Notes to the

Financial Statements

As at 31 March 2019

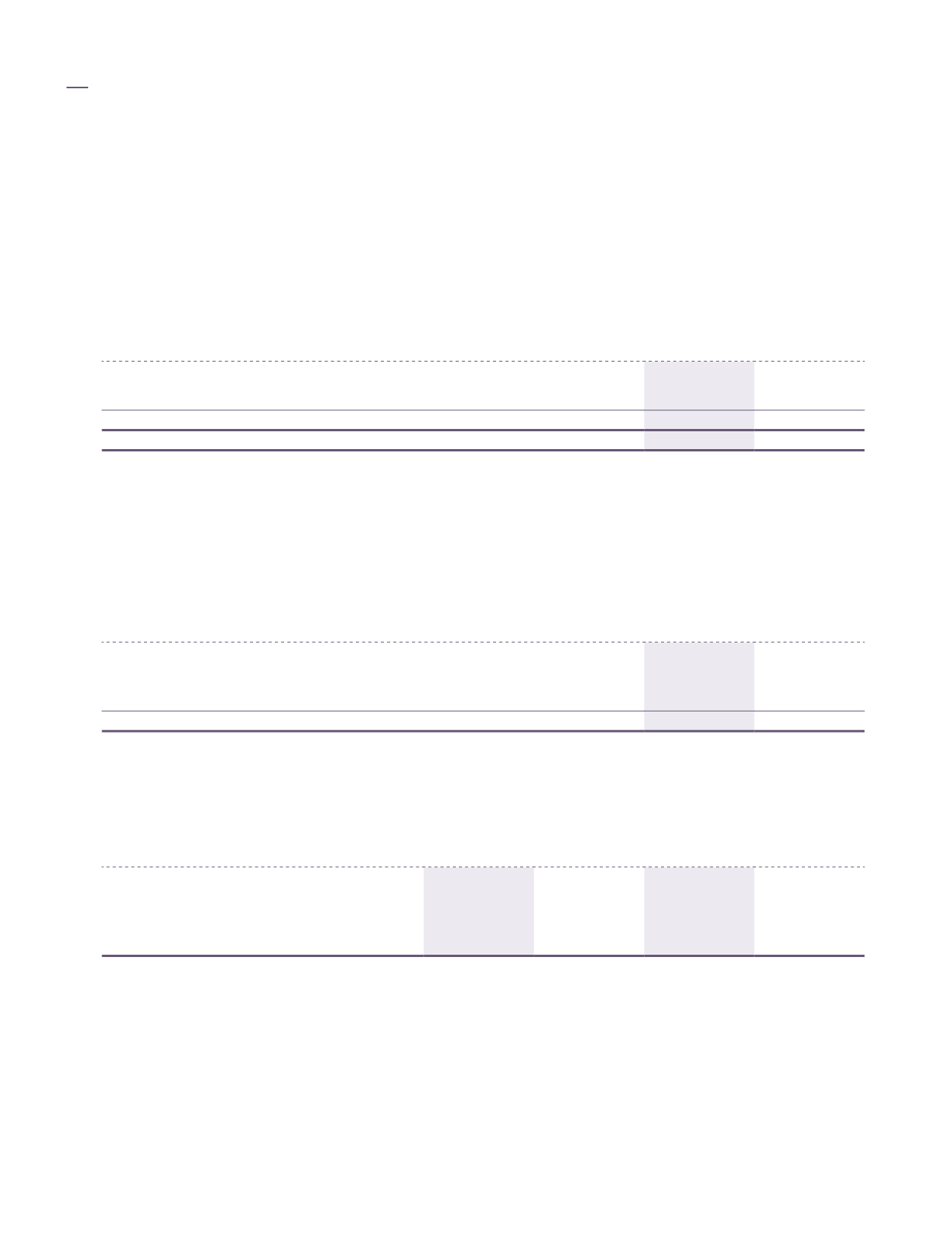

22. Due from/(to) subsidiaries

Company

2019

2018

RM’000

RM’000

Due from subsidiaries

248,909

244,656

Less: Allowance for impairment

-

(7,041)

248,909

237,615

Due to subsidiaries

(6,818)

(17,688)

All the amounts due from/(to) subsidiaries are unsecured, interest free and repayable on demand except for the

amount due from certain subsidiaries amounting to RM185,601,000 (2018: RM207,281,000), which bear interest

of 5.5% (2018: 5.5%) per annum.

Movement in allowance accounts:

Company

2019

2018

RM’000

RM’000

At 1 April 2018

7,041

7,041

Advances to subsidiaries

(5,186)

-

Write back for the year (Note 5)

(1,855)

-

At 31 March

-

7,041

23. Short term cash investments

Group

Company

2019

2018

2019

2018

RM’000

RM’000

RM’000

RM’000

At fair value

Investment in units

- Islamic

148,122

51,886

-

8,003

Short term cash investments represent funds placed with licensed fund managers. The portfolio of securities

managed by the fund managers comprise money market funds, commercial papers and fixed deposits. Short

term cash investments held as fixed deposit placements allow prompt redemption at anytime.

Other details of fair value of short term cash investments are futher disclosed in Note 38.

Kumpulan Fima Berhad

(11817-V)

Annual Report 2019

172