Notes to the

Financial Statements

As at 31 March 2019

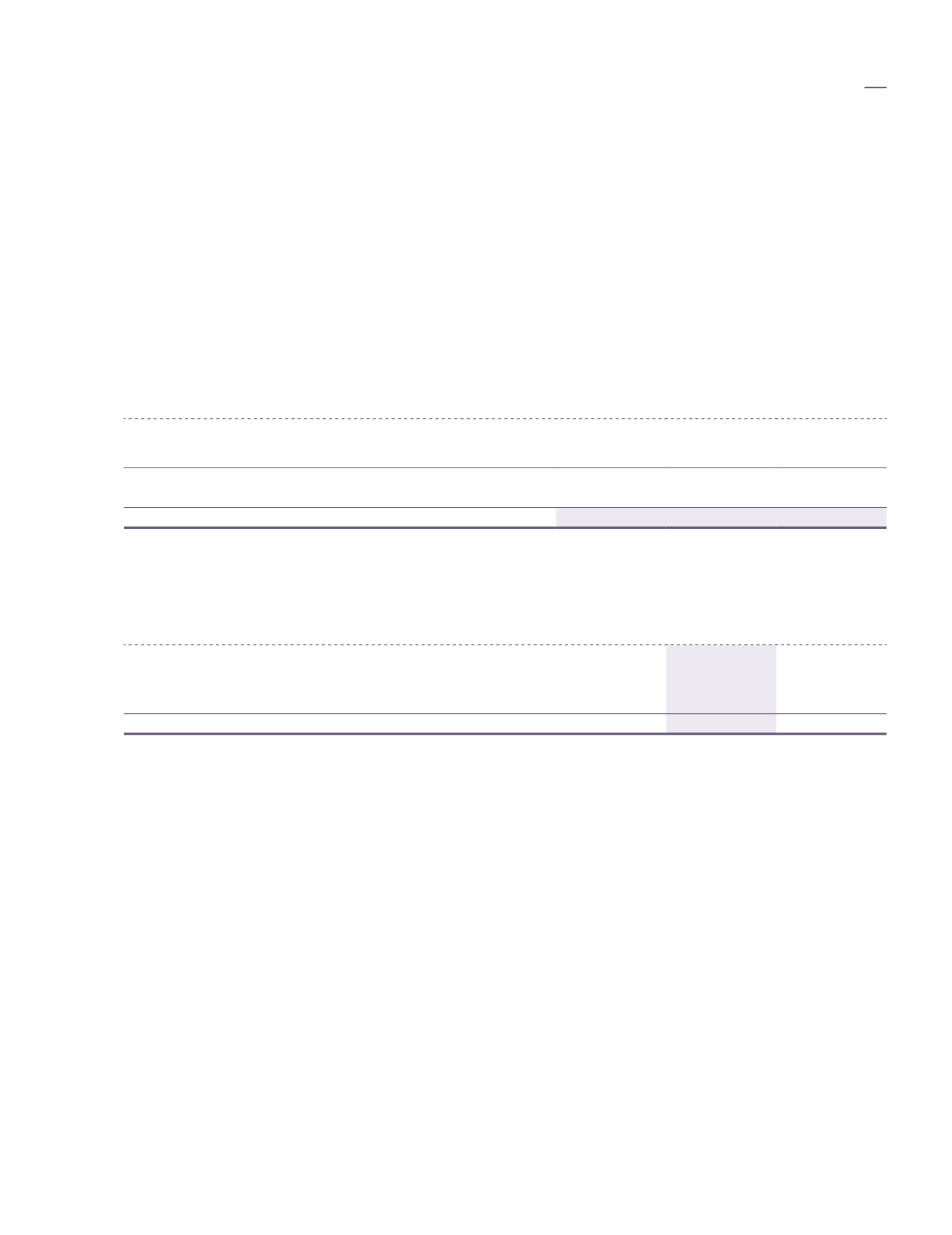

30. Deferred tax (cont’d.)

Deferred tax liabilities/(assets) of the Company:

Accelerated

Provision

capital

for

allowances

liabilities

Total

RM’000

RM’000

RM’000

At 1 April 2017

6,505

(226)

6,279

Recognised in profit or loss

(149)

(64)

(213)

At 31 March 2018

6,356

(290)

6,066

Recognised in profit or loss

(117)

(92)

(209)

At 31 March 2019

6,239

(382)

5,857

Deferred tax assets have not been recognised in respect of the following items:

Group

2019

2018

RM’000

RM’000

Unutilised tax losses

67,371

63,255

Unabsorbed capital allowances

31,424

28,114

Unabsorbed reinvestment allowances

1,528

183

100,323

91,552

The unabsorbed capital allowances of the Group are available indefinitely against future taxable profit of

the respective entities within the Group subject to no substantial changes in shareholdings of those entities

under the Income Tax Act, 1967 and guidelines issued by the tax authority. Deferred tax assets have not been

recognised in respect of these items as they may not be used to offset taxable profit of other entities in the

Group and they have arisen in entities that have a recent history of losses.

Effective from year of assessment 2019 as announced in the Malaysia Annual Budget 2019, the unutilised tax

losses of the Group as at 31 March 2019 and thereafter will only be available for carry forward for a period of

7 consecutive years. Upon expiry of the 7 years, the unutilised tax losses will be disregarded.

Deferred tax assets have not been recognised in respect of these items as they may not be used to offset

taxable profit of other entities in the Group and they have arisen in entities that have a recent history of losses.

financial

statements

179