Notes to the

Financial Statements

As at 31 March 2019

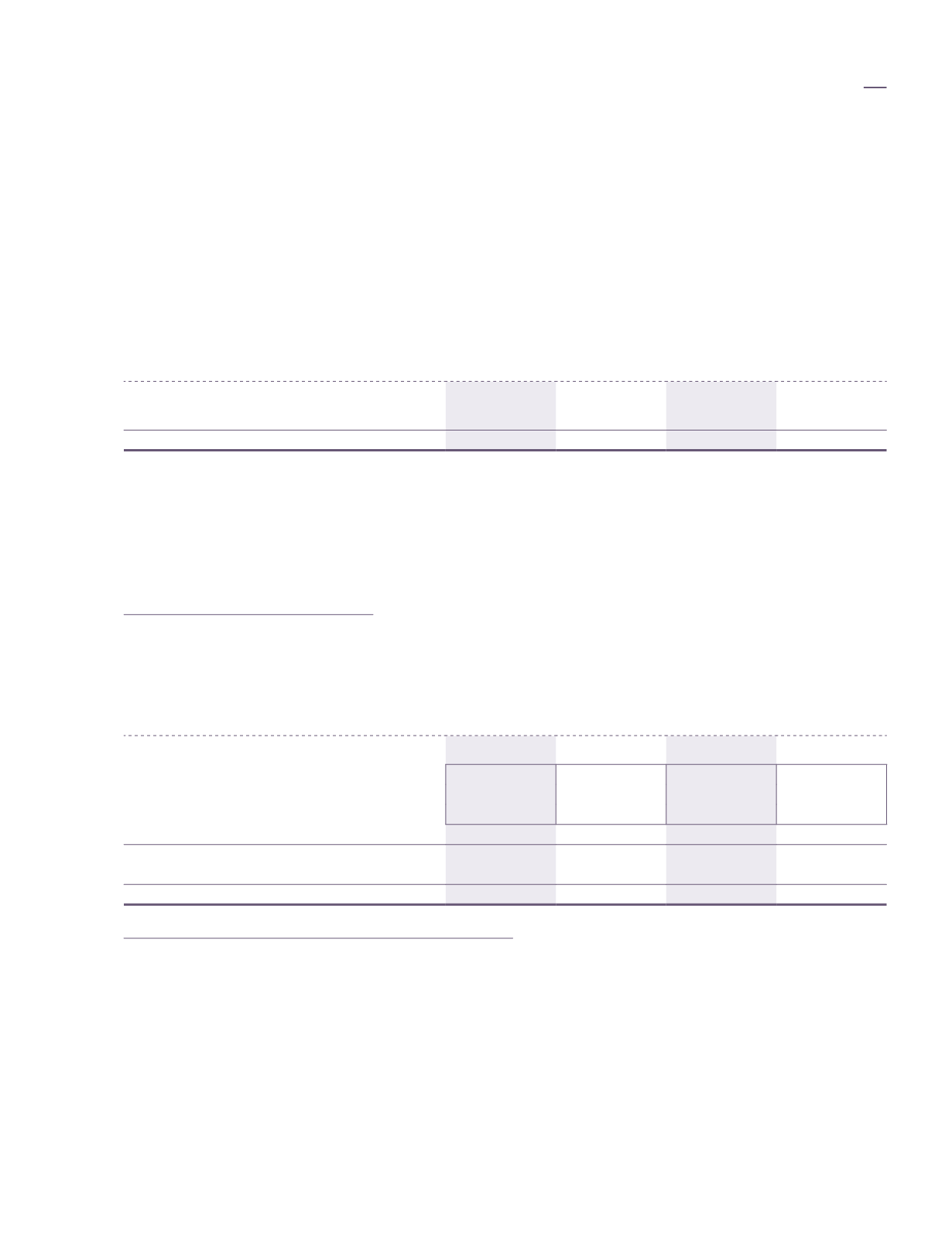

20. Trade receivables

Group

Company

2019

2018

2019

2018

RM’000

RM’000

RM’000

RM’000

(Restated)

Third parties

135,019

147,017

10

10

Less: Allowance for impairment

(5,860)

(7,057)

(10)

(10)

Trade receivables, net

129,159

139,960

-

-

The Group’s normal trade credit term ranges from 30 to 90 days (2018: from 30 to 90 days). Other credit terms

are assessed and approved on a case-by-case basis.

The Group has no significant concentration of credit risk that may arise from exposures to a single debtor or

to group of debtors except for a balance of RM41,827,000 (2018: RM55,319,000) due from the Government of

Malaysia.

Ageing analysis of trade receivables

The ageing analysis of the Group’s and the Company’s trade receivables is as follows:

Group

Company

2019

2018

2019

2018

RM’000

RM’000

RM’000

RM’000

Neither past due nor impaired

49,909

54,190

-

-

1 to 60 days past due but not impaired

27,185

35,496

-

-

61 to 120 days past due but not impaired

5,145

13,051

-

-

More than 121 days past due but not impaired

46,920

37,223

-

-

79,250

85,770

-

-

129,159

139,960

-

-

Impaired

5,860

7,057

10

10

135,019

147,017

10

10

Trade receivables that are neither past due nor impaired

Trade and other receivables that are neither past due nor impaired are creditworthy debtors with good payment

records with the Group.

None of the Group’s trade receivables that are neither past due nor impaired have been renegotiated during the

financial year.

financial

statements

169