Annual Report 2017

201

Notes to the

financial statements

31 march 2017

36. Financial instruments (cont’d.)

(a) Fair value measurement (cont’d.)

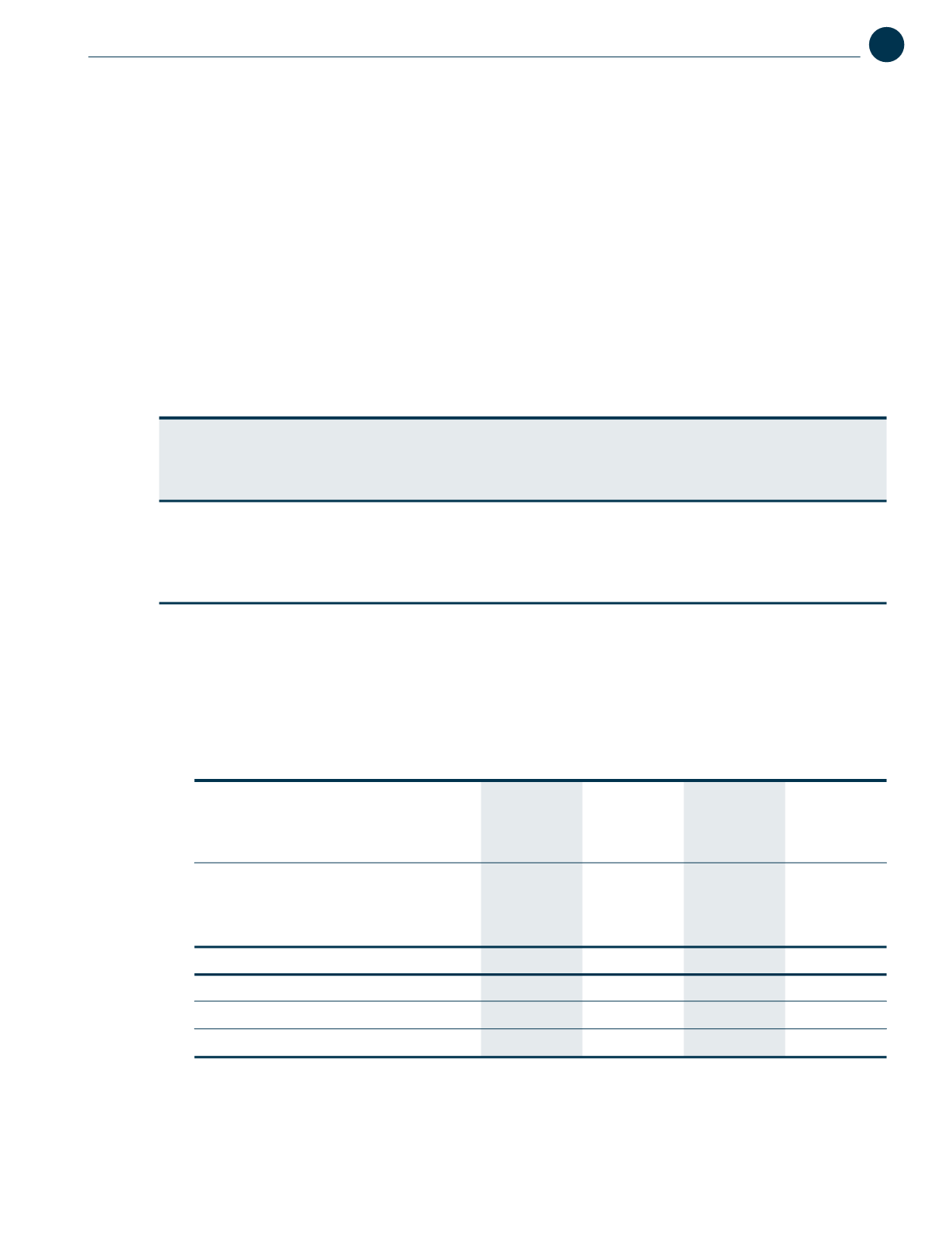

The following table presents the Group’s and the Company’s assets that are measured at fair value as at 31 March 2017

and 2016 respectively.

Group Company

Date of

Level 3

Level 3

valuation

RM’000

RM’000

As at 31 March 2017

Assets disclosed at fair value:

Investment properties (Note 14)

31 March 2017

78,790

3,830

As at 31 March 2016

Assets disclosed at fair value:

Investment properties (Note 14)

31 March 2016

77,277

3,830

(b) Classification of financial instruments

The financial instruments of the Group and of the Company as at the reporting date are categorised into the following

classes:

Group

Company

2017

2016

2017

2016

RM’000

RM’000

RM’000

RM’000

(i)

Loans and receivables

Trade receivables (excluding accrued revenue)

(Note 20)

99,504

183,562

19

20

Other receivables (Note 21)

32,552

27,963

1,100

2,743

Less:

Prepayments (Note 21)

(6,883)

(6,488)

(45)

(39)

Tax recoverable (Note 21)

(581)

(3,450)

(500)

(2,218)

25,088

18,025

555

486

Due from subsidiaries (Note 22)

-

-

216,315

186,129

Cash and bank balances (Note 23)

390,780

247,592

6,706

7,727

Total loans and receivables

515,372

449,179

223,595

194,362