1 7 4

NOTES TO THE FINANCIAL STATEMENTS

31 MARCH 2018

fInanCIal StatementS

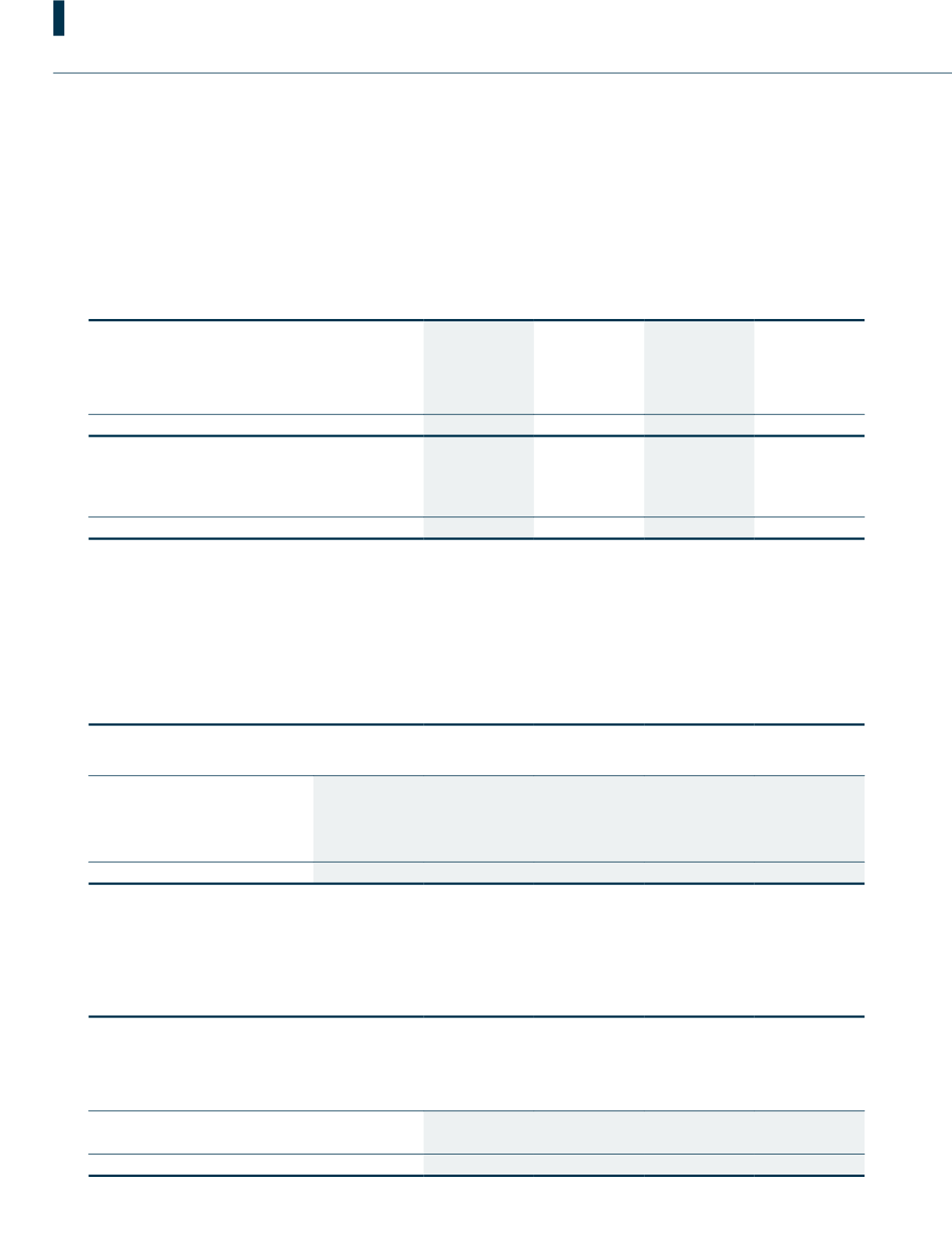

30. Deferred tax

Group

Company

2018

2017

2018

2017

RM’000

RM’000

RM’000

RM’000

At 1 April 2017/2016

25,956

38,557

6,279

6,863

Recognised in:

- profit or loss (Note 10)

1,990

(8,760)

(213)

(584)

- other comprehensive income

(12)

(3,841)

-

-

At 31 March

27,934

25,956

6,066

6,279

Presented after appropriate offsetting as follows:

Deferred tax assets

(9,206)

(6,966)

-

-

Deferred tax liabilities

37,140

32,922

6,066

6,279

27,934

25,956

6,066

6,279

The components and movements of deferred tax assets and liabilities during the financial year prior to offsetting are as follows:

Deferred tax assets of the Group:

Retirement

benefit

obligations

Other

payables

Tax losses and

unabsorbed

capital

allowances

Property,

plant and

equipment

Total

RM’000

RM’000

RM’000

RM’000

RM’000

At 1 April 2016

(389)

(4,669)

(1,690)

(1,646)

(8,394)

Recognised in profit or loss

(64)

1,175

582

(265)

1,428

At 31 March 2017

(453)

(3,494)

(1,108)

(1,911)

(6,966)

Recognised in:

- profit or loss

17

1,573

(3,882)

64

(2,228)

- other comprehensive income

(12)

-

-

-

(12)

At 31 March 2018

(448)

(1,921)

(4,990)

(1,847)

(9,206)

Deferred tax liabilities of the Group:

Accelerated

capital

allowances

Revaluation

on land and

building

Others

Total

RM’000

RM’000

RM’000

RM’000

At 1 April 2016

7,086

28,216

11,649

46,951

Recognised in:

- profit or loss

288

(172)

(10,304)

(10,188)

- other comprehensive income

-

(3,841)

-

(3,841)

At 31 March 2017

7,374

24,203

1,345

32,922

Recognised in profit or loss

2,967

(773)

2,024

4,218

At 31 March 2018

10,341

23,430

3,369

37,140