1 6 4

NOTES TO THE FINANCIAL STATEMENTS

31 MARCH 2018

fInanCIal StatementS

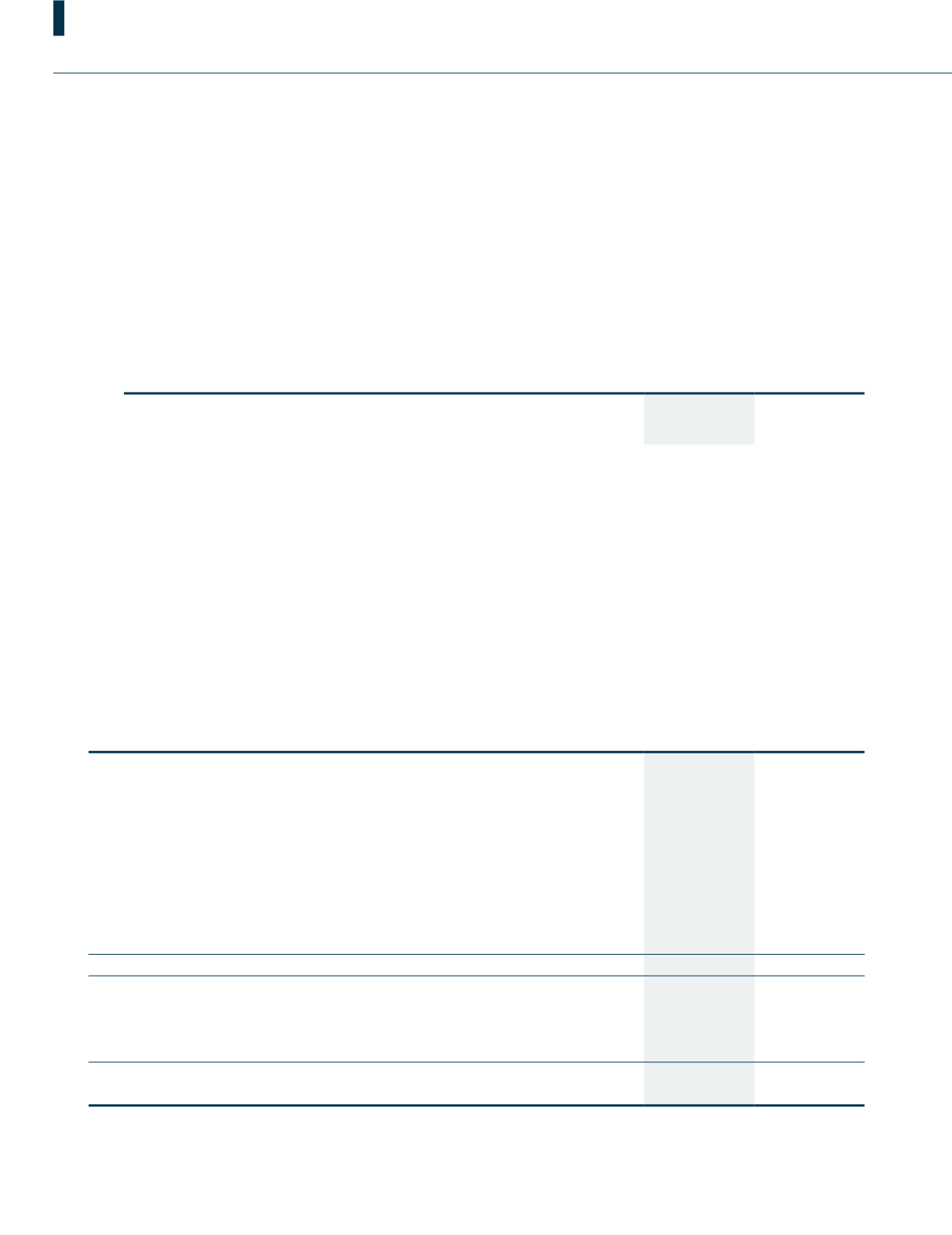

18. Goodwill on consolidation (cont’d.)

(b) Key assumptions used in value-in-use calculations

The following describes each key assumption on which management has based its cash flow projections to undertake

the impairment testing of goodwill:

2018

2017

%

%

Average discount rate

1

10.0

10.5

Terminal growth rate

2

2

2

Assumptions:

1.

Pre-tax discount rate applied to the cash flow projections.

2.

Weighted average growth rate used to extrapolate cash flows beyond the budget period.

(c) Sensitivity analysis

In assessing value-in-use and fair value, management believes that no reasonably possible change in any of the above

key assumptions would cause the carrying value of the goodwill to materially exceed its recoverable amount.

19. Inventories

Group

2018

2017

RM’000

RM’000

At cost:

Raw materials

15,472

21,758

Printing materials

8,910

9,573

Fertilizer

815

877

Oil palm products

8,432

8,244

Work-in-progress

16,596

14,581

Finished goods

19,210

20,427

Consumables

5,409

4,888

74,844

80,348

At net realisable value:

Finished goods

2,580

2,464

77,424

82,812

During the year, the amount of inventories recognised as an expense in cost of sales of the Group was RM110,627,254

(2017: RM151,199,563).