decline is primarily due to reduced

orders from customers in the aviation

sector. Meanwhile trading activities

are making up a greater portion of

FISB’s portfolio and we see trading as

a potential source of future growth for

FISB with revenue contribution from

this segment more than doubled y-o-y.

As a food processor, we already

operate to the highest standards of

cleanliness and hygiene to protect our

employees, to maintain the safety and

high quality of our products. In light

of the Covid-19 pandemic, we have

implemented additional employee

safety measures based on guidance

from the relevant health authorities

across our facilities, including

enhanced hygiene protocols, social

distancing, mask use and temperature

screenings. As of today, all of our

facilities are operating without

significant disruption.

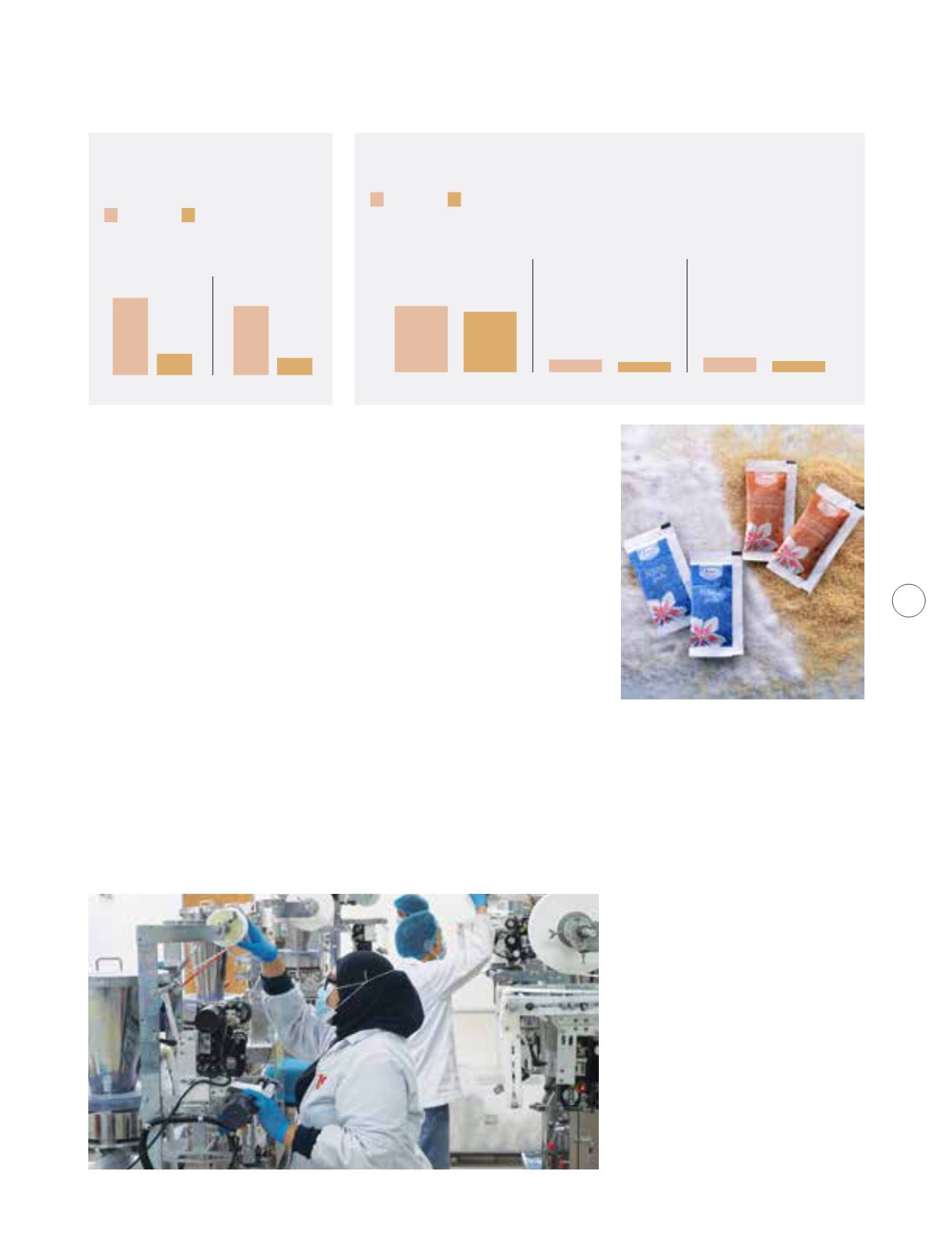

FISB: Revenue & PBT

Contribution

(Rm million)

Revenue PBT

0.88

5.52

0.48

2019

2020

6.31

-12.5%

-45.5%

Food Division : Full Sail Ahead

FISB: Revenue Contribution By Category

(Rm million)

FYE2019

FYE2020

-18.8%

-8.5%

-24.2%

4.08

4.46

0.75

0.99

0.85

0.69

Client/3

rd

Party Brands

In-House Brands

Others

Outlook

The Covid-19 pandemic has had an

impact on demand across some of

the division’s major markets as a result

of shifts in consumer behaviour and

spending patterns. Following the

imposition of movement controls in

mid-March of this year, we have seen

a near term y-o-y increase in demand

for our canned tuna products and a

corresponding decrease in export

demand for tuna loins and fishmeal.

The pandemic has also curtailed

demand for food and beverage

packaging on the back of reduced

foot traffic to food outlets due to

movement restrictions. Although we

expect volumes to improve in tandem

with resumption of economic activities,

the outlook beyond that will depend

on the impact of the overall economy

and resultant impacts on consumer

spending. Further, the recovery in

demand that we are seeing underpins

the importance of ensuring that we

are able to mitigate any potential

disruptions to our supply chains and

that alternative sources for materials

are available.

For this current financial year, our

aim is to: (i) expand market share

by developing and introducing new

products; (ii) capitalise on our existing

customer relationships and business

competencies; and (iii) to improve the

security and agility of our supply chain,

as well as to focus on operational

improvements to reduce costs and

energy consumption. Given the

demand uncertainties and evolving

circumstances, we will nevertheless

assess the timing of any capital

investments and limit it to those that

are necessary or important to our

growth strategy and productivity

improvement programmes.

kumpulan Fima Berhad

(197201000167)(11817-V)

Annual Report 2020

51