1 4 6

NOTES TO THE FINANCIAL STATEMENTS

31 MARCH 2018

fInanCIal StatementS

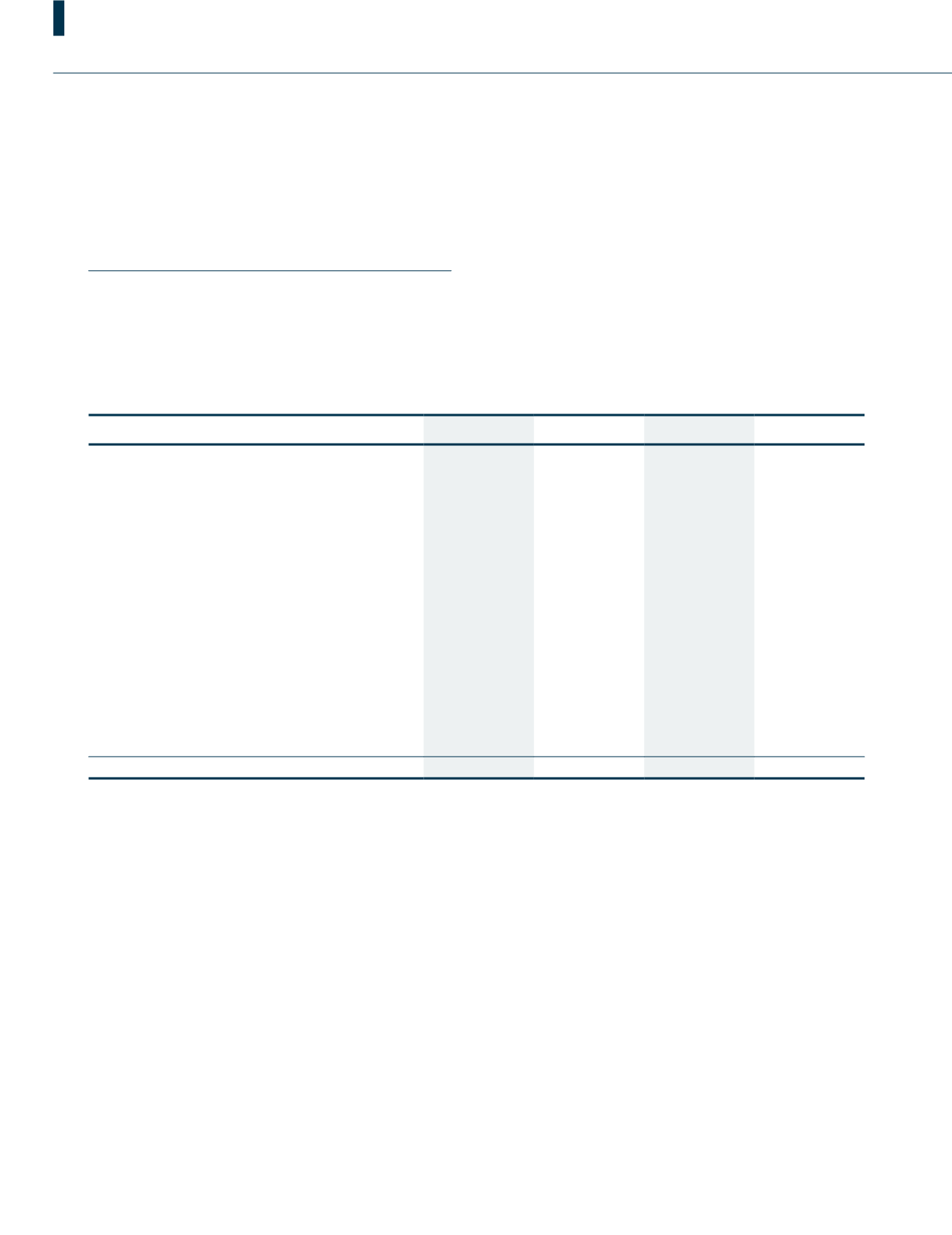

10. Income tax expense (cont’d.)

Reconciliation between tax expense and accounting profit

A reconciliation of income tax expense applicable to profit before tax at the statutory income tax rate to income tax expense

at the effective income tax rate of the Group and of the Company is as follows:

Group

Company

2018

2017

2018

2017

RM’000

RM’000

RM’000

RM’000

Profit before tax

80,484

84,672

42,697

54,300

Taxation at statutory tax rate of 24% (2017: 24%)

19,316

20,321

10,248

13,032

Effect of income not subject to tax

(63)

(695)

(10,499)

(13,428)

Effect of tax rates in foreign jurisdiction

3,029

1,153

-

-

Effect of partial tax exemption

(41)

(32)

-

-

Effect of expenses not deductible for tax purposes

5,991

10,310

2,205

2,420

Effect of utilisation of previously unrecognised

deferred tax

(244)

-

-

-

Effect of share results of associates

(407)

(687)

-

-

Deferred tax assets not recognised in respect

of current year’s tax losses and unabsorbed

capital allowances

3,693

92

-

-

(Over)/under provision of income tax expense

in prior years

(149)

3,037

(23)

1,659

Under/(over) provision of deferred tax in prior years

592

744

(213)

(584)

31,717

34,243

1,718

3,099

11. Earnings per share

Basic earnings per share is calculated by dividing profit for the year, net of tax, attributable to owners of the parent by

the weighted average number of ordinary shares in issue during the financial year, excluding treasury shares held by the

Company.