Notes to the

Financial Statements

As at 31 March 2019

16. Investment in subsidiaries (cont’d.)

(a) Acquisition of subsidiary in previous financial year (cont’d.)

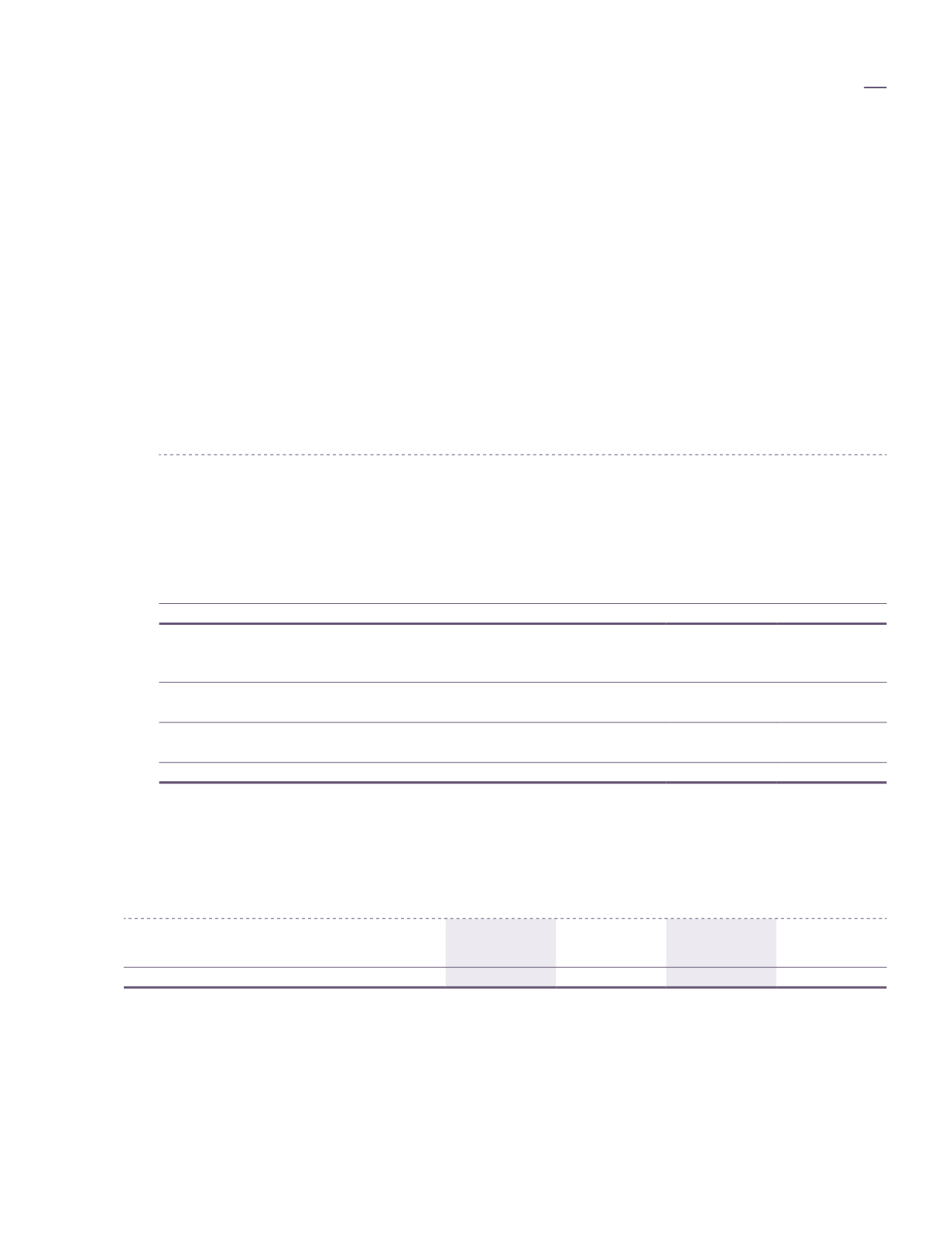

The details of the net assets acquired and cash flows arising from the acquisition of JPSB’s Group

are as follows:

Carrying

Fair

Amount

Value

RM’000

RM’000

Property, plant and equipment

13,038

26,400

Biological assets

11,198

8,600

Trade and other receivables

38

38

Cash and bank balances

50

50

Inventories

6

6

Trade and other payables

(149)

(149)

Borrowings

(29,026)

(29,026)

(4,845)

5,919

Less: Non-controlling interest shares on fair value of Ladang Bunga

Tanjong Sdn. Bhd.

(1,030)

4,889

Negative goodwill on acquisition

(275)

Purchase consideration settled in cash

4,614

Less: Cash and bank balances

(50)

Cash outflow of the Group acquisition

4,564

17. Investment in associates

Group

Company

2019

2018

2019

2018

RM’000 RM’000

RM’000

RM’000

Unquoted shares, at cost

12,251

12,251

2,251

2,251

Share of post acquisition results

19,023

31,396

-

-

31,274

43,647

2,251

2,251

Details of the associates are described in Note 42.

The financial statements of the associates are coterminous with those of the Group, except for Giesecke &

Devrient Malaysia Sdn. Bhd. (“G&D”) which has a financial year end of 31 December to conform with its holding

company’s financial year end. For the purpose of applying the equity method of accounting, the financial

statements of G&D for the year ended 31 December 2018 have been used and appropriate adjustments have

been made for the effects of transactions between 31 December 2018 and 31 March 2019.

financial

statements

165