Notes to the

Financial Statements

As at 31 March 2019

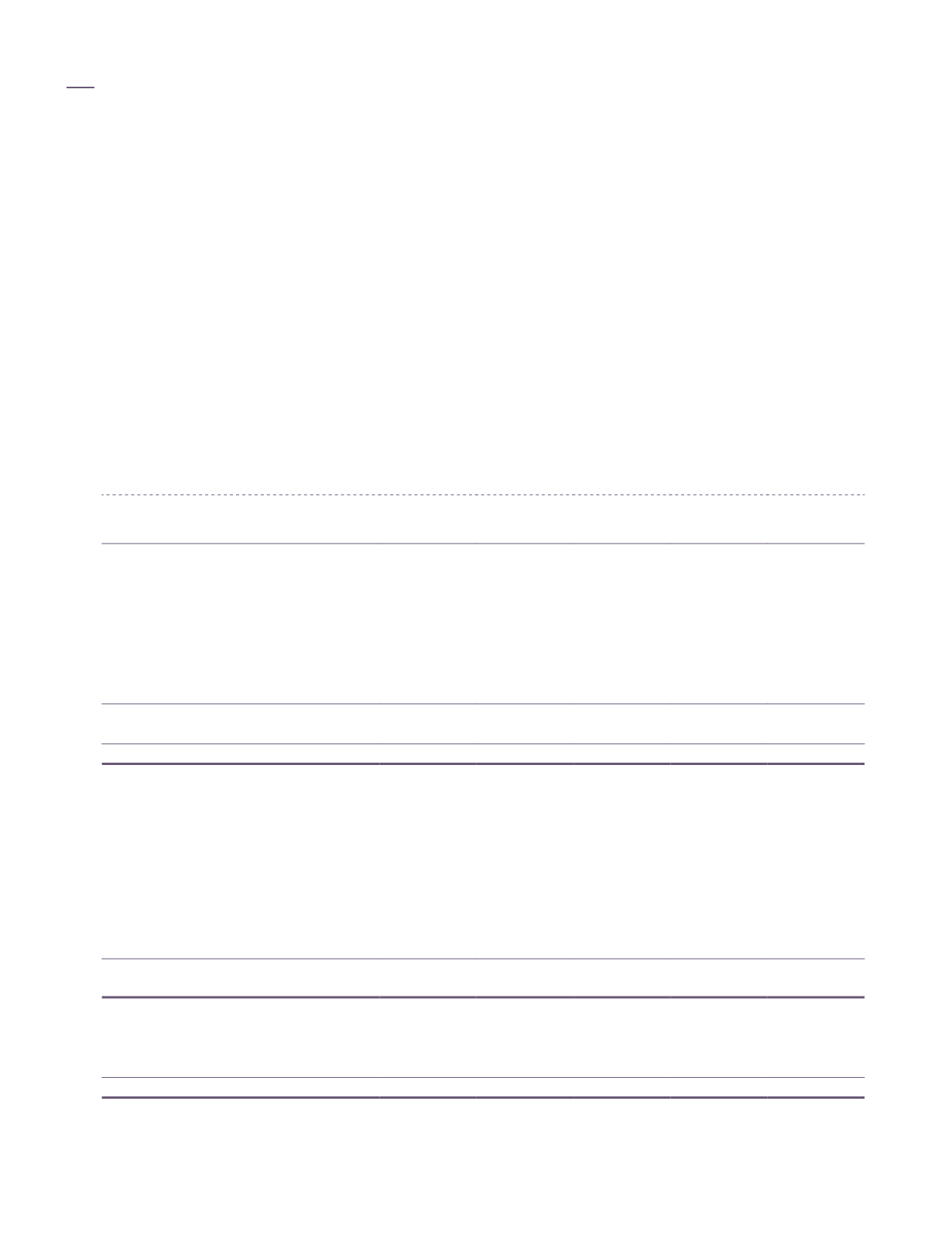

44. Explanation of transition of MFRSs (cont’d.)

The effects of transitioning from FRSs to MFRSs, adoptions of MFRS 9 and MFRS 141 are as follows: (cont’d.)

Reconciliation of Statement of Comprehensive Income

For the year ended 31 March 2018

Effects

Effects

Effects

Previously

from

from

from Reported

reported transition adoption of adoption of

under

under FRS

to MFRS

MFRS 9

MFRS 141

MFRS

Group

RM ‘000

RM ‘000

RM ‘000

RM ‘000

RM ‘000

Revenue

482,460

-

-

-

482,460

Cost of sales

(294,065)

-

-

(802) (294,867)

Gross profit

188,395

-

-

(802)

187,593

Other income

12,276

-

-

-

12,276

Other items of expense

Administrative expenses

(86,244)

-

-

-

(86,244)

Selling and marketing expenses

(12,969)

-

-

-

(12,969)

Other operating expense

(18,999)

-

(1,547)

-

(20,546)

Finance cost

(1,500)

-

-

-

(1,500)

Share of results from associate

(475)

-

-

-

(475)

Profit before tax

80,484

-

(1,547)

(802)

78,135

Income tax expense

(31,717)

-

-

217

(31,500)

Profit net of tax

48,767

-

(1,547)

(585)

46,635

Other comprehensive income/expense,

net of tax

Item that will not be subsequently

reclassified to profit or loss

Remeasurement of defined benefit

liability

(36)

-

-

-

(36)

Item that will be subsequently

reclassified to profit or loss

Foreign currency translation loss

(27,036)

-

-

(288)

(27,324)

Total comprehensive income

for the year

21,695

-

(1,547)

(873)

19,275

Profit attributable to:

Equity holders of the Company

32,057

-

(1,547)

(638)

29,872

Non-controlling interest

16,710

-

-

53

16,763

Profit for the year

48,767

-

(1,547)

(585)

46,635

Kumpulan Fima Berhad

(11817-V)

Annual Report 2019

204