Kumpulan Fima Berhad

(11817-V)

182

Notes to the

financial statements

31 march 2017

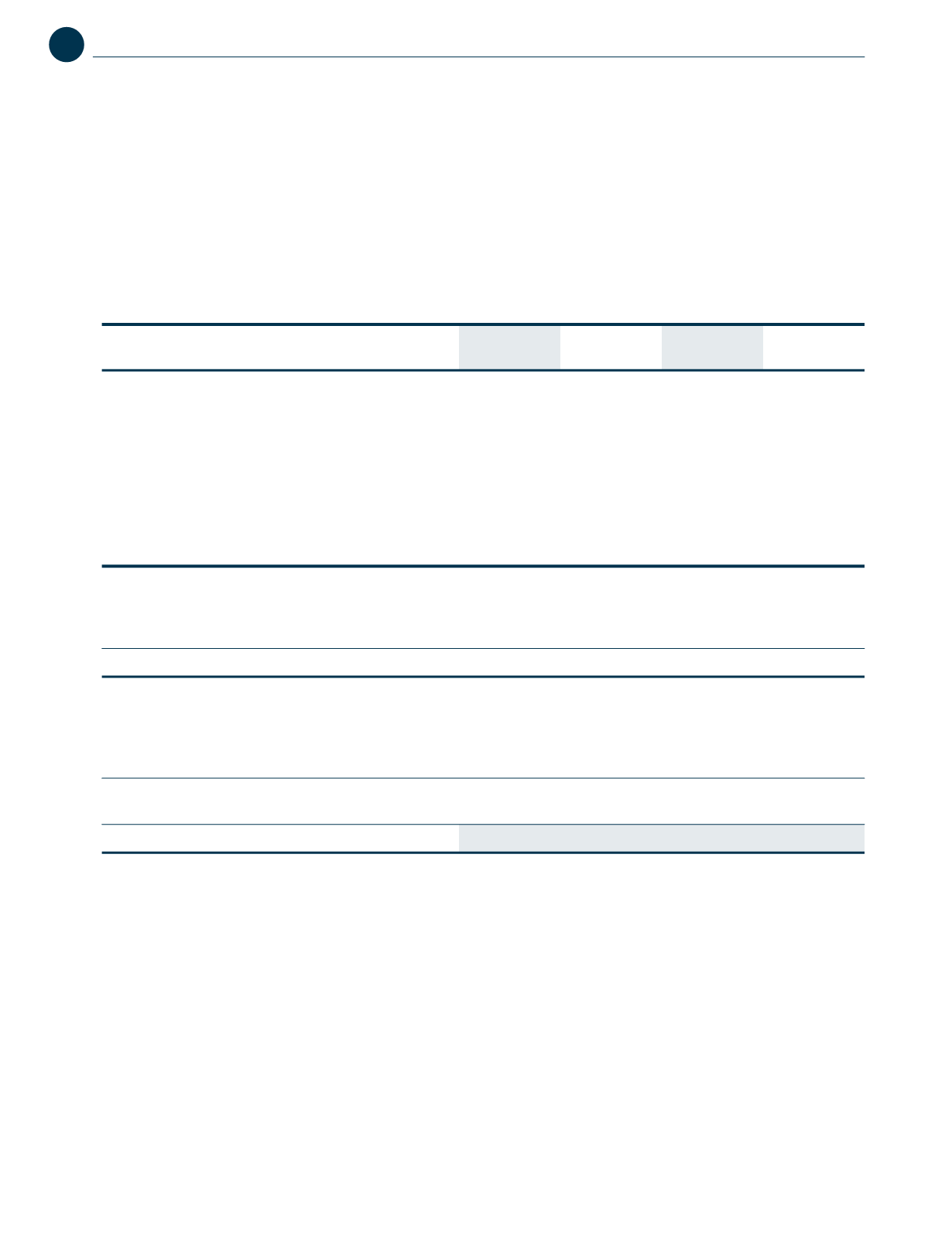

24. Share capital and share premium

Number of ordinary shares

Amount

2017

2016

2017

2016

‘000

‘000

RM’000

RM’000

Authorised:

Ordinary shares of RM1.00 each

-

300,000

-

300,000

Group and Company

Number of

ordinary shares

Total

Share

Share

Share

capital

capital

capital

(Issued and (Issued and

Share

and share

fully paid)

fully paid)

premium premium

‘000

RM’000

RM’000

RM’000

At 1 April 2015

276,087

276,087

23,930

300,017

Exercise of employee share options:

-ESOS

693

693

616

1,309

-RSGS

188

188

167

355

At 31 March 2016

276,968

276,968

24,713

301,681

At 1 April 2016

276,968

276,968

24,713

301,681

Exercise of employee share options:

-ESOS

5,095

5,095

4,725

9,820

-RSGS

169

169

-

169

282,232

282,232

29,438

311,670

Transfer to non-par value regime

-

29,438

(29,438)

-

At 31 March 2017

282,232

311,670

-

311,670

The new Companies Act, 2016 (“New Act”), which came into operation on 31 January 2017, abolished the concept of authorised

share capital and par value of share capital. Consequently, the amounts standing to the credit of the share premium account

becomes part of the Company’s share capital pursuant to the transitional provisions set out in Section 618(2) of the New Act.

There is no impact on the numbers of ordinary shares in issue or the relative entitlement of any of the members as a result of

this transition.

The holders of ordinary shares are entitled to receive dividends as declared from time to time and are entitled to one vote per

share at meetings of the Company. All ordinary shares rank pari passu with regard to the Company’s residual assets.

The share capital issued by the Company during the year are pursuant to the exercise of share options under the ESOS and

share granted under RSGS as disclosed in Note 33.