While the division’s financial and

liquidity profiles remain sound,

we recognise that given the

highly competitive nature of our

markets, the immediate focus

must be given to certain priority

areas that can support future

value-creating opportunities. The

first is to protect and maintain

our niche markets. The second

is to drive cost efficiency and

effectiveness with which we

operate and go to market. We have

established a scalable platform,

but we acknowledge that we

need to become more agile and

collaborative. Towards this end,

we have and will continue to place

emphasis on strategic partnerships,

both local and foreign, centred on

innovative and technology-driven

solutions that can enhance our

competitiveness. Add to that, our

teams continue to remain focused

on proactively matching our cost

structures to the realities of the

top-line pressures we face in the

market. The third is to work to

secure the capabilities we need so

that we can respond to the rapid

technological advancements we are

seeing and to have the ability to

deploy new products and services

through existing channels and meet

While the division’s financial and liquidity

profiles remain sound,

we recognise that

given the highly competitive nature of our

markets

, the immediate focus must be given

to certain priority areas that can support

future value-creating opportunities.

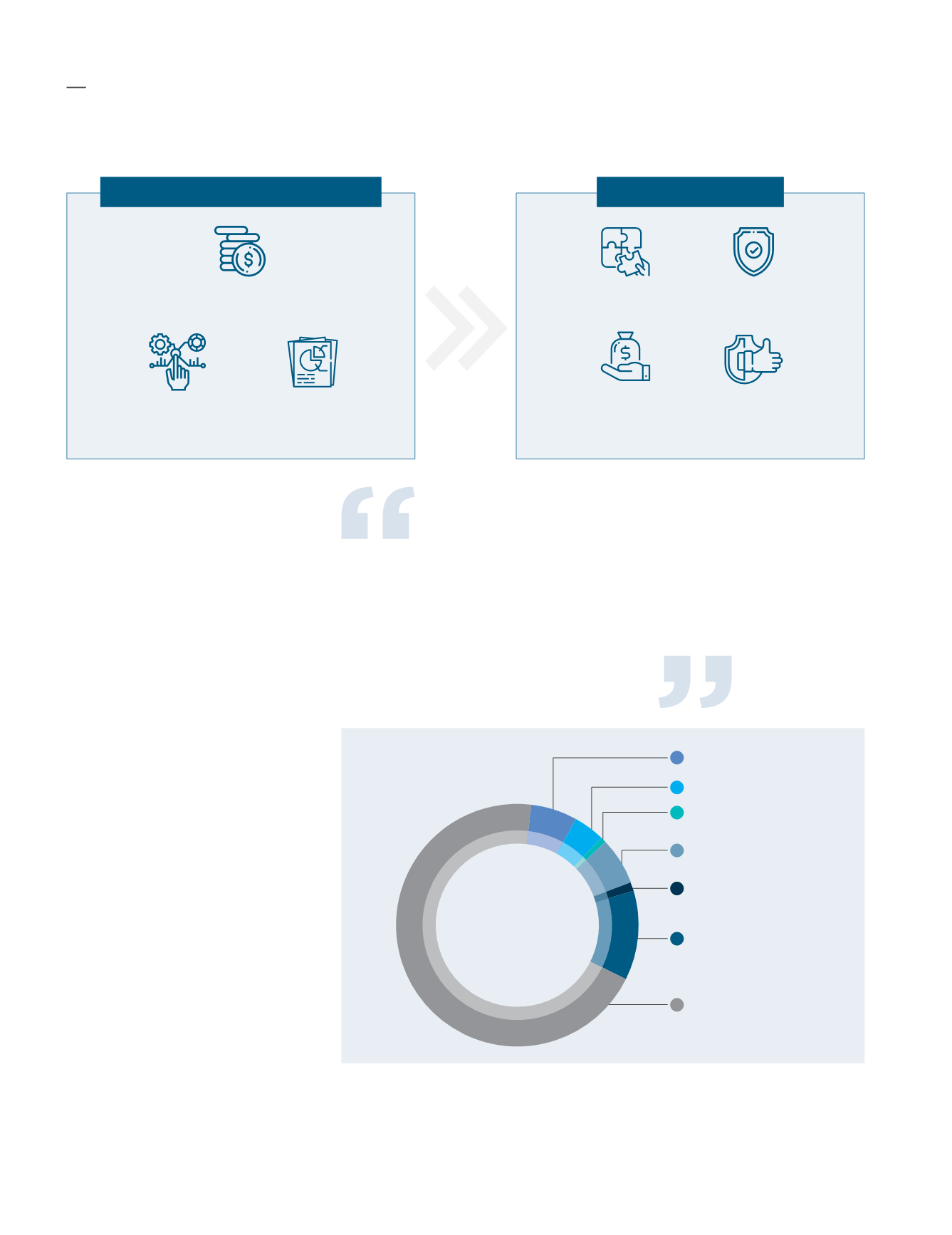

Revenue

Contribution

by product (%)

6.2% Confidentials

Documents

4.2% Certificates & Passes

0.8% Stamps, Postal &

Banking Documents

6.4% Foreign Travel

Documents

1.0% Others

11.9% Travel Documents

69.5% Transport

Documents

Customers needs

Specific business challenges

Megatrends /

digital disruptions

Margins under

pressure – high costs

of doing business

Economic cycles & impact on

governments’ infrastructure spend

Solutions, not

just products

Reduced cost

and increased

productivity

Supply security

& resilience

A trusted and

reliable service

provider

Kumpulan Fima Berhad

(11817-V)

Annual Report 2019

40