6.37% over the previous financial

year. The increase was in line with

the increase of the Group’s net

earnings.

Return on Equity (ROE)

for

FYE2019 of 8.1% (FYE2018:

4.7%) is based on total equity

of RM1,056.96 million (FYE2018:

RM999.93 million).

Capital employed is the total

amount of capital utilises to

generate profits.

Return on Capital

Employed (ROCE)

during FYE2019

improved to 10.5% from 7.7%

registered in the previous year.

Liquidity and Capital Resources

Typically, over the course of a year,

cash, short-term investments and

short-term debt may fluctuate

in order to manage the Group’s

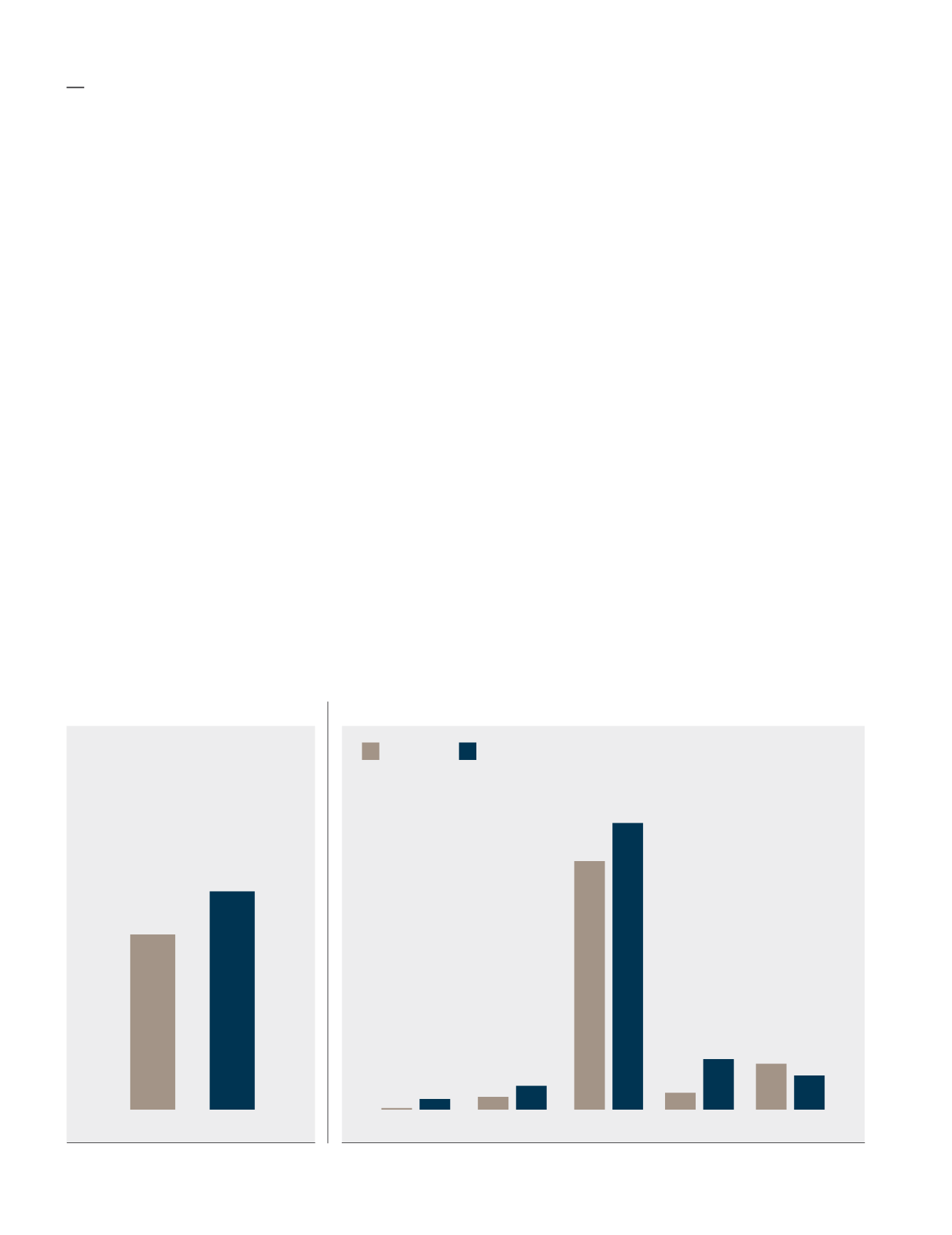

Others

0.16

1.07

Manufacturing

1.28

2.38

Plantation

24.77

28.56

Bulking

1.70

5.05

Food

4.59

3.41

CAPEX Breakdown by Division

(RM Million)

FYE2018

FYE2019

32.50

40.47

+24.5%

Group CAPEX

(RM Million)

liquidity. The Group believes it

has sufficient operating flexibility,

cash flow, cash and short-term

investment balances to meet

future operating needs of the

business as well as any scheduled

payments of debt. The net gearing

ratio of the Group as at 31 March

2019 remained low at 0.17 times.

The Group’s

Cash and Bank

Balances

and

Short-Term Cash

Investments

stood at RM290.32

million in total, 1.1% higher than the

previous year.

Despite a reduction in revenue,

the Group continue to generate

strong cash flow. The

Net Cash

Flow Generated from Operating

Activities

recorded a surplus of

RM52.78 million (FYE2018: deficit

of RM7.52 million) resulting from

operating profit of RM104.77

million offset by net changes in

inventories balances and payment

on taxation.

The Group’s CAPEX of RM40.47

million (FYE2018: RM32.50 million)

was incurred to meet ongoing

CAPEX commitments during

the year. Notably, Plantation

division accounted for 70.6% of

the Group’s total CAPEX spend

which was largely utilised towards

plantation development works,

new planting, construction of

workers quarters and purchase/

replacements of fixed assets.

Sources of funds for CAPEX during

the year were generated internally.

FYE2018

FYE2019

Kumpulan Fima Berhad

(11817-V)

Annual Report 2019

36