the acquisition of Ladang Bunga

Tanjong Sdn. Bhd. which was

completed in February 2018.

The division had in Q2 FYE2019

reversed a previously recorded

impairment on property, plant

and equipment in the Group’s

Indonesian subsidiary, PT Nunukan

Jaya Lestari (“PTNJL”) as a

consequence of the Mahkamah

Agung’s decision that the

Ministerial Order revoking

PTNJL’s HGU be annulled. The

reversal of the impairment has a

positive effect of RM23.63 million

whereupon the division’s PBT for

FYE2019 would be RM32.81 million

with the inclusion of the writeback.

FFB produced by PTNJL decreased

by 6.1% to 164,769 MT (FYE2018:

175,425 MT). A lower yield per

hectare of 26.08 MT was recorded

compared to 27.53 MT last year.

Meanwhile, FFB purchased from

third parties also decreased to

49,902 MT from 60,460 MT in

the previous year. Note that FFB

production was back to normal

following to the bumper crops

recorded last year which is due to

post recovery of El-Nino.

FFB production of our Johor

estates have improved by 4.4%

to 18,708 MT, (FYE2018: 17,912

MT) due to an increase in mature

area from 875 hectares to 981

hectares. However, our average

yield per mature hectare of 20.56

per MT lower than the 21.11 per MT

achieved last year. FFB production

at our estate in Miri, Sarawak

increased by almost threefold from

4,958 MT to 14,122 MT, attributed

Amid a bearish market, the division

recorded revenue of RM118.34

million in FYE2019, 23.0% lower

than last year’s RM153.65 million

largely due to the sharp decline in

palm product prices. The average

price realized for CPO (net of

duty) registered during the year

was RM1,921 per MT compared to

RM2,342 per MT last year. Fresh

fruit bunches (“FFB”) harvested

increased slightly to 198,910 MT

compared to 198,644 MT harvested

last year with an average yield

of 20.77 per mature hectare

(FYE2018: 22.83 MT).

Meanwhile, PBT stood at RM9.18

million (before the writeback of

impairment losses which is discussed

hereinbelow), which was 22.49%

lower than the PBT of RM31.67

million achieved last year. Our

estates in Malaysia which are still in

the process of land development

or palm planting registered a total

pretax loss of RM13.87 million

compared to RM7.13 million pretax

loss recorded last year following to

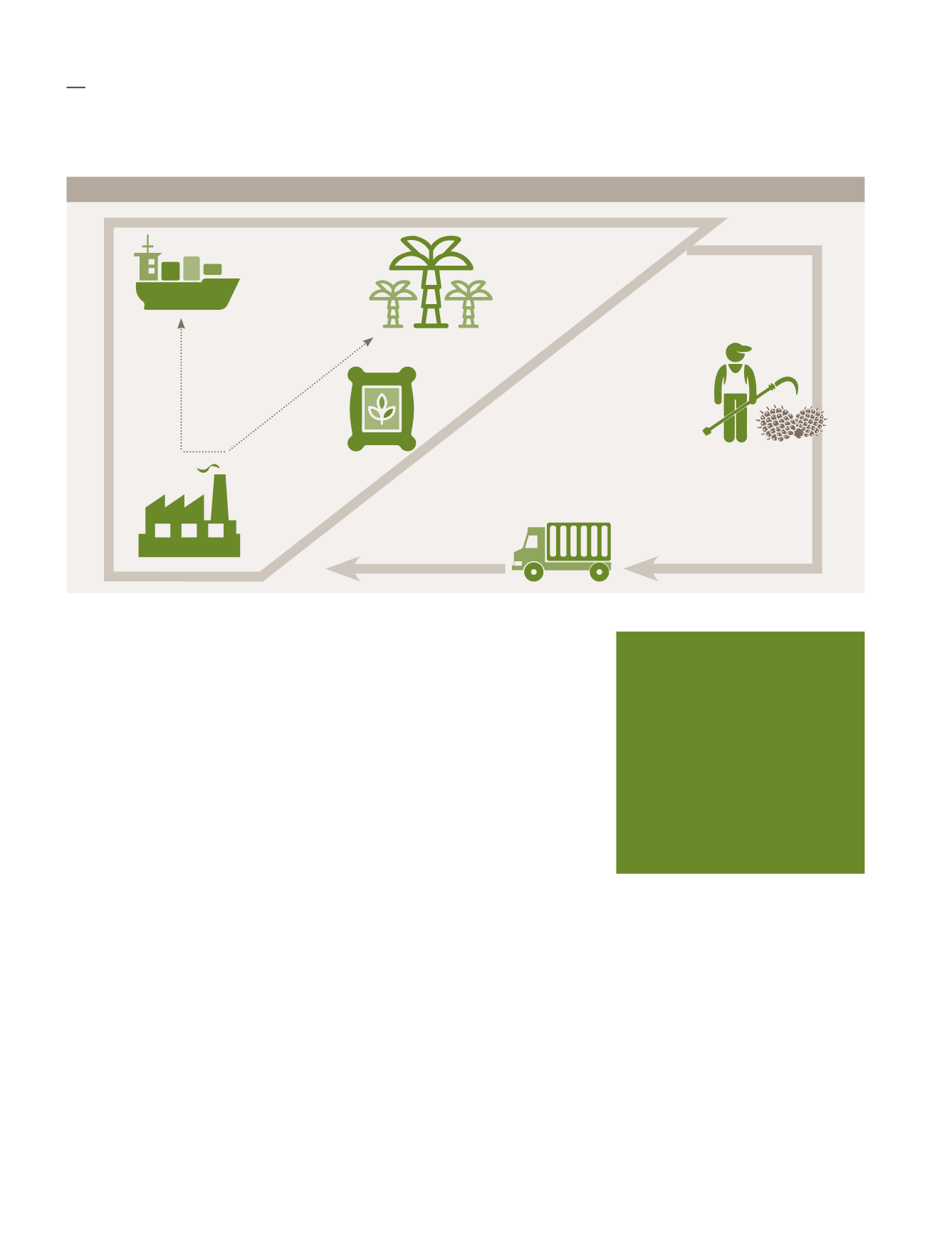

Fruits transported

to mills within 24 hours

At the mill, FFB is sterilised

and pressed to extract oil

Note: The diagram above refers to our Plantation Business in Kalimantan

Crude oil is then

shipped to the

refineries

Organic Fertiliser

Compost

Plantations

fresh fruit

bunches

(“FFB”) are

harvested

Plantation Division Business Model

Immature palms

make up

4,660 ha

of the Group’s total

planted area, which

means the Group’s

crops are

projected

to rise strongly

in

coming years.

Kumpulan Fima Berhad

(11817-V)

Annual Report 2019

44