1 7 5

NOTES TO THE FINANCIAL STATEMENTS

31 MARCH 2018

Kumpulan Fima Berhad (11817-V) •

Annual Report 2018

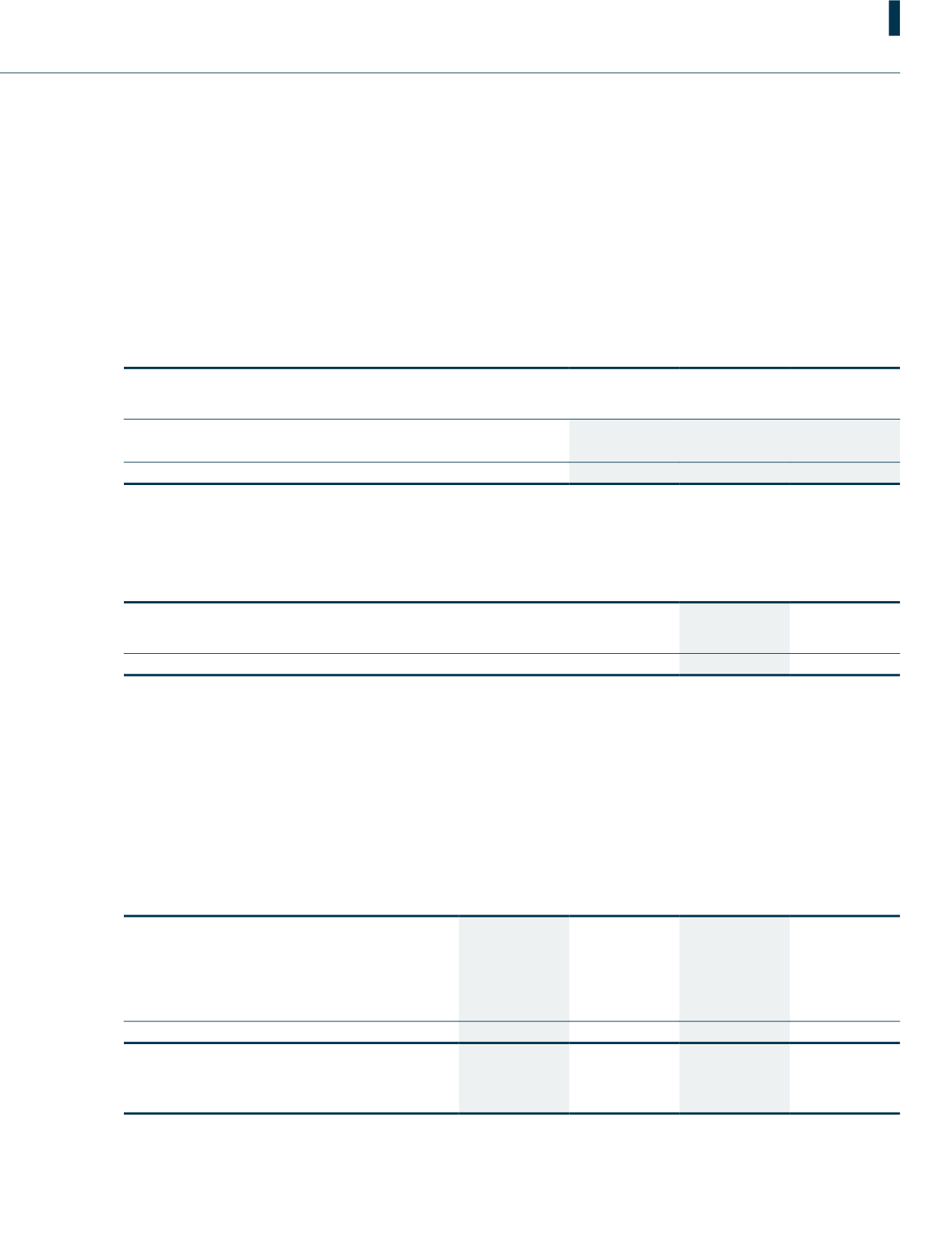

30. Deferred tax (cont’d.)

Deferred tax liabilities of the Company:

Accelerated

capital

allowances

Revaluation

on land and

building

Total

RM’000

RM’000

RM’000

At 1 April 2016

583

6,280

6,863

Recognised in profit or loss

(460)

(124)

(584)

At 31 March 2017

123

6,156

6,279

Recognised in profit or loss

(94)

(119)

(213)

At 31 March 2018

29

6,037

6,066

Deferred tax assets have not been recognised in respect of the following items:

Group

2018

2017

RM’000

RM’000

Unutilised tax losses

29,287

15,868

Unabsorbed capital allowances

9,310

7,341

38,597

23,209

The unutilised tax losses and unabsorbed capital allowances of the Group are available indefinitely against future taxable

profit of the respective entities within the Group subject to no substantial changes in shareholdings of those entities under the

Income Tax Act, 1967 and guidelines issued by the tax authority. Deferred tax assets have not been recognised in respect of

these items as they may not be used to offset taxable profit of other entities in the Group and they have arisen in entities that

have a recent history of losses.

31. Borrowings

Group

Company

2018

2017

2018

2017

RM’000

RM’000

RM’000

RM’000

Short term borrowings

Unsecured:

- Bankers’ acceptances

8,419

4,516

8,419

4,516

- Revolving credit

25,000

10,000

25,000

10,000

33,419

14,516

33,419

14,516

Maturity of borrowings

Within one year

33,419

14,516

33,419

14,516

The revolving credit facility is rolled over every three months.

The weighted average effective interest rate of the facilities during the financial year was 4.87% (2017: 4.47%) per annum.