Annual Report 2020

172

Notes to the Financial Statements

As at 31 March 2020

kumpulan Fima Berhad

(197201000167)(11817-V)

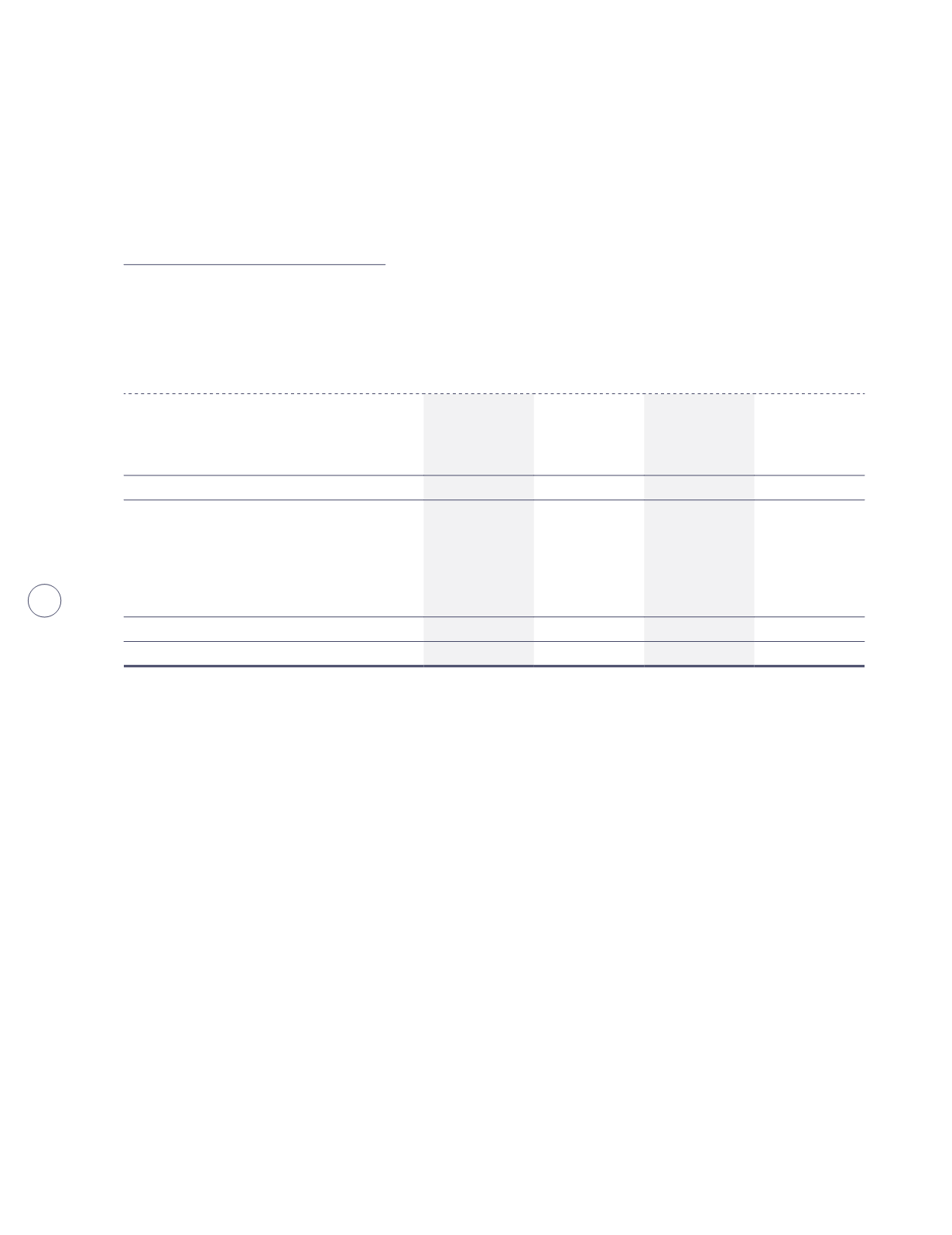

11. Income tax expense

Major components of income tax expense

The major components of income tax expense for the years ended 31 March 2020 and 2019 are:

Group

Company

2020

RM'000

2019

RM'000

2020

RM'000

2019

RM'000

Current income tax:

- Malaysian income tax

19,910

28,681

258

2,132

- Under/(over) provision in prior years

794

(643)

73

(211)

20,704

28,038

331

1,921

Deferred tax (Note 34):

Relating to origination and reversal of

temporary differences

2,989

843

(108)

(199)

Under/(over) provision in prior years

670

796

2

(10)

3,659

1,639

(106)

(209)

Total income tax expense

24,363

29,677

225

1,712

Domestic current income tax is calculated at the statutory tax rate of 24% (2019: 24%) of the estimated assessable profit

for the year.

Taxation for other jurisdictions is calculated at the rates prevailing in the respective jurisdictions. During the current

financial year, the income tax rate applicable to the subsidiaries in Indonesia and Papua New Guinea were 25% (2019:

25%) and 30% (2019: 30%), respectively.