Annual Report 2020

173

Notes to the Financial Statements

As at 31 March 2020

kumpulan Fima Berhad

(197201000167)(11817-V)

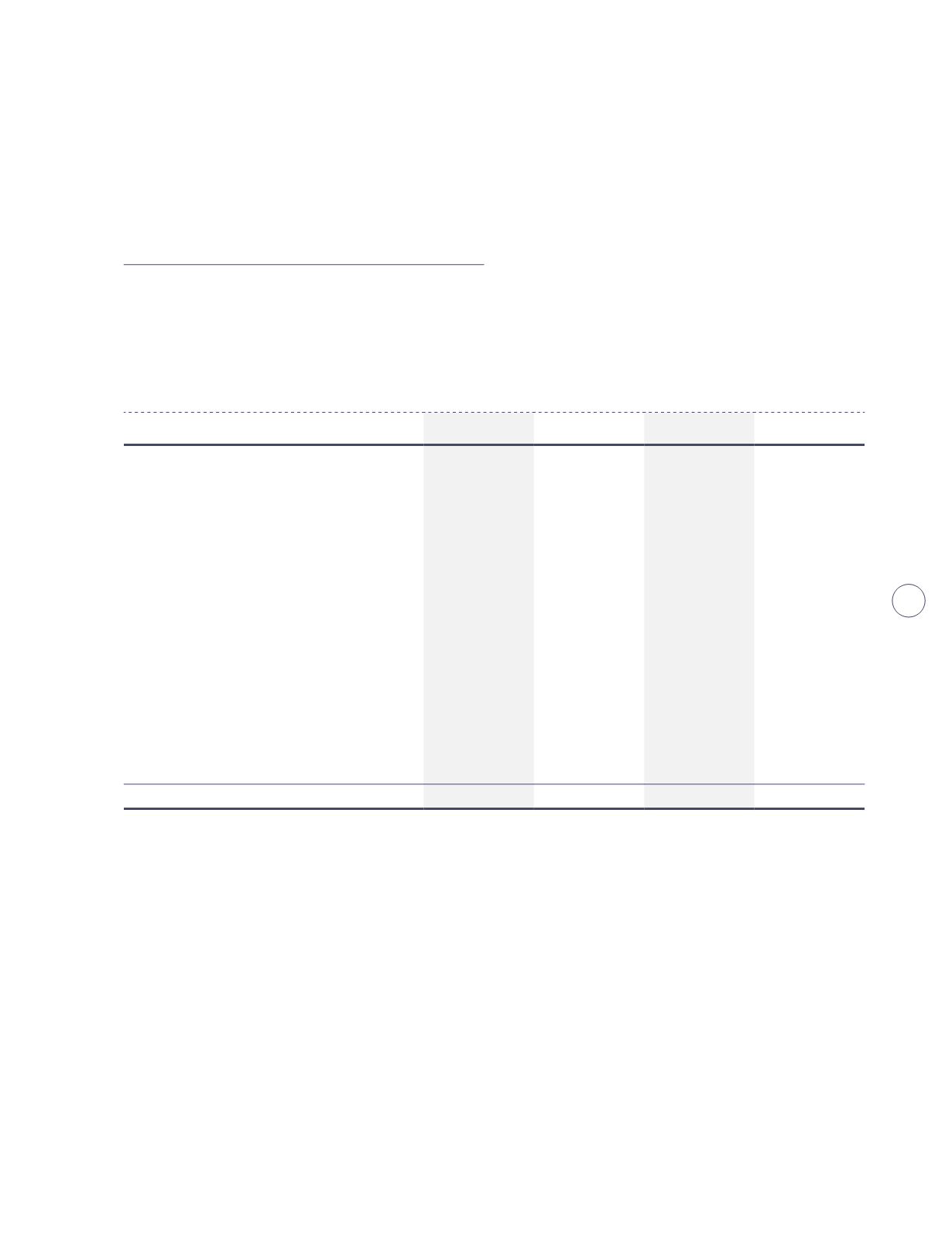

11. Income tax expense (cont’d.)

Reconciliation between tax expense and accounting profit

A reconciliation of income tax expense applicable to profit before tax at the statutory income tax rate to income tax

expense at the effective income tax rate of the Group and of the Company is as follows:

Group

Company

2020

RM'000

2019

RM'000

2020

RM'000

2019

RM'000

Profit before tax

51,831

114,885

30,797

54,716

Taxation at statutory tax rate of 24% (2019: 24%)

12,439

27,572

7,392

13,132

Effect of income not subject to tax

(1,529)

(6,147)

(8,952)

(12,349)

Effect of tax rates in foreign jurisdiction

139

415

-

-

Effect of partial tax exemption

(38)

(17)

-

-

Effect of expenses not deductible for tax

purposes

6,669

6,492

1,710

1,150

Effect of share results of associates

(471)

(896)

-

-

Deferred tax assets not recognised in respect

of current year's tax losses and unabsorbed

capital allowances

5,690

2,105

-

-

Under/(over) provision of income tax expense in

prior years

794

(643)

73

(211)

Under/(over) provision of deferred tax in prior

years

670

796

2

(10)

24,363

29,677

225

1,712