3 7

Kumpulan Fima Berhad (11817-V) •

Annual Report 2018

Bulking Division posted revenue of

RM53.54 million, up 12.8% compared

to last year. PBT improved by 24.6%

to RM24.91 million from RM20.0

million recorded last year. Particularly

strong growth in the edible oils,

industrial chemicals and technical fats

sub-segments throughput was the main

driver of growth for theDivision throughout

FYE2018, offsetting the decline in base

oil and latex sub-segments. Average

occupancy rate was 60.8%, which is

8.8% higher than last year, led by the

technical fats sub-segment. The edible

oils sub-segment has been strong in the

second half of the FYE2018 particularly

at our terminals in Butterworth, benefiting

from the high levels of CPO inventories

during the said period. This is in sharp

contrast to last year when the Division was

severely impacted by the effects of low

CPO production, which led to low palm

oil inventories and intense competition

between terminals, as the decrease in

overall throughput had created excess

capacity for all players.

In some ways, the market conditions

and challenges we have encountered

particularly in the last 2 years proved

instructive causing us to evaluate our

operating structures and pursue various

initiatives aimed at remaining competitive,

creating new revenue streams, and

maximizing productivity and efficiency.

During the year, the Division spent

RM1.70 million on CAPEX which has

been channeled towards upgrading of

our terminals’ infrastructure. We had also

purchased next-generation trucks and

prime movers for our freight-forwarding

and logistics arm as part of an ongoing

commitment to have more efficient

vehicles and improve driving standards

and safety. Further, to strengthen our

cost competitiveness, we had realigned

our pricing and introduced commercial

incentives that have helped deliver

growth in our volumes.

The Division has launched a project

to revive the Group’s 60,000 MT p/a

biodiesel plant which in previous years

had been leased to and operated by

a third party. This project comes at a

time when the market for biodiesel is

expanding globally amid rising crude

oil prices and increased demand for

renewable energy. The plant, which

is expected to be operational in

this current financial year once the

necessary refurbishment/replacement of

major components are completed and

pre-commissioning results meet the

desired performance requirements. This

will serves as a logical next step in a

broader strategy to expand our services

and product offerings.

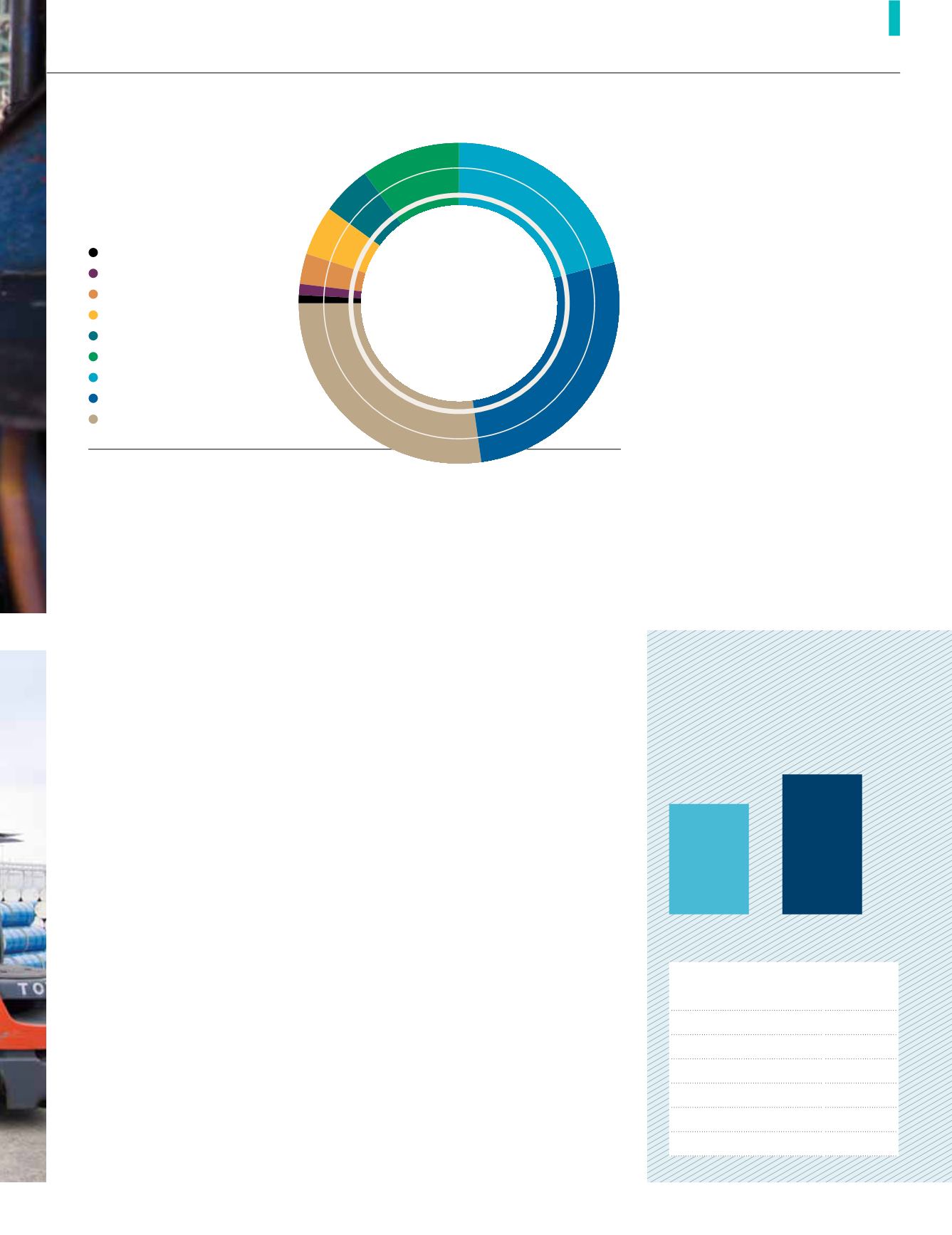

Technical Fat

························

5%

Misc Income

······················

10%

Edible Oil

····························

27%

Industrial Chemicals

����������

21%

Base Oil

·····························

27%

Transportation

······················

5%

Freight Forwarding

���������������

1%

Latex

····································

1%

Oleo Chemical

······················

3%

Revenue contribution

by product

RM53.54

million

division revenue

Total Throughput

(MT)

751,651

FYE2017

951,851

FYE2018

(MT)

Edible Oil

510,049

Oleo Chemical

11,894

Technical Fats

49,278

Industrial Chemicals

165,269

Base Oil

160,413

Latex

14,412

Transportation

40,536

There have been signs of improvements

in both customer sentiment and the

broader macro-economic conditions

in Malaysia since end-2017, albeit with

some volatility along the way. Positive

as they are, both supply and demand

factors remain uncertain in view of

recent and ongoing developments in

the US and European Union especially

those pertaining to policy changes on

biofuels and other trade measures; and

the impact of these developments on

our customers’ end markets. We expect

continued uncertainty in the segments

we serve in this current financial year and

so within this context we will conduct

our business efficiently and aligned

with market trends. We believe that our

robust business model, infrastructure

and our reputation as a reliable and

cost-effective provider of services will

position us well to navigate continued

challenging market conditions along the

commercial corridors we serve, and to

capitalize on any opportunities.

Bulking Division