1 5 7

NOTES TO THE FINANCIAL STATEMENTS

31 MARCH 2018

Kumpulan Fima Berhad (11817-V) •

Annual Report 2018

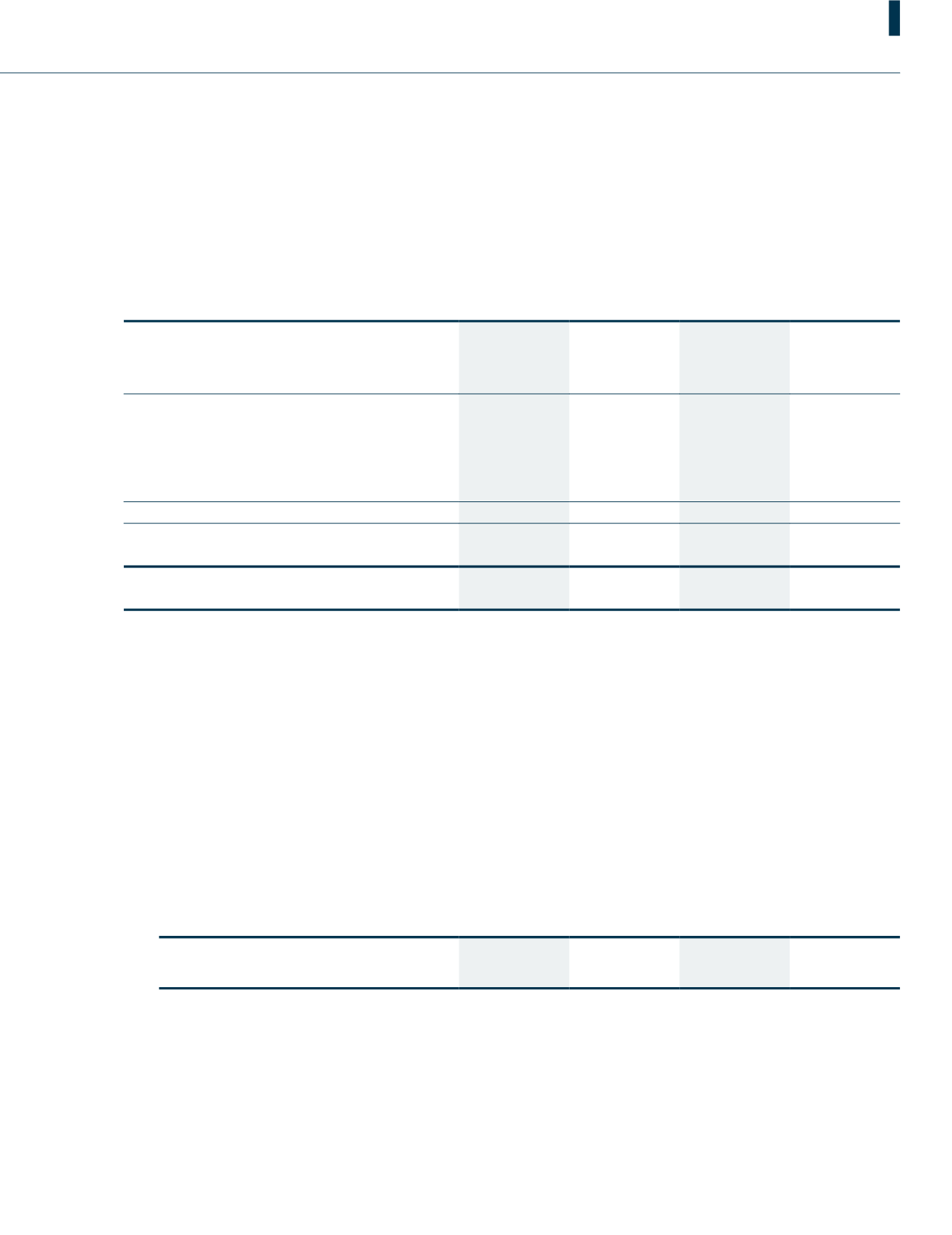

14. Investment properties

Group

Company

2018

2017

2018

2017

RM’000

RM’000

RM’000

RM’000

Cost

At 1 April 2017/2016 and 31 March

96,572

96,572

3,408

3,408

Accumulated depreciation

At 1 April 2017/2016

28,108

26,475

275

241

Charge for the year

1,635

1,633

37

34

At 31 March

29,743

28,108

312

275

Net carrying amount

66,829

68,464

3,096

3,133

Fair value

77,515

78,790

3,830

3,830

(a)

The land title of a freehold land and building of the Group with a net book value of approximately RM48,633,000

(2017: RM49,777,000) is pledged as security for certain unutilised credit facilities of the Group.

(b)

Factory buildings of a subsidiary, Percetakan Keselamatan Nasional Sdn. Bhd. with a net book value of RM5,458,771

(2017: RM5,717,685) are situated on a piece of leasehold land which will expire on 29 September 2086.

(c)

The fair value of the investment properties during the year was determined based on comparison approach. The fair

value of the properties as at 31 March 2018 and 31 March 2017 are based on valuation carried out by professional

independent valuers, Messrs Hatta & Associates Sdn. Bhd..

(d)

Rental income generated from and direct operating expenses incurred on income generated from investment properties

are as follows:

Group

Company

2018

2017

2018

2017

RM’000

RM’000

RM’000

RM’000

Rental income

5,224

5,278

686

681

Direct operating expenses

2,493

2,583

128

211