page

21

KUMPULAN FIMA BERHAD

(11817-V) |

Annual Report

2016

The Group will continue to pursue a dividend practice

that recognises the need to achieve a balance between

providing reasonable returns to shareholders whilst

conserving funds for new investment opportunities

critical to long term growth.

ACQUISITION

On 4 December 2015, the Group’s subsidiary, FCB

Plantation Holdings Sdn Bhd had completed the

acquisition of 140,000 ordinary shares of RM1.00 each

in R.N.E. Plantation Sdn Bhd (“R.N.E. Plantation”),

representing 70% of the total issued and paid up

share capital of R.N.E. Plantation for a total purchase

consideration of RM4.20 million. R.N.E. Plantation

has been granted a sub-lease over a parcel of land

measuring approximately 2,000 hectares / 4,940

acres situated in Mukim Sungai Siput, Daerah Kuala

Kangsar, Perak Darul Ridzuan for a term of 60 years

with an option to renew for a further period of 30

years. The acquisition of R.N.E. Plantation is in line

with the Group’s aspirations to expand its plantation

business, particularly in Malaysia, and capitalise on

the long-term fundamentals of the palm oil sector.

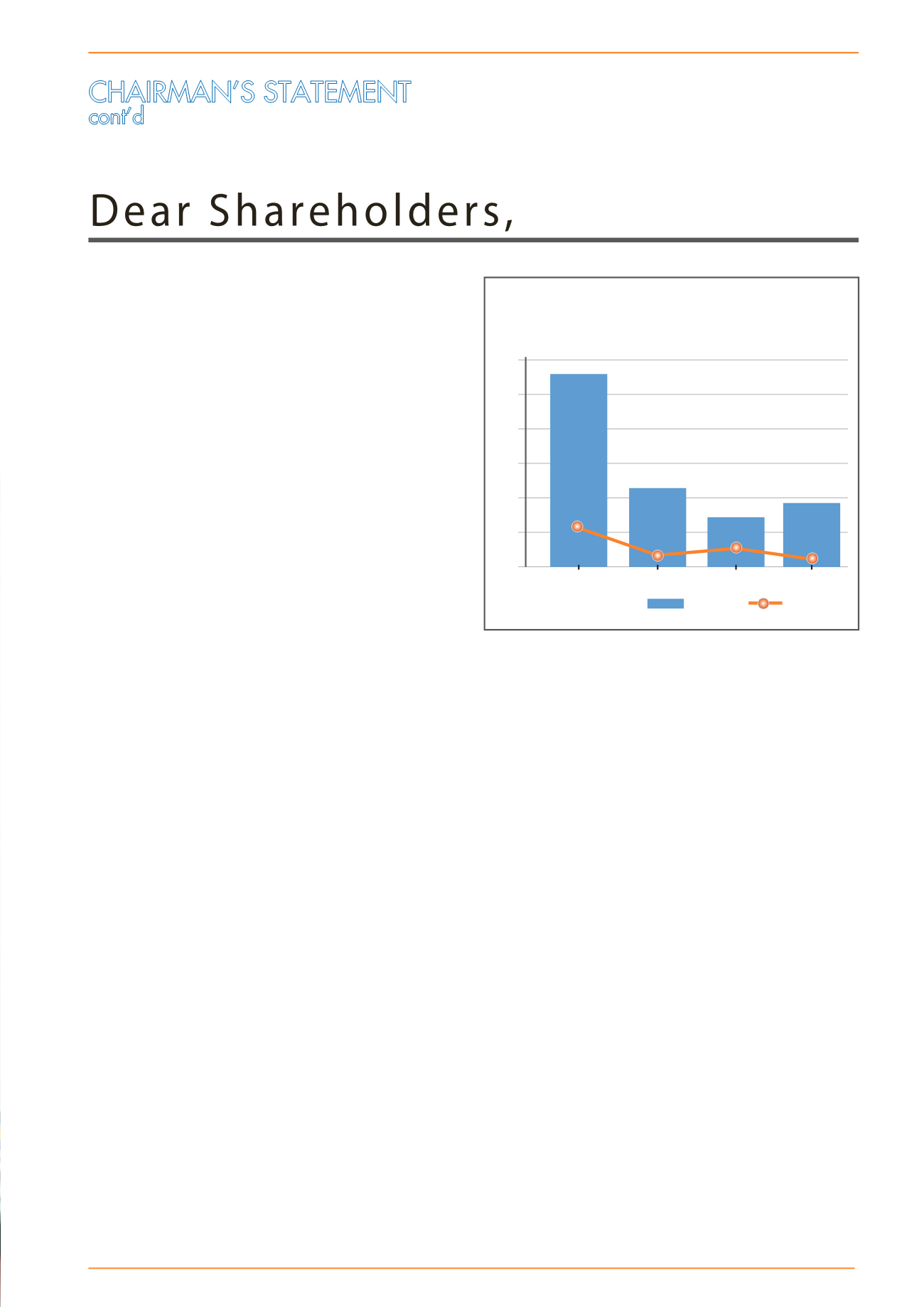

Bulking

Food

Revenue

PBT

Manufacturing Plantation

67.45

88.42

54.01

14.78

38.88

4.72

112.63

268.30

0

50

100

150

250

200

300

Summary of Revenue and PBT By Divisions

(RM’ Million)

FINANCIAL RESULTS AND PERFORMANCE

In presenting our financial results and performance for

the financial year ended 31 March 2016 (“FYE2016”),

the Group reported consolidated revenue of RM541.11

million, representing a marginal decline of 0.7% over

last year. Profit before tax (“PBT”) also decreased

to RM111.67 million compared to RM122.30 million

recorded last year. The Group’s earnings before

interest, taxation, depreciation and amortisation

(“EBITDA”) was RM150.43 million, lower than the

EBITDA of RM 159.44 million recorded last year.

The Group’s FYE2016 results reflect the challenging

market conditions across all our businesses. Despite

the higher fresh fruit bunch (“FFB”) production, the

lower average Crude Palm Oil (“CPO”) price realized

during the year had weighed down the earnings

contribution of the Plantation Division. We are however

encouraged by the improved profit contributions

from the Food Division, giving us cause for cautious

optimism that we can return this business to positive

levels of growth. Contributions from the Manufacturing

and Bulking Divisions have also remained steady with

modest year-on-year increase in revenue and PBT

respectively.

Earnings per share and net assets per share stood at

20.51 sen and RM2.70, respectively, from 21.26 sen

and RM2.65, respectively, the year before.

A more detailed review of the results and the operating

performance for the year of each of the Group’s

business divisions is set out on pages 25 to 35 of this

Annual Report.

DIVIDEND

Reflecting on the Group’s performance, the Board of

Directors is pleased to recommend for shareholders’

approval a final single-tier dividend of 9.0% for the

financial year ended 31 March 2016 at the forthcoming

Annual General Meeting.