Notes to the

Financial Statements

As at 31 March 2019

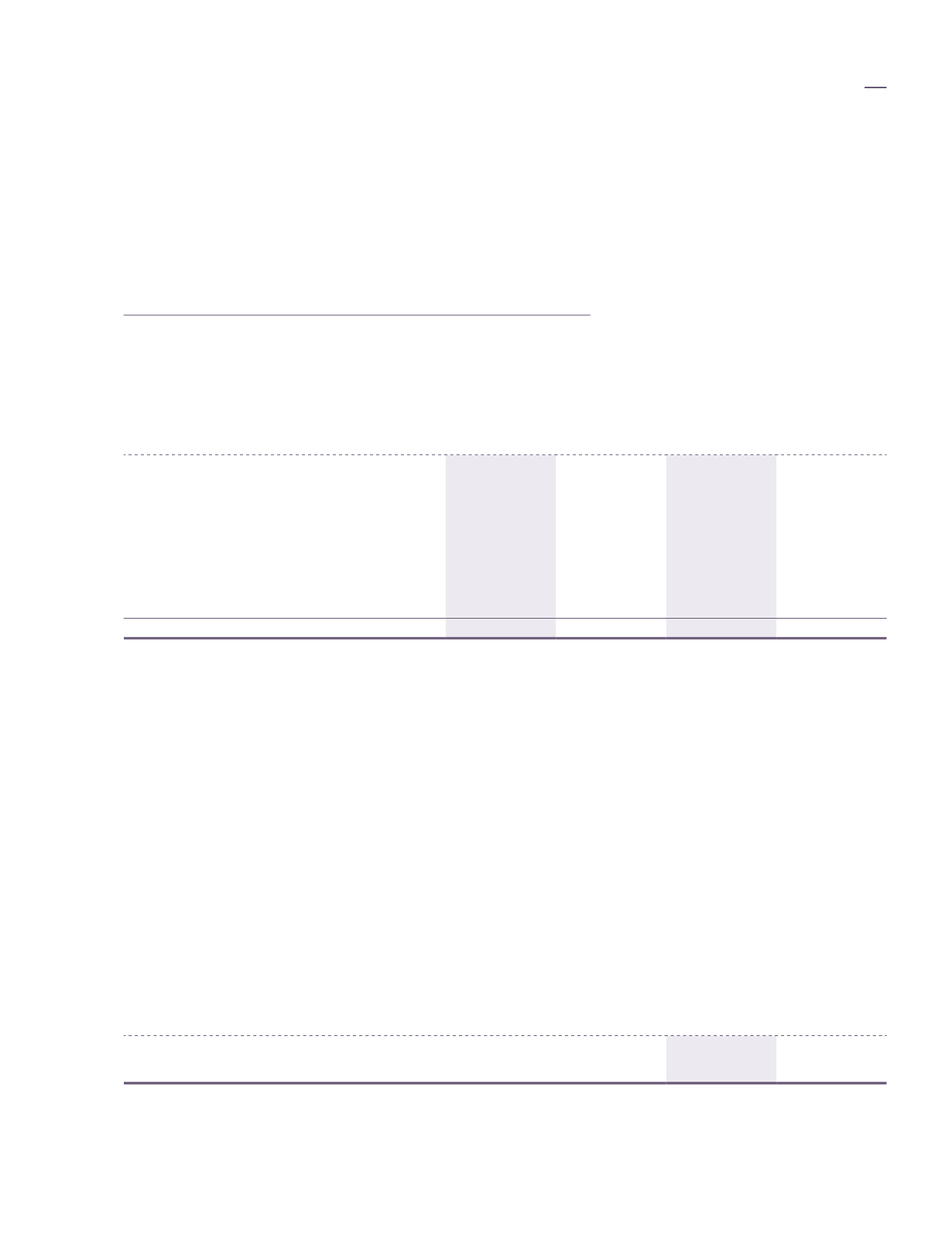

10. Income tax expense (cont’d.)

Reconciliation between tax expense and accounting profit (cont’d.)

A reconciliation of income tax expense applicable to profit before tax at the statutory income tax rate to income

tax expense at the effective income tax rate of the Group and of the Company is as follows: (cont’d.)

Group

Company

2019

2018

2019

2018

RM’000

RM’000

RM’000

RM’000

Effect of share results of associates

(896)

(407)

-

-

Deferred tax assets not recognised in respect

of current year’s tax losses and unabsorbed

capital allowances

2,105

3,693

-

-

Overprovision of income tax expense in

prior years

(643)

(149)

(211)

(23)

Under/(over) provision of deferred tax in

prior years

796

399

(10)

(213)

29,677

31,500

1,712

1,718

Domestic current income tax is calculated at the statutory tax rate of 24% (2018: 24%) of the estimated

assessable profit for the year.

Taxation for other jurisdictions is calculated at the rates prevailing in the respective jurisdictions. During the

current financial year, the income tax rate applicable to the subsidiaries in Indonesia and Papua New Guinea

were 25% (2018: 25%) and 30% (2018: 30%), respectively.

11. Earnings per share

Basic earnings per share is calculated by dividing profit for the year, net of tax, attributable to owners of the

parent by the weighted average number of ordinary shares in issue during the financial year, excluding treasury

shares held by the Company.

The following tables reflect the profit and share data used in the computation of basic and diluted earnings per

share for the years ended 31 March:

Group

2019

2018

RM’000

RM’000

Profit net of tax attributable to equity holders of the Company used in the

computation of basic/diluted earnings per share

59,840

29,872

financial

statements

153