Notes to the

Financial Statements

As at 31 March 2019

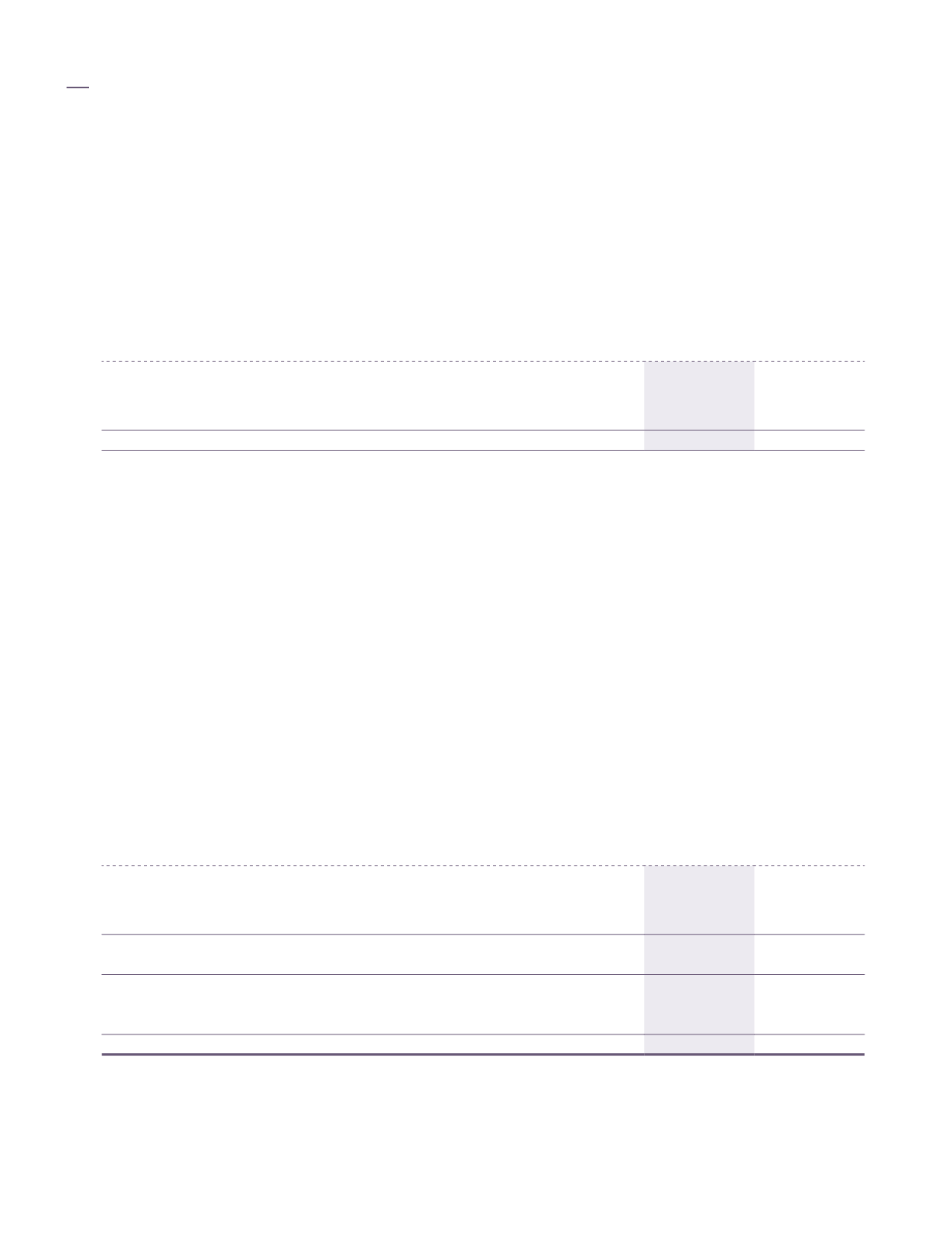

15. Biological assets

Group

2019

2018

RM’000 RM’000

At 1 April 2018/2017

5,102

6,289

Fair value changes recognised in profit or loss

(744)

(802)

Exchange differences

146

(385)

At 31 March

4,504

5,102

Biological assets represents the fresh fruit bunches (“FFB”) of up to 15 days prior to harvest for use in the Group’s

palm product operations. During the financial year ended 31 March 2019, the Group harvested approximately

198,910 metric tonnes (“MT”) of FFB (2018: 198,644 MT). The quantity of unharvested FFB of the Group as at 31

March 2019 included in the fair valuation of FFB was 7,286 MT (2017: 7,316 MT).

In arriving at the fair value, the Group adopted the income approach which considers the net present value of

all directly attributable cash inflows, cash outflows and imputed contributory asset charges where no actual

cash flows associated with the use of assets essential to the agricultural activity. Changes to the assumed prices

of the FFB and tonnage included in the valuation will have a direct effect on the reported valuation.

The Groups biological assets computation is a Level 3 fair value estimation.

If the selling prices of FFB or tonnage changed by 10%, the Group’s fair value changes in FFB would have

increased or decreased by approximately RM275,000 (2018: RM436,000).

16. Investment in subsidiaries

Company

2019

2018

RM’000

RM’000

Unquoted ordinary shares, at cost

In Malaysia

160,913

160,912

Outside Malaysia

44,415

44,415

205,328

205,327

Advances to subsidiaries

14,399

-

219,727

205,327

Less: Accumulated impairment losses

in Malaysia

(21,855)

(16,669)

197,872

188 ,658

Details of the subsidiaries are described in Note 41.

Kumpulan Fima Berhad

(11817-V)

Annual Report 2019

162