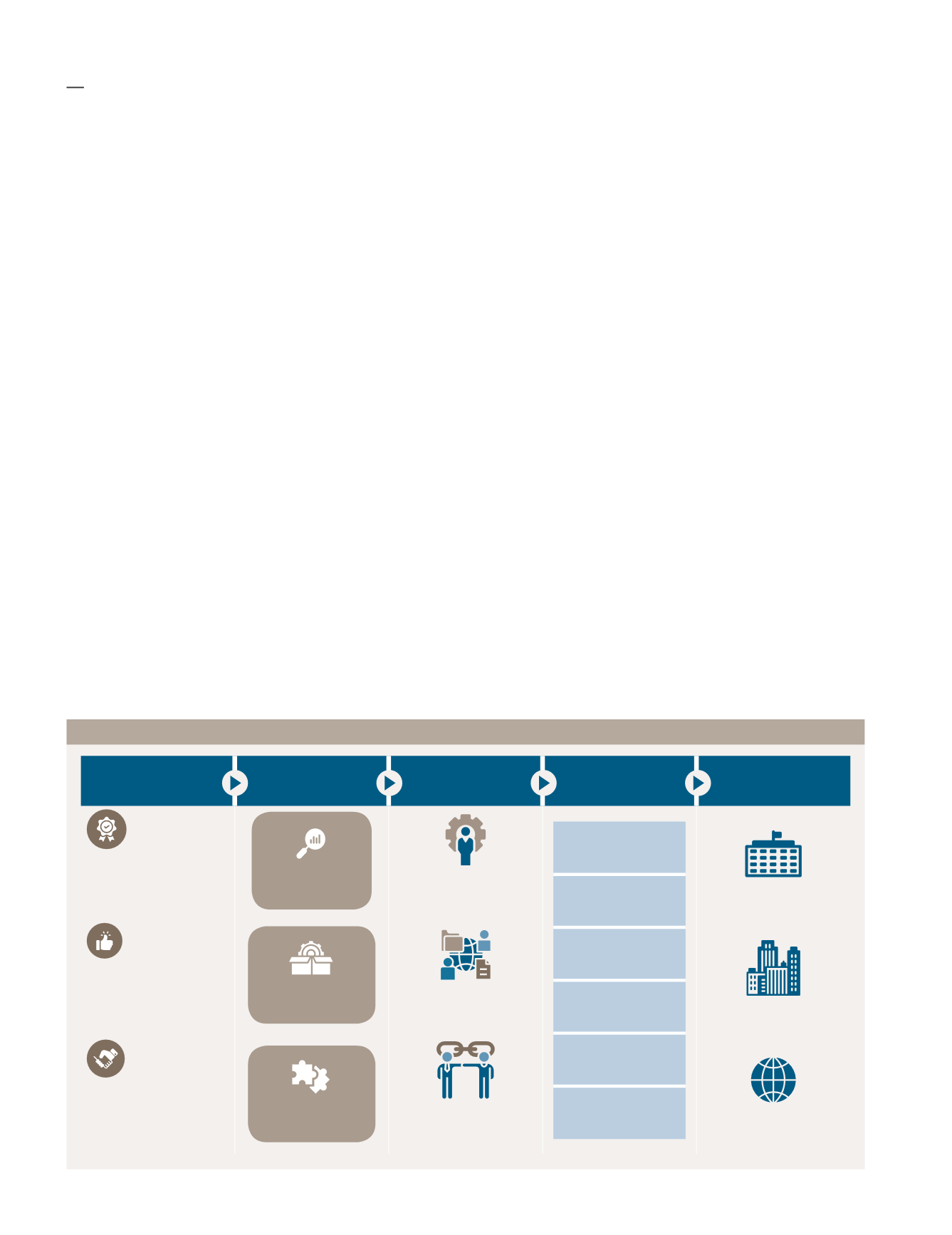

Core

Values

Innovative

Organization

Trusted

Brand

Integrated

Technology

Based Solution

New Market for

Existing Portfolio

QUALITY

• Products and services

• Deliver proven

solutions

Research &

Development

Account

Management

Design &

Origination

Product

Upgrades

Solution &

Infrastructure

Logistics Services

Technical

Support

Forensics

Government

EXCELLENCE

• Service level

guarantee, support &

maintenance of end

to end solutions

Product

Development

Strategic

Technical Partners

GLC

TRUSTWORTHY

• Partner you can trust,

reliability, financially

strong

• Ethical

Business

Development

Supply

Chain

Vendor

(International)

Manufacturing Business Model

I

n FYE2019, the division’s

revenue declined by 4.3% to

RM134.78 million from RM140.78

million reported last year due to

a decline in the travel documents

subsegment where the expiry of

a major supply contract in the last

financial year had significantly

weighed in on the division’s topline

performance despite strong

performance in the transport

and confidential documents

subsegments.

PBT, however, was up by 34.0% to

RM30.56 million compared to the

RM22.81 million recorded last year

as a result of sales mix, higher write

back of certain provisions as well as

lower direct costs and depreciation.

The share of results of associate

company Giesecke & Devrient

Malaysia Sdn Bhd (“G&D”)

increased to RM3.73 million from

RM1.70 million last year. G&D

achieved higher revenue and PBT

of RM184.08 million and RM17.67

million, an improvement by 11.9%

and 52.7% respectively.

The division’s trade receivables

decreased 16.0% y-o-y to RM68.17

million. A significant amount of

the trade receivables arise from

customers with whom the division

has had a long-term relationship

and therefore the Board is of

the view there is no significant

concentration of credit risk and

that the receivables are collectable.

The transport and confidential

documents subsegments continued

to show improvement in revenue

growth, albeit modest, cumulatively

generating approximately

RM102.07 million in revenue, an

increase of 0.4% over the prior

year. Certain strategic contracts

within these product subsegments

have been successfully extended

during the year. Transport and

confidential documents are now

the division’s largest revenue

segment groups, albeit all with

different margin structures. We

view these segments groups as

potential long-term growth drivers

and we are investing strategically

to foster this incremental

growth opportunity. Except for

travel documents, results of the

other product segments have

remained relatively stable and are

comparable to last year. Likewise,

we expect their activity and

performance in this current year

will be sustained at FYE2019 levels.

During the year under review,

the Company had announced

that its wholly-owned subsidiary

Percetakan Keselamatan Nasional

Sdn Bhd (“PKN”), had commenced

legal action against Datasonic

Technologies Sdn. Bhd. (“DTSB”)

at the Kuala Lumpur High

Court. The claim is for a sum of

RM24,975,000.00 (excluding

interest and cost) being the

amount due and owing by the

DTSB to PKN for the 1.5 million

Malaysian passport booklets which

Kumpulan Fima Berhad

(11817-V)

Annual Report 2019

38