Notes to the

Financial Statements

As at 31 March 2019

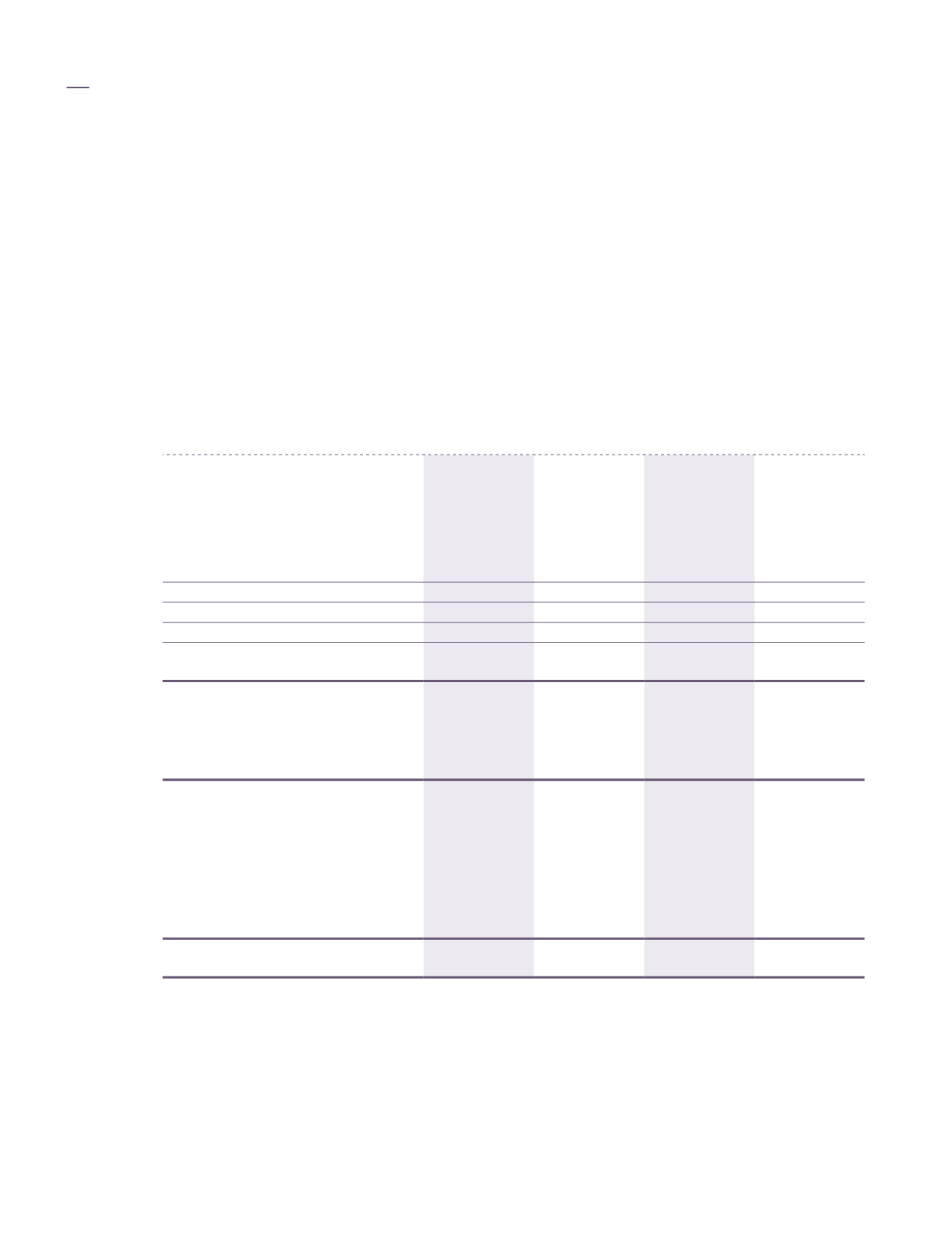

38. Financial instruments (cont’d.)

(b) Classification of financial instruments

The financial instruments of the Group and of the Company as at the reporting date are categorised into

the following classes:

Group

Company

2019

2018

2019

2018

RM’000 RM’000

RM’000

RM’000

(i) Financial assets measured at

amortised cost

Trade receivables (Note 20)

129,159

139,960

-

-

Other receivables (Note 21)

36,789

20,941

1,400

1,756

Less: Prepayments (Note 21)

(11,276)

(7,958)

(60)

(52)

Tax recoverable (Note 21)

(4,948)

(1,404)

(770)

(976)

20,565

11,579

570

728

Due from subsidiaries (Note 22)

-

-

248,909

237,615

Cash and bank balances (Note 24)

142,196

235,297

17,179

11,578

Total financial assets measured at

amortised cost

291,920

386,836

266,658

249,921

(ii) Fair value through profit or loss

Short term cash investments

(Note 23)

148,122

51,886

-

8,003

(iii)Financial liabilities measured at

amortised cost

Trade payables (Note 32)

13,675

12,788

111

123

Other payables (Note 32)

50,685

53,032

2,141

1,710

Due to subsidiaries (Note 22)

-

-

6,818

17,688

Borrowings (Note 31)

34,506

33,419

34,506

33,419

Total financial liabilities measured at

amortised cost

98,866

99,239

43,576

52,940

Kumpulan Fima Berhad

(11817-V)

Annual Report 2019

188