Annual Report 2017

203

Notes to the

financial statements

31 march 2017

37. Financial risk management objectives and policies (cont’d.)

(b) Liquidity/funding risk

The Group defines liquidity/funding risk as the risk that funds will not be available to meet liabilities as they fall due.

The Group actively manages its operating cash flows and the availability of funding so as to ensure that all funding

needs are met. As part of its overall prudent liquidity management, the Group maintains sufficient levels of cash or

cash convertible instruments to meet its working capital requirements. To ensure availability of funds, the Group closely

monitors its cash flow position on a regular basis.

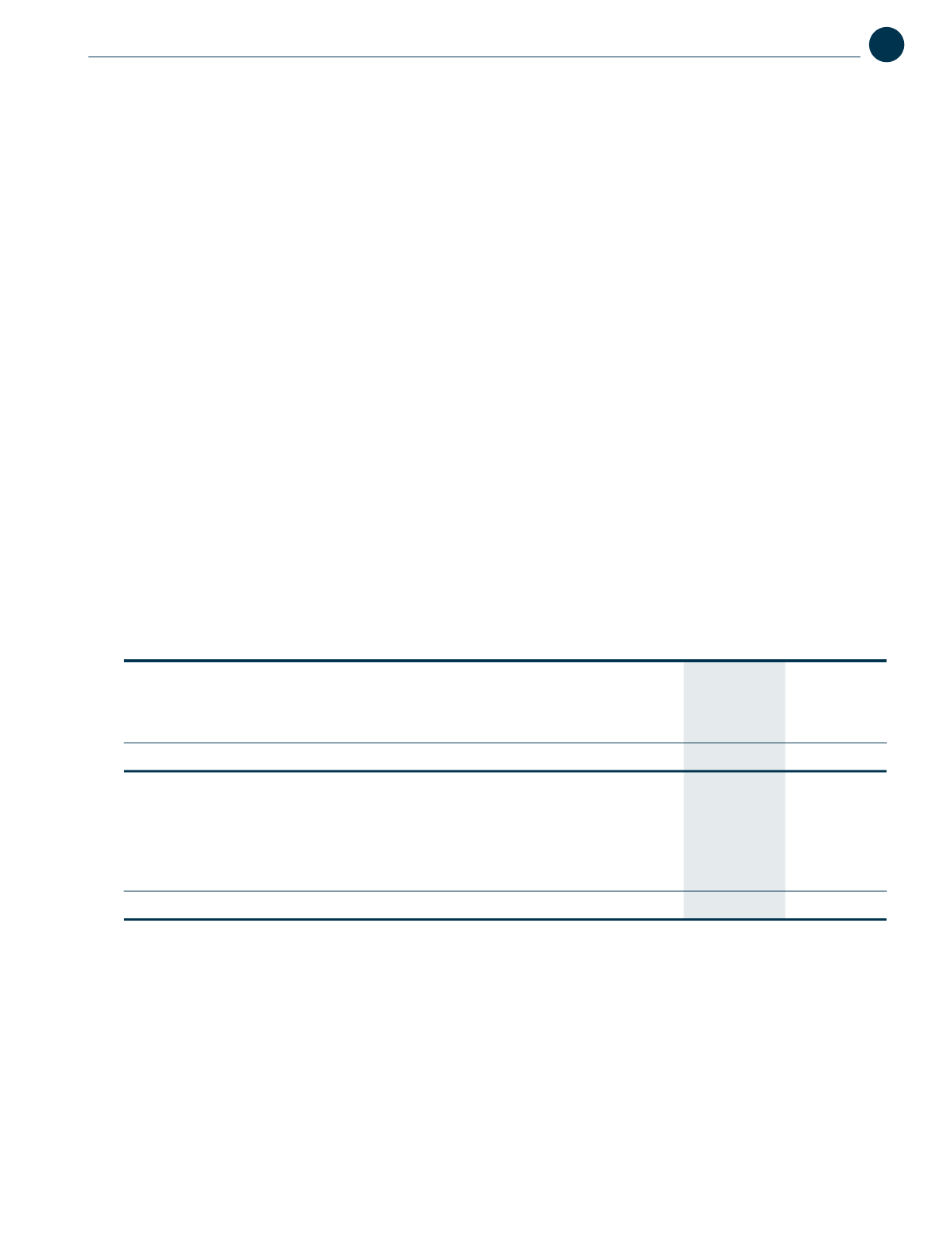

Analysis of financial instruments by remaining contractual maturities

The table below summarises the maturity profile of the Company’s liabilities at the reporting date based on contractual

undiscounted repayment obligations.

Contractual cashflow

on demand or

within one year

2017

2016

RM’000

RM’000

Group

Financial liabilities:

Trade and other payables

112,459

85,388

Borrowings

14,516

15,281

Total undiscounted financial liabilities

126,975

100,669

Company

Financial liabilities:

Trade and other payables

1,432

1,348

Due to subsidiaries

17,573

25,344

Borrowings

14,516

13,020

Total undiscounted financial liabilities

33,521

39,712