to more fields attaining maturity i.e. from 822 hectares

last year to 1,648 hectares in FYE2019.

CPO and CPKO production during the year under

review were 47,966 MT and 4,434 MT respectively

(FYE2018: 51,887 MT and 4,013 MT respectively) in line

with the decline in FFB production and lower third

party crop. Average CPKO price was RM3,015 per

MT, compared with RM4,431 per MT in the prior year.

Meanwhile, the Group’s oil extraction rate (“OER”)

average of 22.34% was slightly higher compared to

22.09% OER recorded last year.

On 23 August 2018, we had announced that the

Mahkamah Agung Republik Indonesia, vide its written

decision dated 21 August 2018, has allowed PTNJL’s

appeal and ruled that the Ministerial Order revoking

PTNJL’s HGU be annulled. The Mahkamah Agung

also ordered the Menteri Agraria dan Tata Ruang/

Kepala Badan Pertahanan Nasional Republik Indonesia

(“Defendant”) to simultaneously:

i.

issue an order cancelling PTNJL’s HGU rights over

the areas overlapping with third party interests

measuring 3,500 hectares; and

ii. issue a new HGU certificate in favour of PTNJL for

an area measuring 16,474.130 hectares, (which is

19,974.130 hectares less the 3,500 hectares referred

to in paragraph (i) above).

Arising therefrom, the impairment of property, plant

and equipment previously affected by the Ministerial

Order was reversed in Q2 of FYE2019.

We had also announced in February 2019 that the

Defendant had subsequently made a judicial review

application to set aside the decision. This was followed

by PTNJL filing a counter-memorandum in March 2019

in response thereof. Our Indonesian solicitors have

advised that based on normal timelines for judicial

review, we could expect the decision to be made in

six to twelve months from the date PTNJL’s counter-

memorandum was filed. Further, commencement of

the judicial review proceedings do not prevent the

implementation of the Mahkamah Agung’s written

decision as aforementioned.

During the year, PTNJL commenced construction of a

“terminal khusus” (specific terminal) at the estate. The

terminal which was completed in this current financial

year has locational advantages as it will allow for

more efficient loading and dispatch of PTNJL’s CPO

and CPKO thereby reducing transport costs as well as

PTNJL’s environmental footprint.

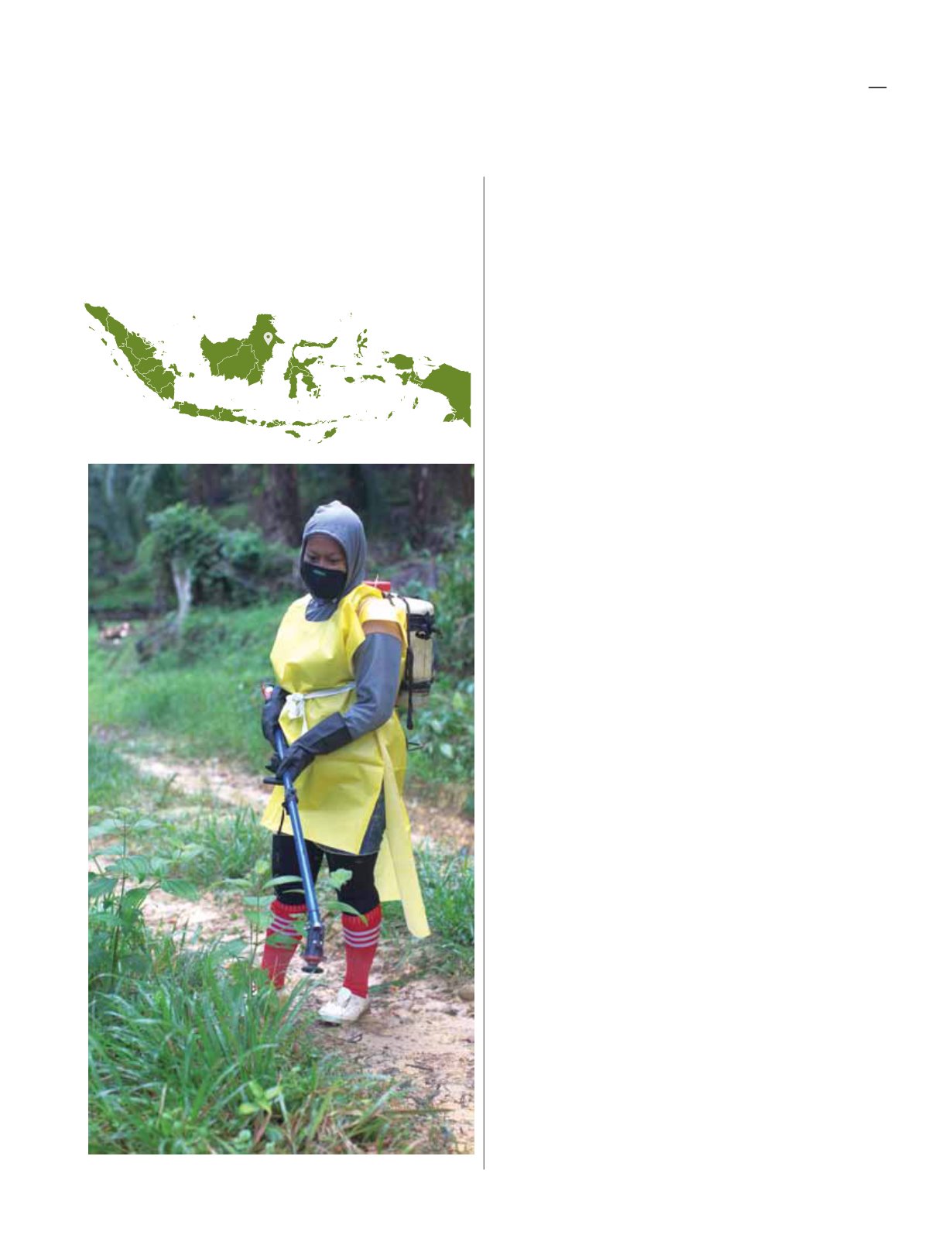

indonesia

Estate Operations

performance

review

45