Kumpulan Fima Berhad

(11817-V)

204

Notes to the

financial statements

31 march 2017

37. Financial risk management objectives and policies (cont’d.)

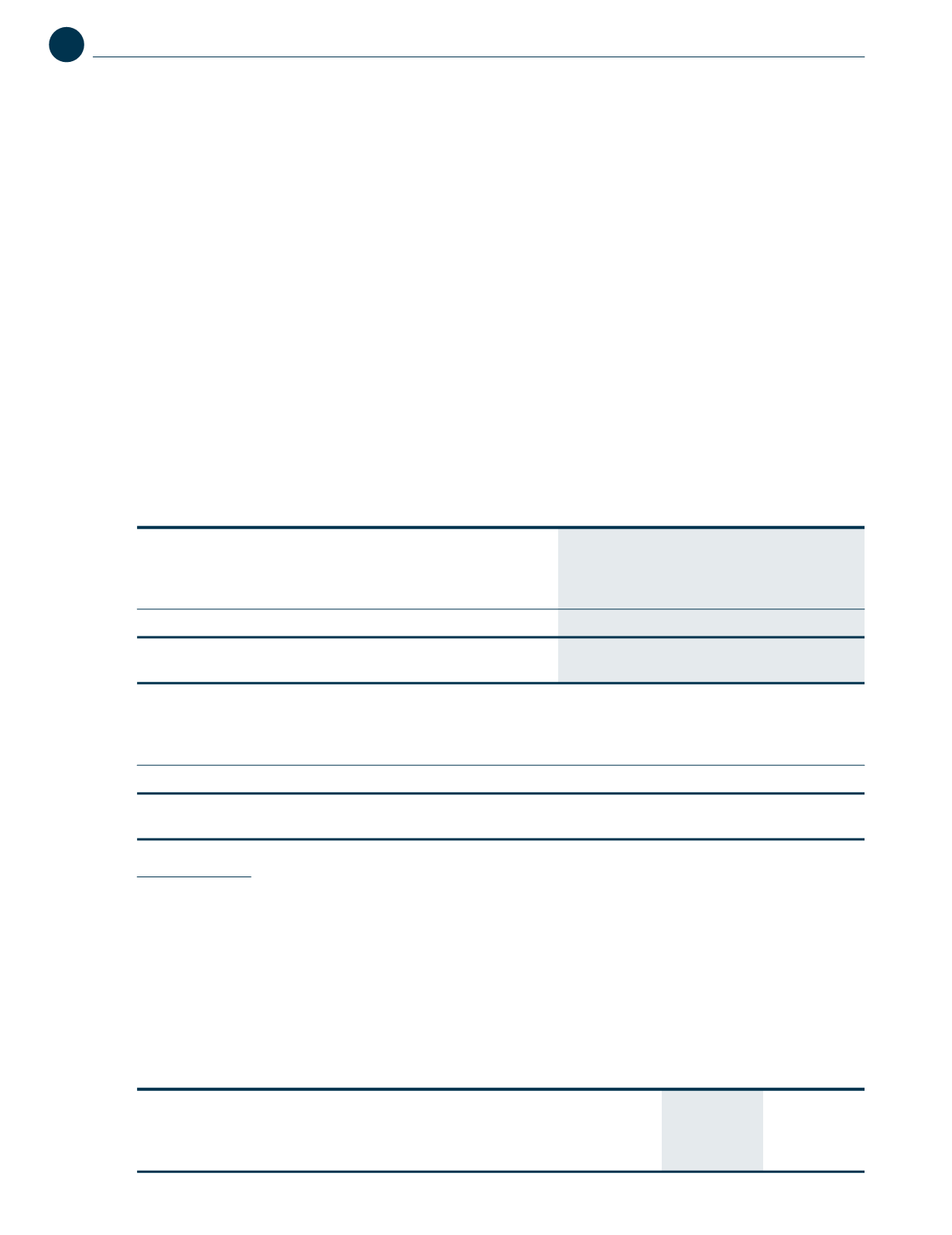

(c) Foreign currency risk

The Group is exposed to transactional currency risk primarily through sales and purchases that are denominated in

a currency other than the functional currency of the operations to which they relate. The currencies giving rise to this

risk are primarily Indonesian Rupiah and Papua New Guinea Kina. The Group does not practise any fund hedge for its

purchases and sales transaction.

The net unhedged financial assets and financial liabilities of the Group that are not denominated in the functional

currency of the Company are as follows:

Papua New

Indonesian

Guinea

Rupiah

Kina

Total

RM’000

RM’000

RM’000

At 31 March 2017

Assets

- Trade and other receivables

27,812

32,662

60,474

- Cash and cash equivalents

51,797

11,709

63,506

79,609

44,371

123,980

Liabilities

- Trade and other payables

11,761

8,698

20,459

At 31 March 2016

Assets

- Trade and other receivables

21,841

26,607

48,448

- Cash and cash equivalents

18,427

26,005

44,432

40,268

52,612

92,880

Liabilities

- Trade and other payables

7,843

12,300

20,143

Sensitivity analysis

The following table demonstrates the sensitivity of the Group’s profit net of tax to a reasonably possible change in the

Indonesian Rupiah (“IDR”) and Papua New Guinea Kina (“PNGK”) exchange rates against the functional currency of the

affected group companies (“RM”) with all other variables held constant.

Group

2017

2016

Effect on

Effect on

profit

profit

net of tax

net of tax

RM’000

RM’000

IDR - strengthen 5% (2016: 5%)

2,578

1,232

IDR - weaken 5% (2016: 5%)

(2,578)

(1,232)

PNGK - strengthen 7% (2016: 2%)

1,898

613

PNGK - weaken 7% (2016: 2%)

(1,898)

(613)