1 7 2

NOTES TO THE FINANCIAL STATEMENTS

31 MARCH 2018

fInanCIal StatementS

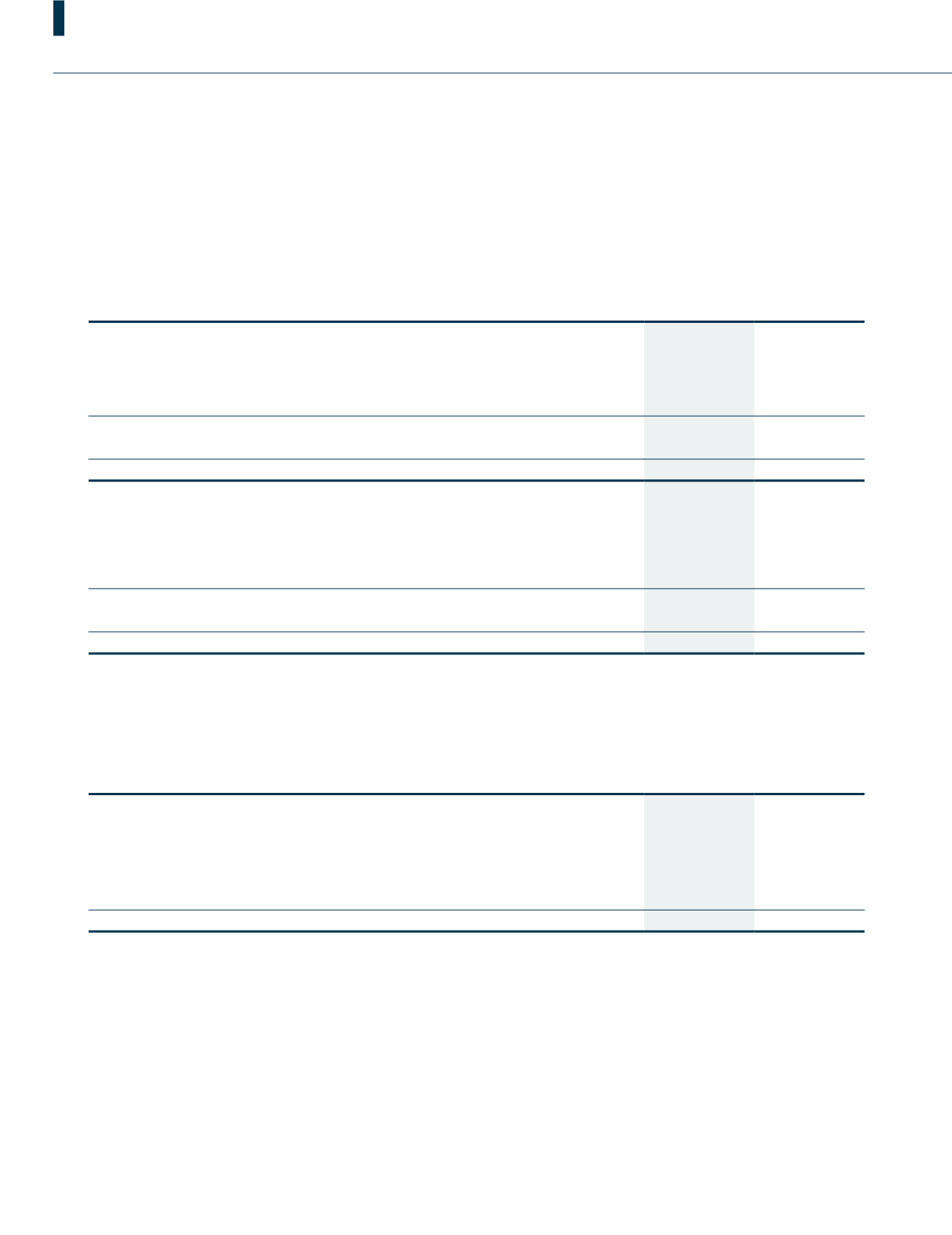

28. Finance lease obligations

Group

2018

2017

RM’000

RM’000

Minimum lease payments:

- due no later than one year

772

742

- due later than one year and no later than 5 years

4,423

4,030

- due later than 5 years

82,460

83,595

Total minimum lease payments

87,655

88,367

Less: Amounts representing finance charges

(71,456)

(71,567)

Present value of minimum lease payments

16,199

16,800

Present value of finance lease payables:

- due no later than one year

611

624

- due later than one year and no later than 5 years

2,430

2,284

- due later than 5 years

13,158

13,892

Present value of minimum lease payments

16,199

16,800

Less: Amount due within 12 months

(611)

(624)

Amount due after 12 months

15,588

16,176

29. Retirement benefit obligations

Group

2018

2017

RM’000

RM’000

At 1 April 2017/2016

1,837

1,391

Recognised in profit or loss (Note 6)

289

284

Contributions paid

(43)

(50)

Remeasurement of defined benefit liability

(49)

100

Exchange differences

(221)

112

At 31 March

1,813

1,837

The foreign subsidiary in Indonesia operates an unfunded defined benefit plan for its eligible employees. The obligations under

the retirement benefit scheme are calculated using the projected unit credit method, is determined by a qualified independent

actuary, considering the estimated future cash outflows using market yields at the reporting date of high quality corporate

bonds. The latest actuarial valuation was carried out using the employee data as at 31 March 2018.