1 1 6

fInanCIal StatementS

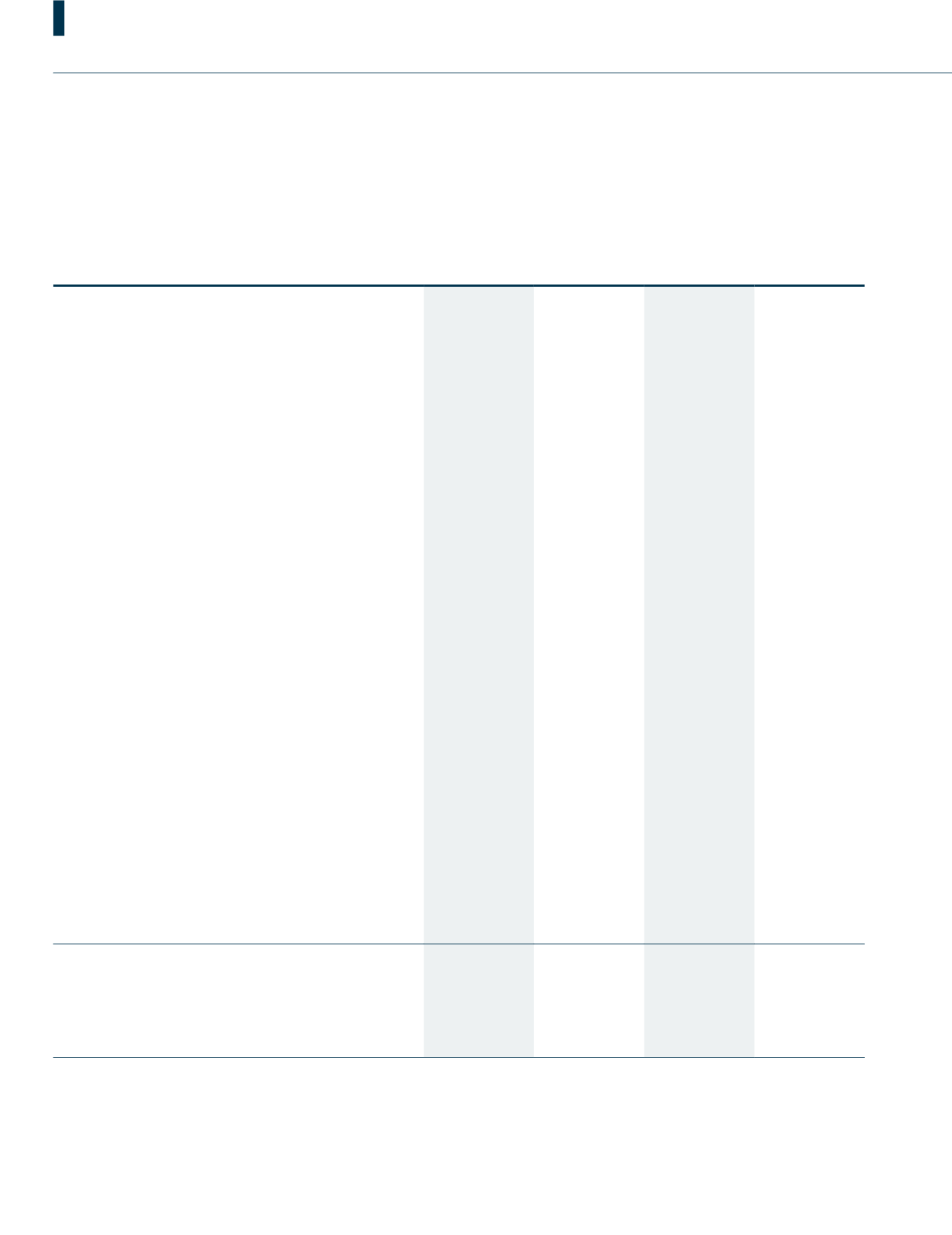

STATEMENTS OF CASH FLOWS

F O R T H E Y E A R E N D E D 3 1 M A R C H 2 0 1 8

Group

Company

2018

2017

2018

2017

RM’000

RM’000

RM’000

RM’000

Cash flows from operating activities

Profit before tax

80,484

84,672

42,697

54,300

Adjustment for:

Amortisation of biological assets

3,893

6,450

-

-

Depreciation

- Property, plant and equipment

19,113

25,755

597

653

- Investment properties

1,635

1,633

37

34

Dividend income

-

-

(41,223)

(52,317)

Impairment loss on:

- property, plant and equipment

832

4,646

-

-

- biological assets

-

24,779

-

-

- trade receivables

55

111

-

-

- other receivables

368

3,991

9

-

Interest expense

1,500

748

1,560

420

Interest income

(8,945)

(8,792)

(10,585)

(9,649)

Distribution from short term cash investments

(457)

-

(3)

-

Negative goodwill on acquisition of subsidiaries

(275)

-

-

-

Net gain on disposal of property, plant and equipment

(108)

(2)

(4)

(2)

Net unrealised forex loss

8,438

3

-

-

Provision for retirement benefits

289

284

-

-

Net reversal of provision for warranty

(4,866)

(2,287)

-

-

Share of results of associates

475

(2,861)

-

-

Share and options granted under ESS

-

43

-

43

Write back of impairment loss on:

- trade receivables

(265)

(1,498)

-

-

- other receivables

(2,534)

-

-

-

- amount due from a subsidiary

-

-

-

(150)

Write down of inventories

2,484

2,462

-

-

Write off of biological assets

-

70

-

-

Operating profit/(loss) before working capital changes

102,116

140,207

(6,915)

(6,668)

Decrease in inventories

2,904

4,101

-

-

(Increase)/decrease in receivables

(24,969)

60,425

(646)

(74)

Increase in net amount due from related companies

-

-

(21,185)

(37,845)

(Decrease)/increase in payables

(56,371)

25,606

401

84