C

ommodity markets were

plagued by challenging

conditions in the year under

review. In 2018, the prices of oil

palm products were traded lower

globally. CPO price was lower by

19.3%, averaging RM2,239.00 per

metric tonne (“MT”) compared

to RM2,795.00 per MT in 2017.

Depreciating currencies of key

importing countries such as India

and China further limited their

purchasing power on palm oil. As

a result of the weaker demand

and stronger CPO production in

Indonesia, the Malaysian palm oil

stocks hit a record high by the

end of 2018 thereby adversely

impacting prices.

The trade dispute between China

and the US, which intensified in

July 2018 with China imposing

a tax on US exports including

soybeans also contributed to

the volatility of commodity

prices and heavily influenced

the direction of CPO prices

during the year.

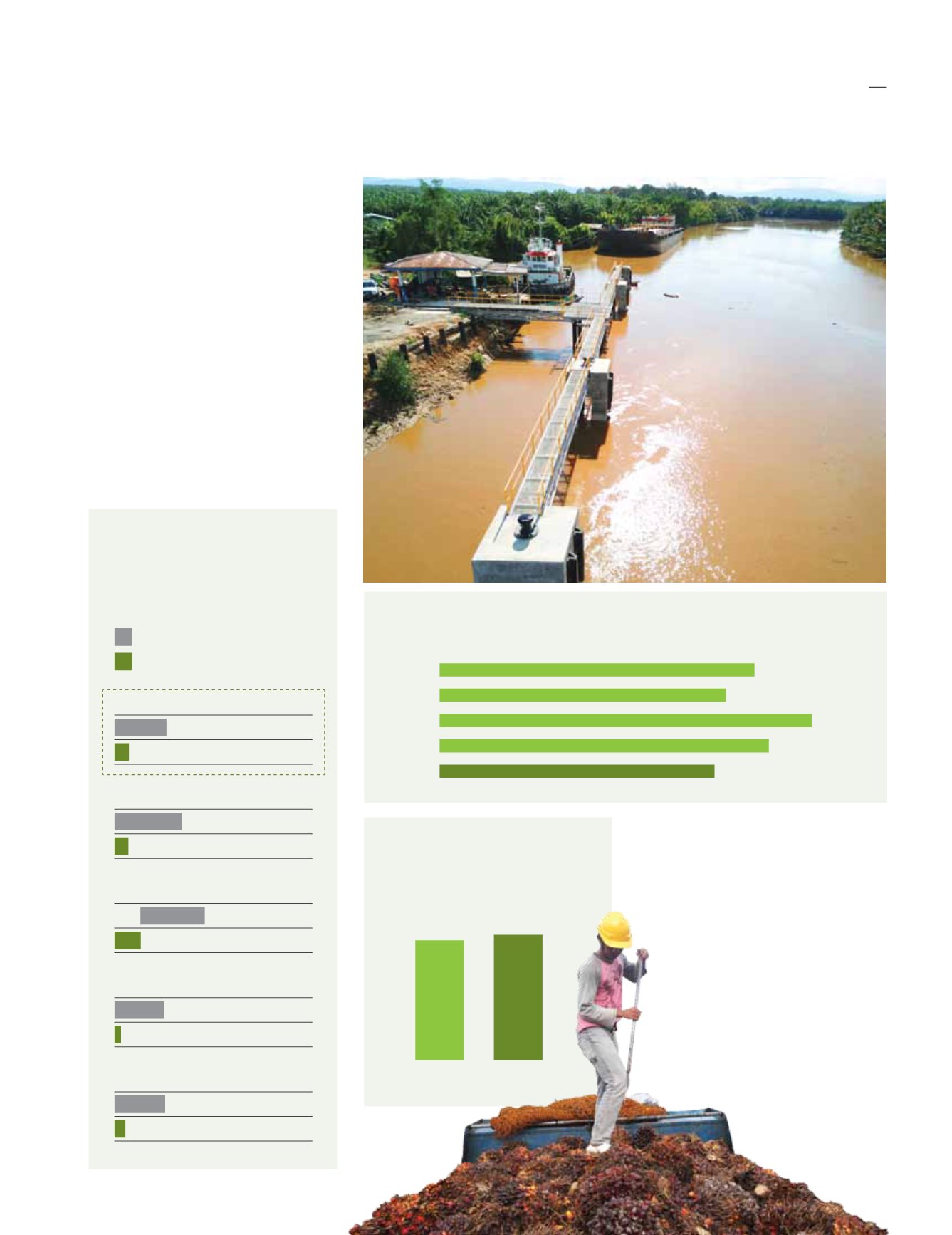

Average Cpo Price Realised

(RM/MT)

Group FFB

Harvested

(MT)

198,910

FYE2018

FYE2019

198,644

2,342

FYE2018

2,625

FYE2017

2,064

FYE2016

2,207

FYE2015

FYE2019

1,921

Plantation Division:

5-Years Revenue & PBT

Performance

(RM Million)

Revenue

PBT

118.34

32.81

FYE2019

153.65

31.67

FYE2018

146.87

-5.96

FYE2017

112.63

14.78

FYE2016

115.69

24.73

FYE2015

-23.0%

+3.6%

performance

review

43