Notes to the

Financial Statements

As at 31 March 2019

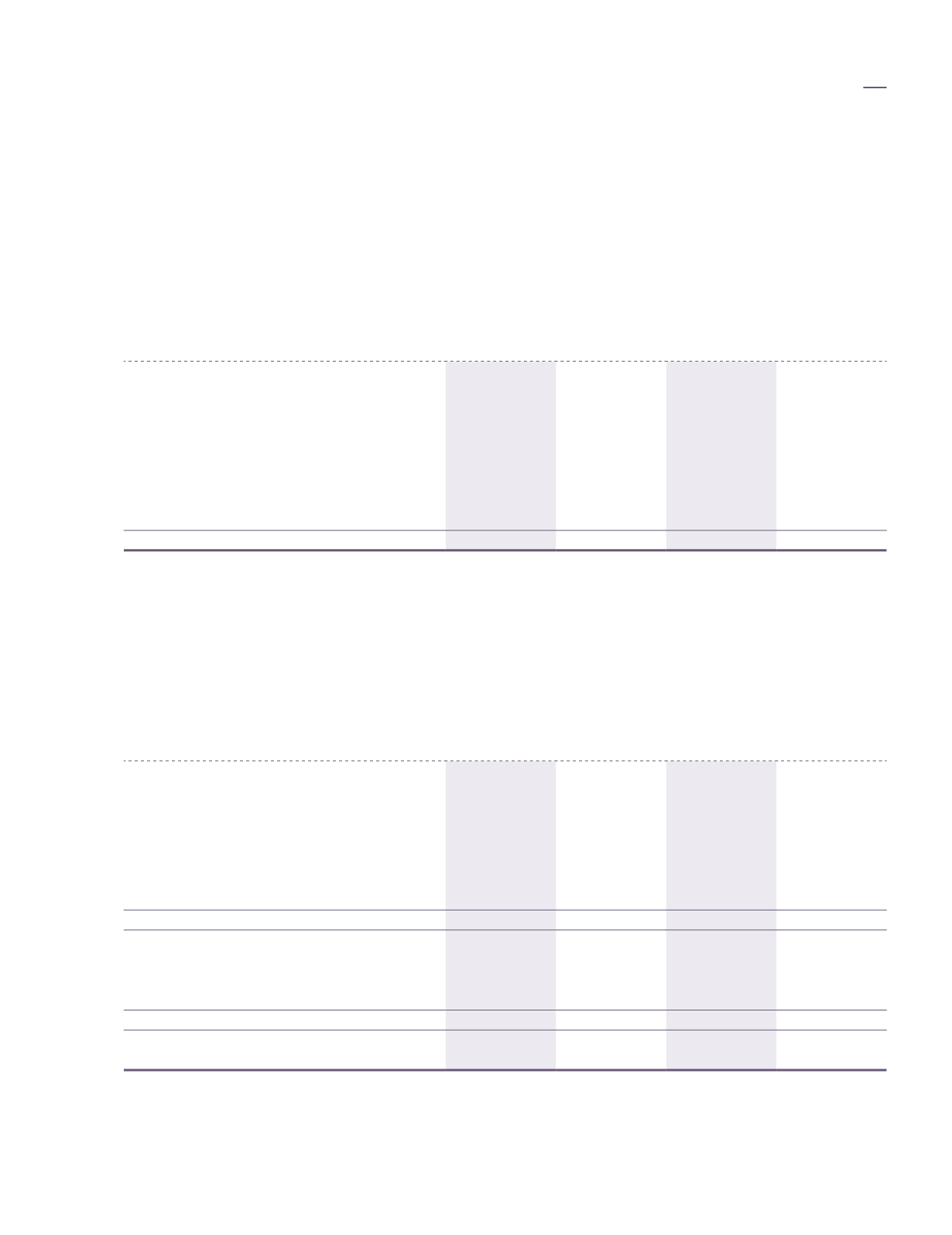

6.

Staff costs

Group

Company

2019

2018

2019

2018

RM’000

RM’000

RM’000

RM’000

Wages and salaries:

- Company’s Executive Director (Note 7)

2,531

2,480

1,012

946

- Others

42,358

40,070

4,327

3,827

Social security costs

404

400

35

29

Pension costs:

- defined contribution plan

5,395

6,168

849

807

- defined benefit plan (Note 29)

240

289

-

-

Other staff related expenses

8,584

7,487

279

235

59,512

56,894

6,502

5,844

Included in staff costs of the Group and of the Company is the Managing Director’s remuneration amounting to

RM2,630,000 (2018: RM2,543,000) and RM1,038,000 (2018: RM946,000) respectively as further disclosed in

Note 7.

7.

Directors’ remuneration

Group

Company

2019

2018

2019

2018

RM’000

RM’000

RM’000

RM’000

Directors of the Company

Executive:

Salaries and other emoluments

1,239

1,175

496

472

Bonus

885

956

354

323

Pension costs - defined contribution plan

407

349

162

151

Benefits-in-kind

99

63

26

-

2,630

2,543

1,038

946

Non-executive:

Fees

289

360

271

321

Meeting allowance

94

113

92

104

383

473

363

425

Total

3,013

3,016

1,401

1,371

financial

statements

149