2018 to shareholders

whose names appear on the register as

at 20 September 2018.

Sustainability

Besides improving our financial

outcomes, we are also stepping up our

sustainability aspirations. FYE2018 has

been a busy year for our sustainability

programme as we have been formalising

and communicating our approach. There

is still much to do but we are happy

with the progress that has been made;

in particular, the support our employees

have given. In the coming year, we will

give higher profile to the communication

of different aspects of our sustainability

programme to our employees as we

intend to set measurable environmental

targets.