Notes to the

Financial Statements

As at 31 March 2019

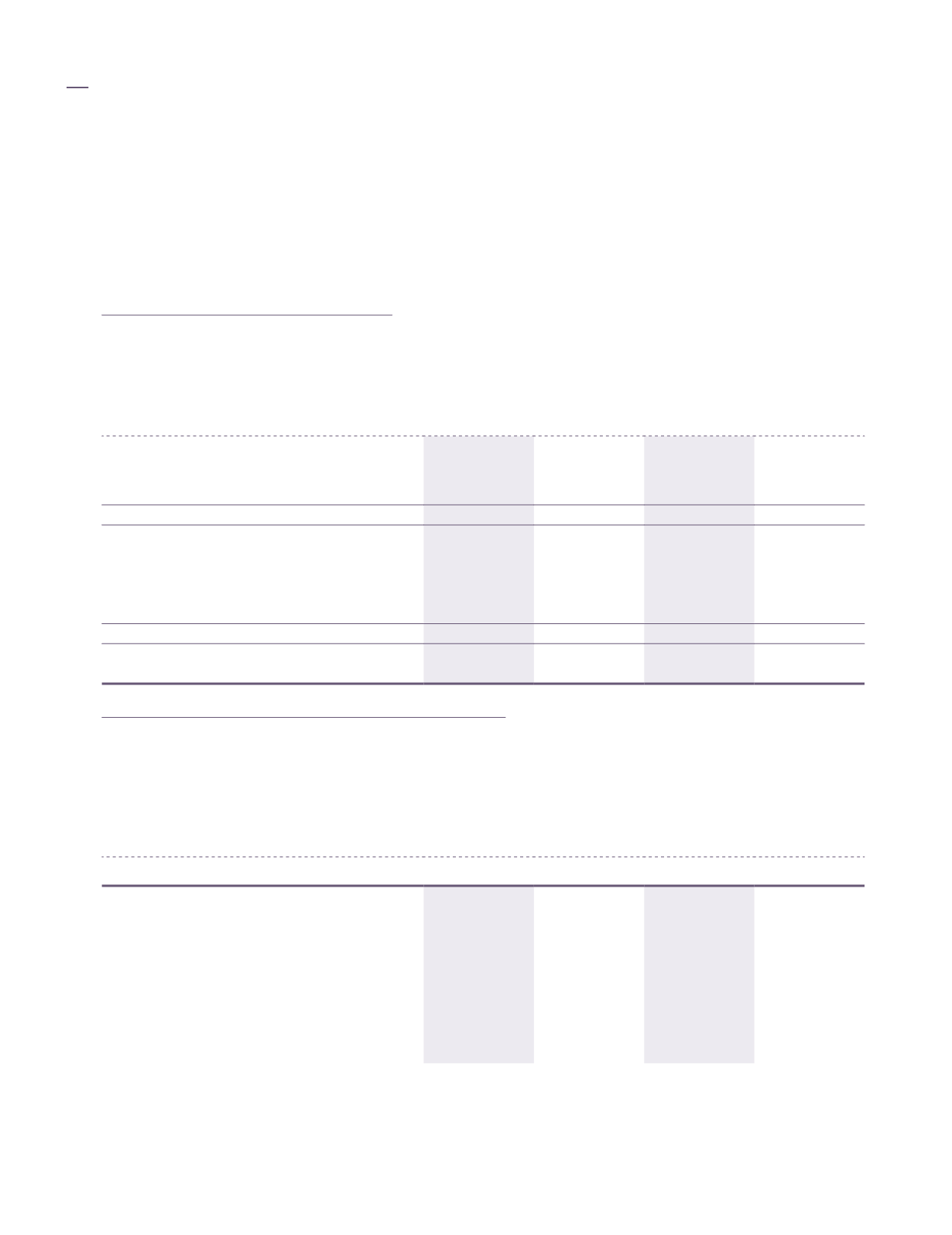

10. Income tax expense

Major components of income tax expense

The major components of income tax expense for the years ended 31 March 2019 and 2018 are:

Group

Company

2019

2018

2019

2018

RM’000

RM’000

RM’000

RM’000

Current income tax:

- Malaysian income tax

28,681

29,973

2,132

1,954

- Underprovision in prior years

(643)

(149)

(211)

(23)

28,038

29,824

1,921

1,931

Deferred tax (Note 30):

Relating to origination and reversal of

temporary differences

843

1,277

(199)

-

Under/(over) provision in prior years

796

399

(10)

(213)

1,639

1,676

(209)

(213)

Total income tax expense

29,677

31,500

1,712

1,718

Reconciliation between tax expense and accounting profit

A reconciliation of income tax expense applicable to profit before tax at the statutory income tax rate to

income tax expense at the effective income tax rate of the Group and of the Company is as follows:

Group

Company

2019

2018

2019

2018

RM’000

RM’000

RM’000

RM’000

Profit before tax

114,885

78,135

54,716

42,697

Taxation at statutory tax rate of 24% (2018: 24%)

27,572

18,752

13,132

10,248

Effect of income not subject to tax

(6,147)

(63)

(12,349)

(10,499)

Effect of tax rates in foreign jurisdiction

415

3,029

-

-

Effect of partial tax exemption

(17)

(41)

-

-

Effect of expenses not deductible for tax

purposes

6,492

6,351

1,150

2,205

Effect of utilisation of previously

unrecognised deferred tax

-

(244)

-

-

Kumpulan Fima Berhad

(11817-V)

Annual Report 2019

152