The Group recorded

ROE

of 2.6%

based on shareholders’ equity

of RM1,038.67 million (FYE2019:

RM1,056.96 million) compared to

8.1% recorded in the previous year

consistent with the decrease in PAT.

Capital employed is the total amount

of capital utilised to generate profits.

ROCE during FYE2020 decreased to

5.0% from 10.5% registered in the

previous year.

Liquidity and Capital Resources

The Group’s financial position

remained sound with

Cash and Bank

Balances

and

Short-Term Cash

Investments

totalling RM295.92 million

(FYE2019: RM290.32 million), 1.9%

higher than the previous year.

During the year,

Total Liabilities

increased to RM214.84 million

from RM176.94 million while total

equity reduced to RM1.04 billion

from RM1.06 billion, resulting in an

increase in the group’s gearing ratio

to 0.21 times.

The Group’s Retained

Earnings FYE2020 stood

at RM437.36 million

against RM433.56 million

in the previous financial

year due to the variance

between the dividend

payments of RM25.30

million (FYE2019:

RM25.35 million) against

the profit attributable to

the equity holders of the

Company of RM29.21

million (FYE2019:

RM59.84 million).

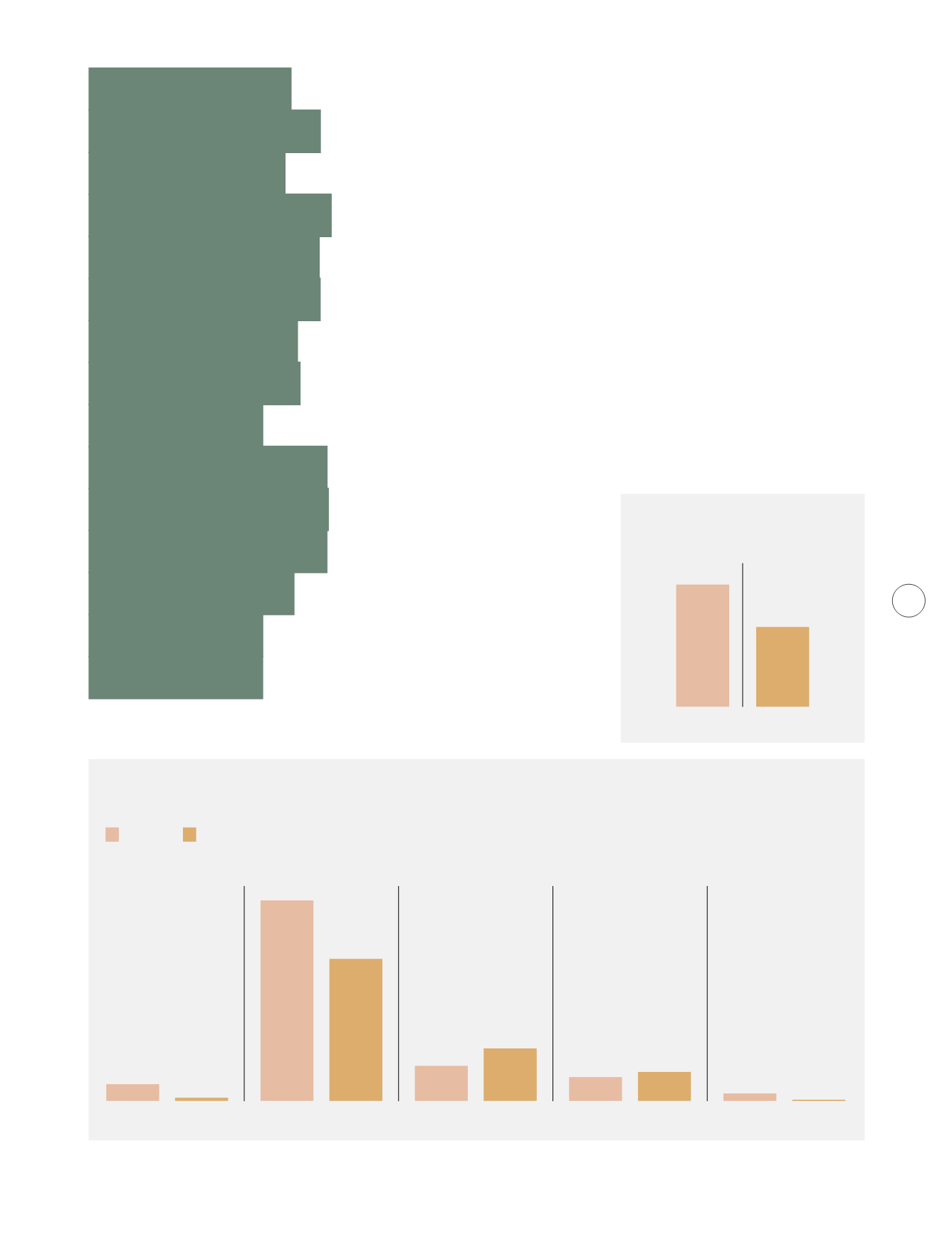

Group CAPEX

(Rm million)

40.47

32.60

FYE2019

FYE2020

CAPEX Breakdown by Division

(Rm million)

FYE2019

FYE2020

0.46

2.38

7.64

5.05

4.12

3.41

0.18

1.07

28.56

20.20

Manufacturing

Plantation

Bulking

Food

Other

The Group continue to generate

strong cash flow in FYE2020 despite

the reduction in revenue.

Net Cash

Flow Generated from Operating

Activities

provided net cash flow

surplus of RM82.20 million compared

to RM52.78 million in prior year.

Capital Expenditure (“CAPEX”)

The Group’s CAPEX of RM32.60 million

(FYE2019: RM40.47 million) was incurred

to meet ongoing CAPEX commitments

during the year. Notably, Plantation

division accounted for 61.5% of the

Group’s total CAPEX spend which

was largely utilised towards plantation

development works, new planting,

construction of workers quarters and

purchase/replacements of fixed assets.

Sources of funds for CAPEX during the

year were generated internally.

kumpulan Fima Berhad

(197201000167)(11817-V)

Annual Report 2020

31