Annual Report 2020

188

Notes to the Financial Statements

As at 31 March 2020

kumpulan Fima Berhad

(197201000167)(11817-V)

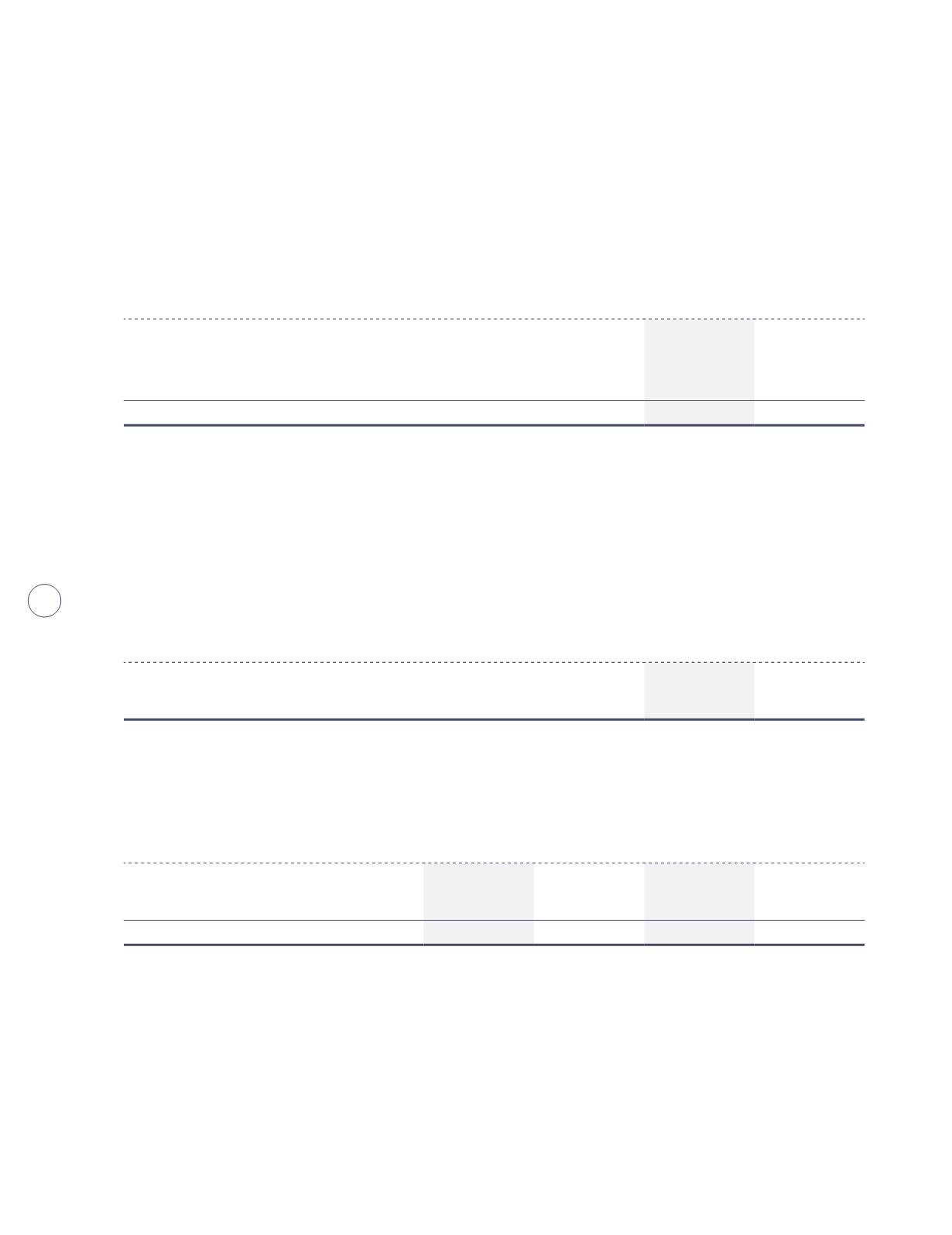

21. Biological assets

Group

2020

RM’000

2019

RM’000

At 1 April 2019/2018

4,504

5,102

Fair value changes recognised in profit or loss

2,705

(744)

Exchange differences

(344)

146

At 31 March

6,865

4,504

The fair value of biological assets was based on the actual quantity of fresh fruit bunches (“FFB”) for 2 weeks period and

the observable current market price of FFB at each point of fair value.

Sensitivity analysis

A 10% increase/decrease in the average FFB selling price (RM/MT) would result in the following to the fair value change

of the biological asset:

Group

2020

RM’000

2019

RM’000

10% increase

442

230

10% decrease

(442)

(230)

22. Trade receivables

Group

Company

2020

RM’000

2019

RM’000

2020

RM’000

2019

RM’000

Third parties

143,461

135,019

12

10

Less: Allowance for impairment

(2,906)

(5,860)

(10)

(10)

Trade receivables, net

140,555

129,159

2

-

The Group’s normal trade credit term ranges from 30 to 90 days (2019: from 30 to 90 days). Other credit terms are

assessed and approved on a case-by-case basis.

The Group has no significant concentration of credit risk that may arise from exposures to a single debtor or to group of

debtors except for a balance of RM60,806,000 (2019: RM41,827,000) due from the Government of Malaysia.