page

24

KUMPULAN FIMA BERHAD

(11817-V) |

Annual Report

2016

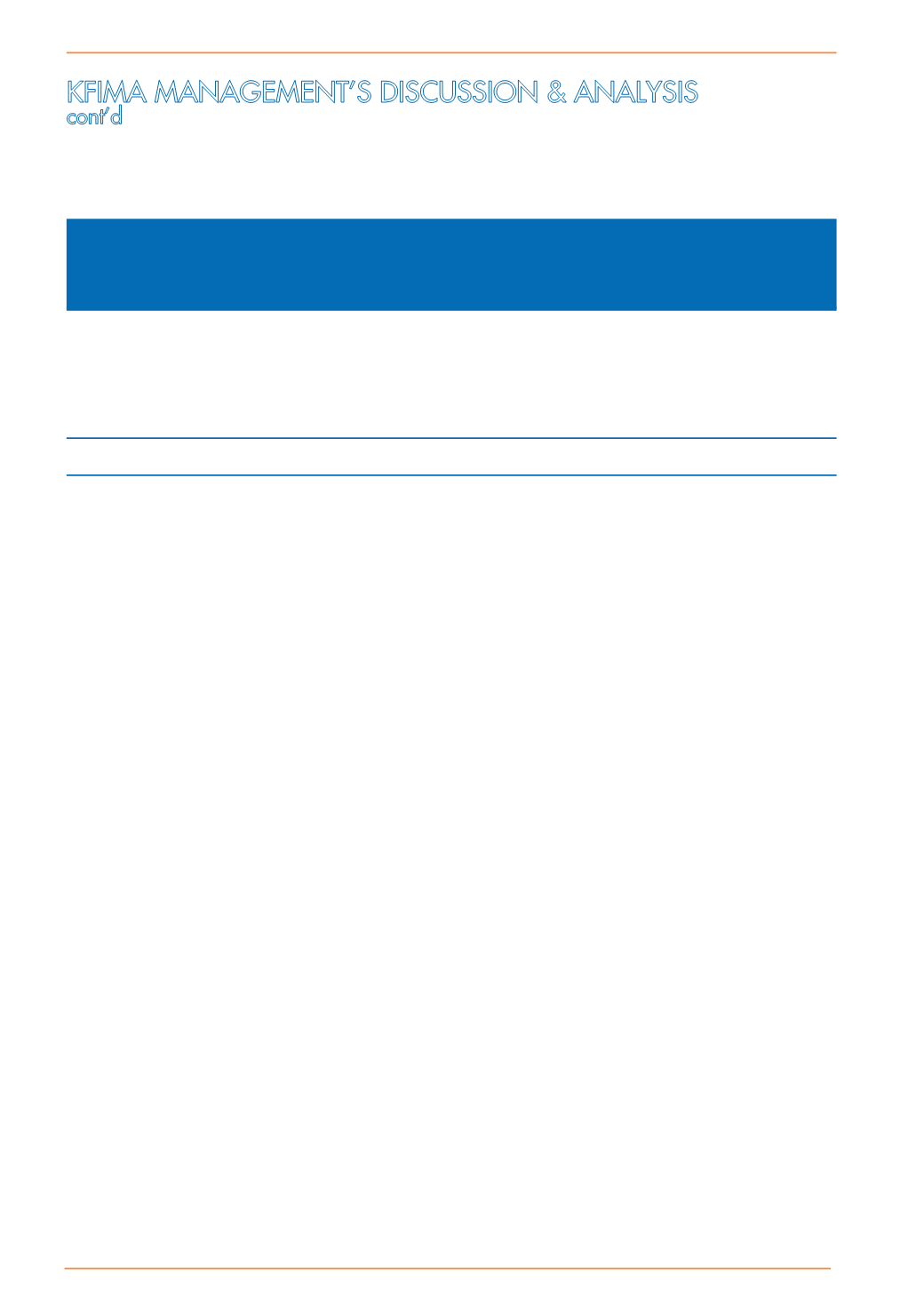

PBT

contributions from the segments are as follows:

%

%

Contribution

Contribution

FYE2016 (from Group FYE2015 (from Group

RM million PBT)

RM million PBT)

Manufacturing

54.01

48.4

50.54

41.3

Plantation

14.78

13.2

24.73

20.2

Bulking

38.88

34.8

38.08

31.1

Food

4.72

4.2

0.28

0.3

Others *

(2.39)

(2.1)

4.53

3.7

Associate Companies

1.67

1.5

4.14

3.4

Group PBT

111.67

100.0

122.30

100.0

* rental income and property management services

•

The Manufacturing Division’s PBT increased by 6.9% to RM54.01 million mainly on the back of the higher

revenue generated and lower depreciation costs.

•

Plantation Division’s PBT decreased by 40.2% to RM14.78 million, impacted by higher manuring costs

of RM3.6 million following the implementation of an improved fertilizer application programme by PTNJL.

In addition, withholding tax on foreign dividend income increased by RM1.7 million while interest income

decreased by RM1.1 million.

•

Bulking Division’s PBT improved 2.1% due to higher contributions from the edible oil and technical fats

product segments.

•

Food Division’s PBT improved from RM0.28 million recorded in the year before to RM4.72 million largely due

to lower overheads as well as implementation of a number of operational efficiency projects.

•

Share of profits from associate companies registered a y-o-y decline in PBT of 59.7%

Profit After Tax

declined by 4.8% to RM80.00 million in line with the decrease in PBT.

ROE

of 8.1% recorded in FYE2016 based on an average shareholders’ equity of RM988.65 million (FYE2015 –

RM685.28 million) was in line with the decrease in net earnings, as compared to 12.26% recorded in the previous

financial year.

ROCE

decreased to 10.7% for FYE2016, down from 12.8% recorded last year. This is due to higher percentage

decrease in EBIT as compared to the percentage increase in average capital employed.

The Group will endeavour to enhance ROE and ROCE by continuous improvement in operating performance and

by active management of its capital structure.

For FYE2016, the Group spent a total of RM53.11 million for

Capital Expenditure (“CAPEX”)

comprising of

biological assets expenditure (RM28.84 million) and property, plant & equipment (RM24.27 million). The Group

retains strong discipline in respect of CAPEX, with generally conservative business cases and appropriate

benchmarks applied to commensurate with the nature and/or risks of the activity or project.

The Group’s

Shareholders’ Equity

as at FYE2016 stood at RM999.29 million, an increase of RM21.28 million or

2.2% over the previous financial year due to improvements in the Group’s retained earnings.

The Group also continues to maintain a healthy cash and bank balance, which stood at RM247.59 million.