1 5 6

NOTES TO THE FINANCIAL STATEMENTS

31 MARCH 2018

fInanCIal StatementS

13. Property, plant and equipment (cont’d.)

(a)

Buildings, plant and machinery, storage tanks and pipelines of the subsidiaries carrying out bulking activities with a net

book value of approximately RM17,940,000 (2017: RM21,186,000) are situated on land which is leased from Lembaga

Pelabuhan Kelang (“LPK”) by the subsidiaries. The lease will expire in 2022.

(b)

A building of a subsidiary, Fima Palmbulk Services Sdn. Bhd., with a net book value of RM1 (2017: RM1) was constructed

on land leased from Penang Port Commission. The subsidiary has a renewal option to renew the lease for a term of five

years beginning from 1 July 2018 to 30 June 2023. It is expected that the subsidiary will continue to lease the land from

Penang Port Commision.

(c)

Included in the property, plant and equipment of the Group and of the Company are cost of fully depreciated assets

which are still in use amounting to approximately RM212,478,299 (2017: RM196,773,000) and RM2,694,472 (2017:

RM2,641,000) respectively.

(d)

Freehold land and buildings have been revalued on 31 March 2015 based on valuations performed by accredited

independent valuers. The valuations have been performed by the valuer and are based on proprietary databases of

prices of transactions for properties of similar nature, location and condition.

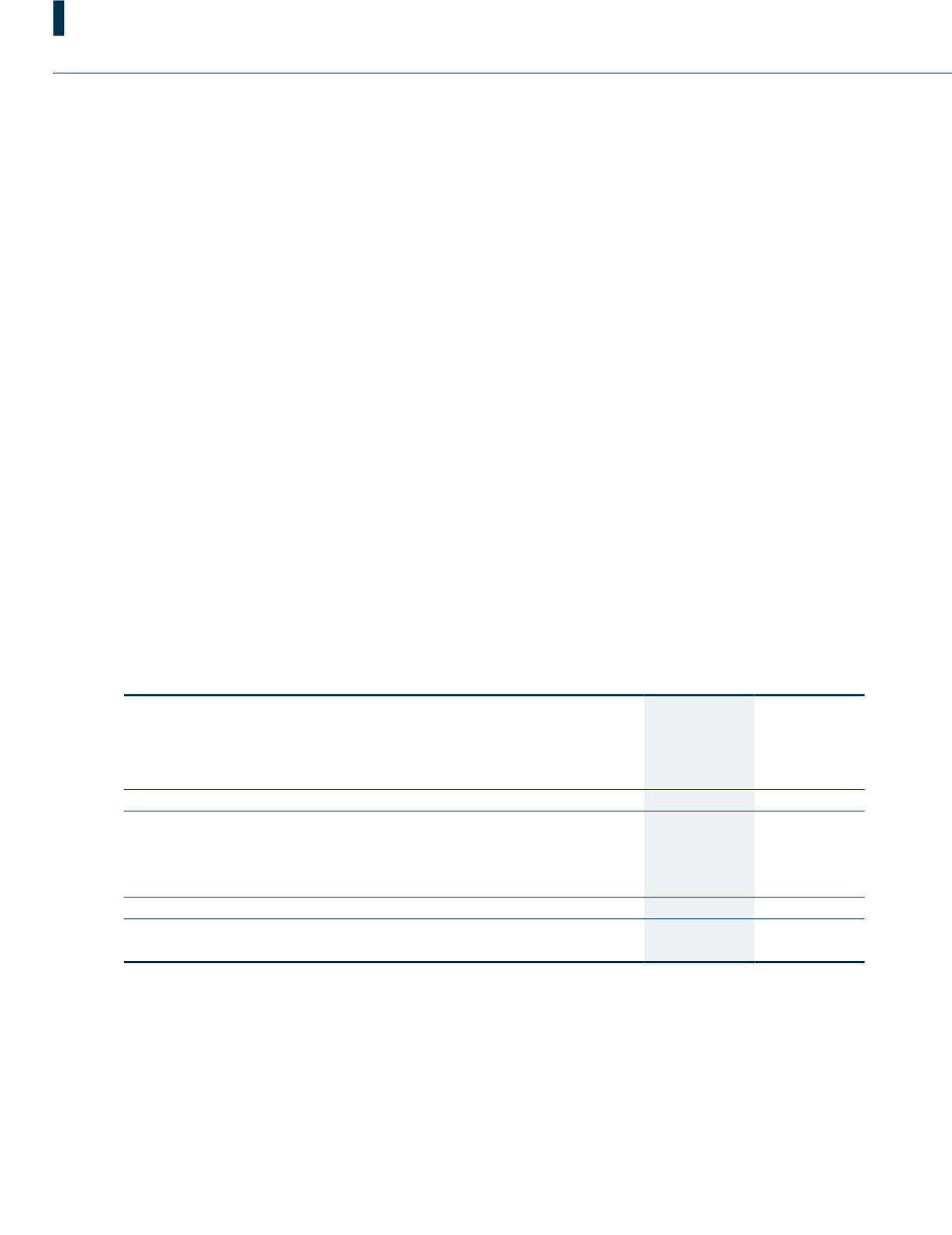

(e)

If the total amounts of the freehold land, leasehold land and buildings had been determined in accordance with the

historical cost convention, they would have been included at:

Group

2018

2017

RM’000

RM’000

Cost

Freehold land

2,178

2,178

Leasehold land

103,663

74,551

Buildings

24,513

25,207

130,354

101,936

Accumulated depreciation

Leasehold land

9,524

5,165

Buildings

12,138

12,762

21,662

17,927

Net carrying amount

108,692

84,009