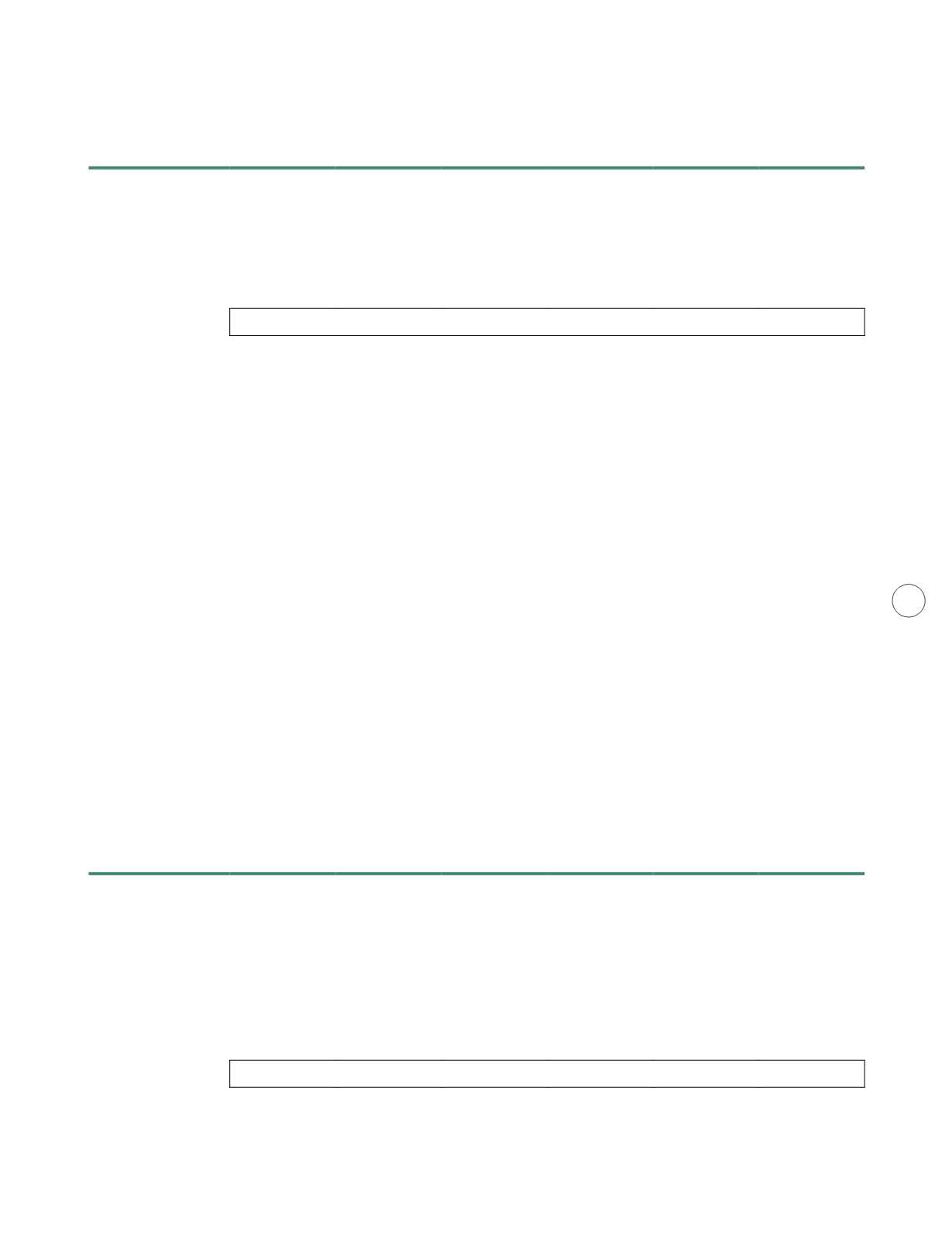

Revenue

FYE2019 Contribution FYE2020 Contribution

Variance

RM Million

%

RM Million

%

RM Million

%

Manufacturing

134.78

28.7

134.00

26.8

(0.78)

(0.6)

Plantation

118.34

25.2

123.38

24.6

5.04

4.3

Bulking

81.15

17.3

106.67

21.3

25.52

31.4

Food

130.32

27.8

131.69

26.3

1.37

1.1

Other

4.88

1.0

5.16

1.0

0.28

5.7

Group Results

469.47

100.0

500.90

100.0

31.43

6.7

Profitability

FYE2019 Contribution FYE2020 Contribution

Variance

RM Million

%

RM Million

%

RM Million

%

Manufacturing

30.56

26.6

25.99

50.1

(4.57)

(15.0)

Plantation

32.81

28.6

(20.55)

(39.6)

(53.36)

(162.6)

Bulking

43.13

37.5

35.29

68.1

(7.84)

(18.2)

Food

8.33

7.3

14.92

28.8

6.59

79.1

Other

(0.87)

(0.8)

(5.78)

(11.2)

(4.91)

562.8

Associated

Companies

0.93

0.8

1.96

3.8

1.03

110.8

Group Results

114.89

100.0

51.83

100.0

(63.06)

(54.0)

The Group generated revenue of RM500.90 million compared to RM469.47 million recorded last year, representing an

increase of 6.7% mainly attributable to improvements in contributions from the Bulking, Plantation, and Food divisions.

Bulking division’s revenue surged by 31.4% y-o-y to RM106.67 million compared to RM81.15 million in the prior year

attributed to higher throughputs achieved for most products segments as well as contributions from biodiesel which

generated revenue of RM24.57 million in its first full year of operation.

Despite the lower volumes of CPO and CPKO sold in FYE2020, Plantation division’s revenue improved by 4.3% to RM123.38

million compared to RM118.34 million recorded last year. In addition, CPO and CPKO prices realised also improved y-o-y by

7.9% and 7.5% respectively. Average CPO (CIF, net of duty) selling price was RM2,073 per MT (FYE2019: 1,921 per MT) while

the average CPKO price achieved was RM3,242 per MT (FYE2019: RM3,015 per MT). The improved performance was partially

offset by lower overall FFB production during the year.

Food division’s revenue improved by 1.1% to RM131.69 million from RM130.32 million recorded in the previous year on the

back of improved sales in the canned tuna segments. However, it was offset by reduced volumes for tuna loins, fish meal and

canned mackerel.

Manufacturing division’s revenue declined by 0.6% to RM134.00 million from RM134.78 million achieved last year, impacted

by the declines in volumes as well as changes in order patterns for certain product segments.

kumpulan Fima Berhad

(197201000167)(11817-V)

Annual Report 2020

29